Omni Crypto Explained: What Is Omni, How It Works & Omni Price Prediction

OMNI crypto experienced a surge of over 100% in a single day after being listed on Korean exchange. This kind of explosive movement is reminiscent of other high-profile coins like OP and Hyperlane, which also spiked significantly after similar listings. This article provides an in-depth look at Omni Crypto, covering its recent price movements, future price predictions, and why Omni Network is significant in the evolving Ethereum ecosystem.

Source: CoinMarketCap

What is Omni Crypto?

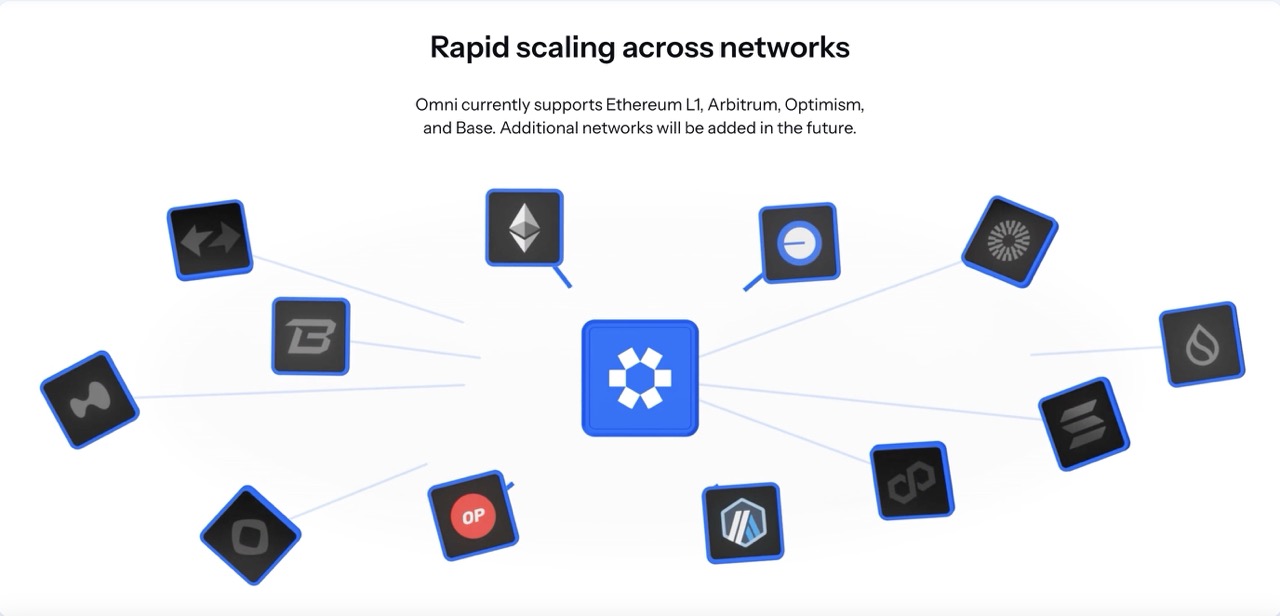

Omni crypto is the core token and infrastructure powering Omni Network—an Ethereum-native interoperability protocol designed to bridge all Ethereum rollups. As Ethereum’s rollup ecosystem has grown, isolated chains have created fragmentation in capital, users, and developer activity. Omni crypto solves this problem by acting as a universal communication and liquidity layer, seamlessly connecting all rollup architectures.

What sets omni crypto apart is its minimal integration requirements, making it compatible with any rollup regardless of its specific architecture. This design promotes continual innovation and supports Ethereum’s broader vision for modular, scalable networks. Omni crypto is positioned as a next-generation infrastructure for cross-rollup applications, attracting both users and developers looking for speed, flexibility, and scalability omni whitepaper.pdf.

How Does Omni Crypto Work?

At the heart of omni crypto is a robust, dual staking security framework. Validators secure the network using both OMNI tokens and restaked ETH, creating a powerful blend of staking incentives and cryptoeconomic security. The amount and type of assets staked determine both reward distribution and voting power, enhancing network integrity and incentivizing honest participation.

From a technology perspective, omni crypto leverages innovations such as CometBFT, ABCI++, and the Engine API. These tools empower validators to achieve sub-second verification of cross-rollup transactions, offering low latency that is vital for real-world decentralized applications.

Another core feature is Omni’s universal gas marketplace. This mechanism allows users to pay transaction fees in their preferred native assets, which are seamlessly converted into OMNI within the protocol. The result is a frictionless experience for developers and users interacting across multiple rollups. The addition of Omni EVM also gives developers a global platform for deploying and managing cross-rollup decentralized applications, further strengthening omni crypto’s appeal omni whitepaper.pdf.

Omni Crypto Tokenomics

The OMNI token is key to the omni crypto ecosystem. It’s an ERC-20 token with a maximum supply of 100,000,000:

-

Public Launch: 9.27% (9,270,000 OMNI) allocated to early adopters and liquidity pools.

-

Ecosystem Development: 29.5% (29,500,000 OMNI) reserved for ongoing technical and developer growth.

-

Community Growth: 12.67% (12,666,667 OMNI) supporting grants and outreach initiatives.

-

Core Contributors: 25.25% (25,250,000 OMNI) subject to a 3-year vesting period.

-

Advisors: 3.25% (3,250,000 OMNI), also subject to 3-year vesting.

At genesis, just over 10 million tokens were in circulation. Most allocations for core contributors and advisors are vesting, which supports network health and discourages dumping. OMNI also plays a central role in staking, governance, and as the underlying asset in the universal gas marketplace, reinforcing its utility throughout the omni crypto ecosystem omni whitepaper.pdf.

Omni Price Prediction: Analysis for Investors

Short-Term Omni Price Prediction (Next 3–6 Months):

Following its high-visibility mainnet launch, omni crypto surged dramatically. However, as is common with major launches, profit-taking could prompt short-term corrections. Based on trading volume and early support levels, a consolidation phase could establish OMNI’s support around initial post-listing prices, with potential for upward momentum if staking and on-chain usage remain strong.

Mid-to-Long-Term Omni Price Prediction (2026-2027):

Omni crypto’s fundamentals support significant upside if adoption continues and more rollups onboard. Strong staking participation, lower liquid supply, and growing developer ecosystem are bullish indicators. Technical analysis points to the potential for OMNI to target the $10–$30 range in a 1–2 year window, assuming continuous network growth and favorable crypto market conditions.

Key Drivers for Omni Price Prediction:

-

Adoption by more rollups and Ethereum applications

-

Increased network staking and utility

-

Developer and user growth expanding demand

-

Ongoing technological upgrades and global outreach

Conclusion

Omni crypto stands at the forefront of Ethereum’s interoperability revolution. Its dual staking model, low-latency architecture, and universal gas marketplace make it an attractive choice for developers and investors striving to build and participate in a unified, next-gen blockchain ecosystem.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.