Bitcoin January slump nothing new in ‘post-halving years’ — Analysts

From cointelegraph by Martin Young

A major Bitcoin correction in the first month of a year after the blockchain sees a halving is historically not unusual, according to analysts who have compared previous cycles.

“Bitcoin dumping in January has historically been a common occurrence in post-halving years,” crypto analyst Axel Bitblaze told his 123,000 X followers on Jan. 12. “We all know what happened after the 2017 and 2021 dumps.”

Bitcoin BTC$93,462 has lost 10% so far this month in a fall from its high of $102,300 on Jan. 7 to just below $92,000 before recovering slightly to now hover around $94,000.

In January 2021, the next most recent post-halving year, Bitcoin fell more than 25% from over $40,000 to just above $30,000 by the end of the month. It then skyrocketed 130% to a new all-time high of $69,000 by November.

In January 2017, the year after the 2016 halving, Bitcoin slumped 30%, falling from $1,130 to $784. It then surged 2,400% that year, culminating in an all-time high of $20,000 by December.

Bitcoin post-halving year January slumps. Source: Axel Bitblaze

Meanwhile, YouTuber and analyst Crypto Rover observed that Bitcoin has consistently dropped in the first half of the month for the past year.

“This is just a small dip compared to what we’ve seen before,” he said.

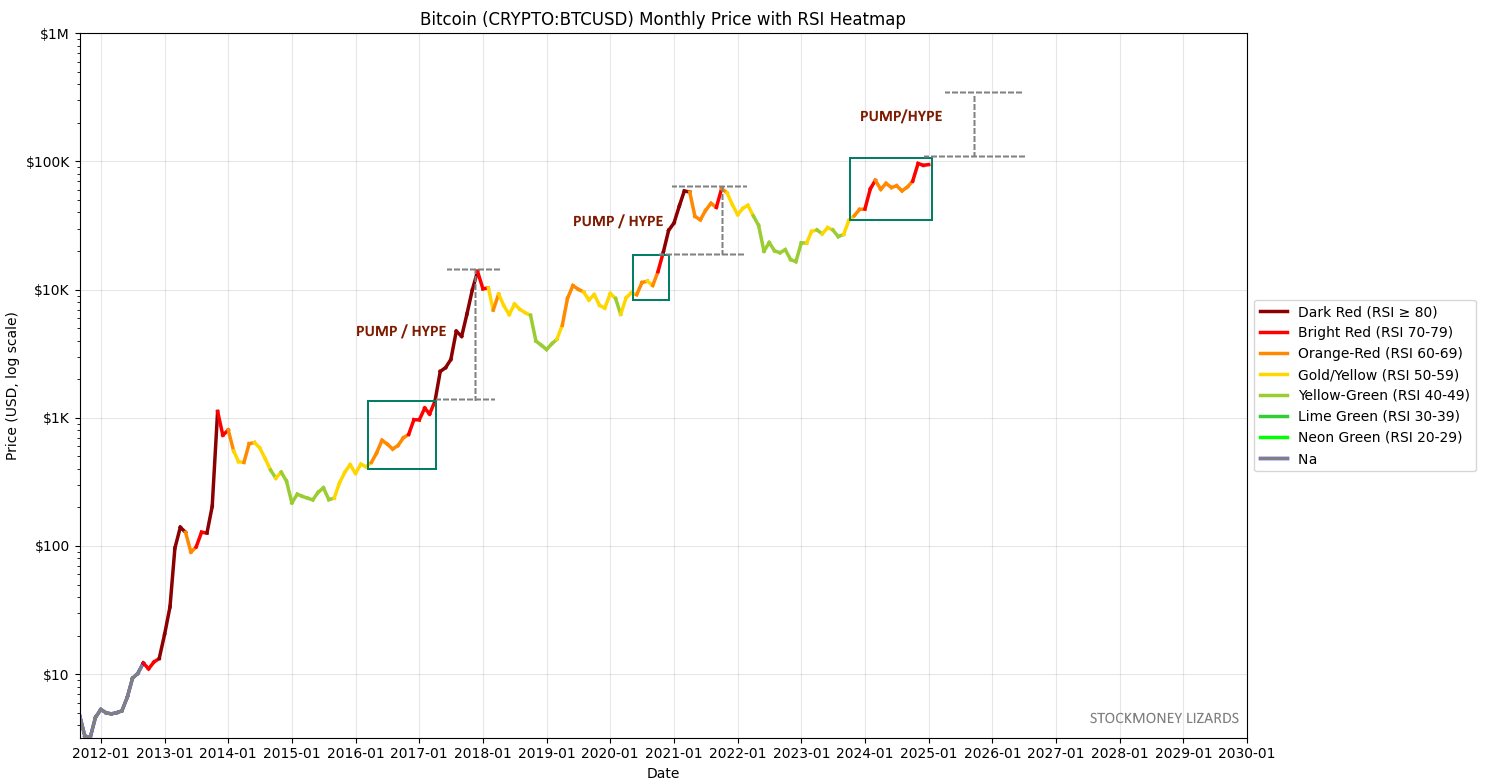

“Bitcoin has NOT reached the ultimate hype/pump phase,” posted the finance analysis Stockmoney Lizards X account on Jan. 12. “This cycle has more fuel in the coming 12 months.”

Bitcoin monthly chart with RSI color coding. Source: Stockmoney Lizards

The analyst acknowledged that things were a bit different in every cycle but added that “with mass adoption, pro-crypto governments worldwide, ETFs, etc. I think it underlines our hypothesis.”

A 130% move similar to that in the peak year of the previous cycle could send BTC prices from current levels to over $200,000 before the end of 2025.

On the flip side, a pullback of the magnitude seen in January of the last two cycles could send prices below $70,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The likelihood of a bitcoin short squeeze to $90,000 increases as funding rates turn negative

After dropping from $106,000 to $80,600, Bitcoin has stabilized and started to rebound, sparking discussions in the market about whether a local bottom has been reached. While whales and retail investors continue to sell, mid-sized holders are accumulating. Negative funding rates suggest a potential short squeeze. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

TGE tonight: A quick look at the ecosystem projects mentioned by Monad on the first day

Including prediction markets, DeFi, and blockchain games.

In-depth Conversation with Sequoia Capital Partner Shaun: Why Does Musk Always Defeat His Rivals?

Shaun not only led the controversial 2019 investment in SpaceX, but is also one of the few investors who truly understands Elon Musk's operational system.

11 million cryptocurrencies stolen, physical attacks are becoming a mainstream threat

A man posing as a delivery driver stole $11 million worth of cryptocurrency this weekend, while incidents of burglary are also on the rise.