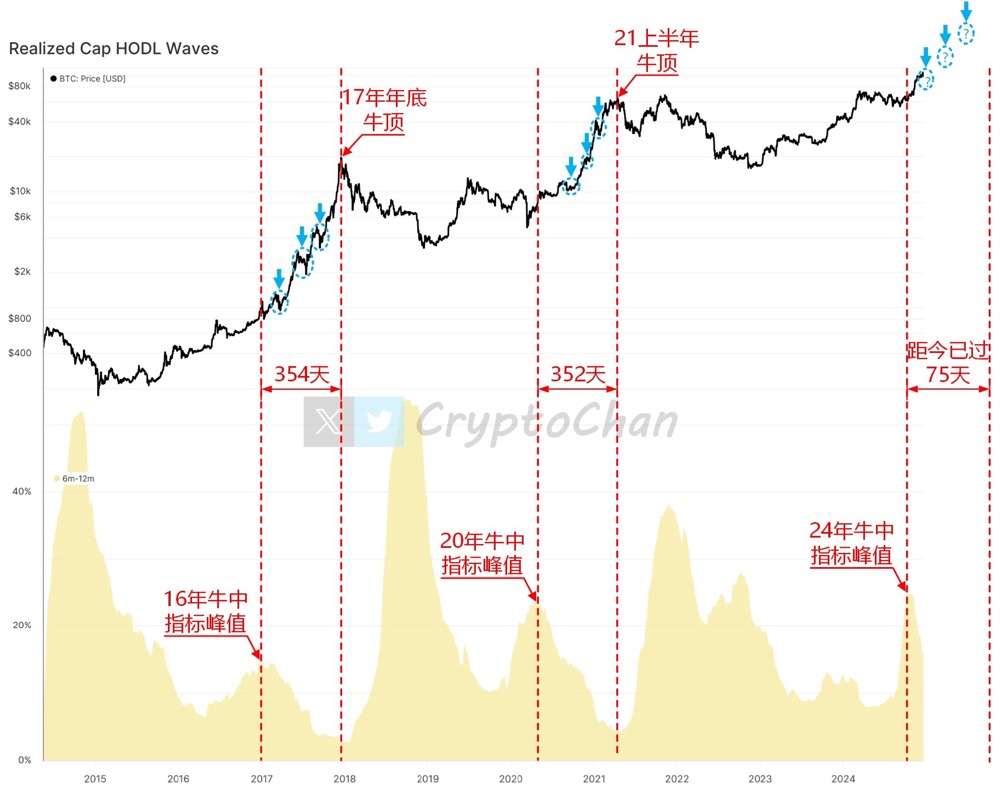

Bitcoin chain index peak warning: bull market callback or inevitable, the historical trend is surprisingly consistent

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin wavers under $88K as traders brace for $14B BTC options expiry

The likelihood of a bitcoin short squeeze to $90,000 increases as funding rates turn negative

After dropping from $106,000 to $80,600, Bitcoin has stabilized and started to rebound, sparking discussions in the market about whether a local bottom has been reached. While whales and retail investors continue to sell, mid-sized holders are accumulating. Negative funding rates suggest a potential short squeeze. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

TGE tonight: A quick look at the ecosystem projects mentioned by Monad on the first day

Including prediction markets, DeFi, and blockchain games.

In-depth Conversation with Sequoia Capital Partner Shaun: Why Does Musk Always Defeat His Rivals?

Shaun not only led the controversial 2019 investment in SpaceX, but is also one of the few investors who truly understands Elon Musk's operational system.