Seven Days, Seven DAOs: Proposal for Governance and Market Flows

From Scroll’s governance suspension to Hyperliquid’s USDH battle and Ronin’s Ethereum migration, this week’s DAO proposals could reshape liquidity, incentives, and investor sentiment across DeFi.

Seven major DAO proposals emerged during a turbulent week, including Scroll’s governance shift and the USDH ticker dispute on Hyperliquid. Strategic moves from Ronin and dYdX also contributed to the significant proposals.

These decisions impact their respective ecosystems and could directly affect investors.

DAOs Heat This Week

Over the past seven days, key proposals and debates across major DAOs have painted a volatile picture of on-chain governance. From a Layer-2 (L2) project suspending its DAO operations to crucial votes deciding the future of stablecoins and buyback trends being considered by multiple protocols, the DAO market is hotter than ever.

One of the most shocking announcements came from Scroll, which revealed it would suspend its DAO and change to a more centralized model. This move raises significant questions about the balance between development speed and the philosophy of decentralization. In an era where L2 networks are fiercely competitive, Scroll’s “taking the reins” could allow faster upgrades — but also stir community concerns over transparency and user participation.

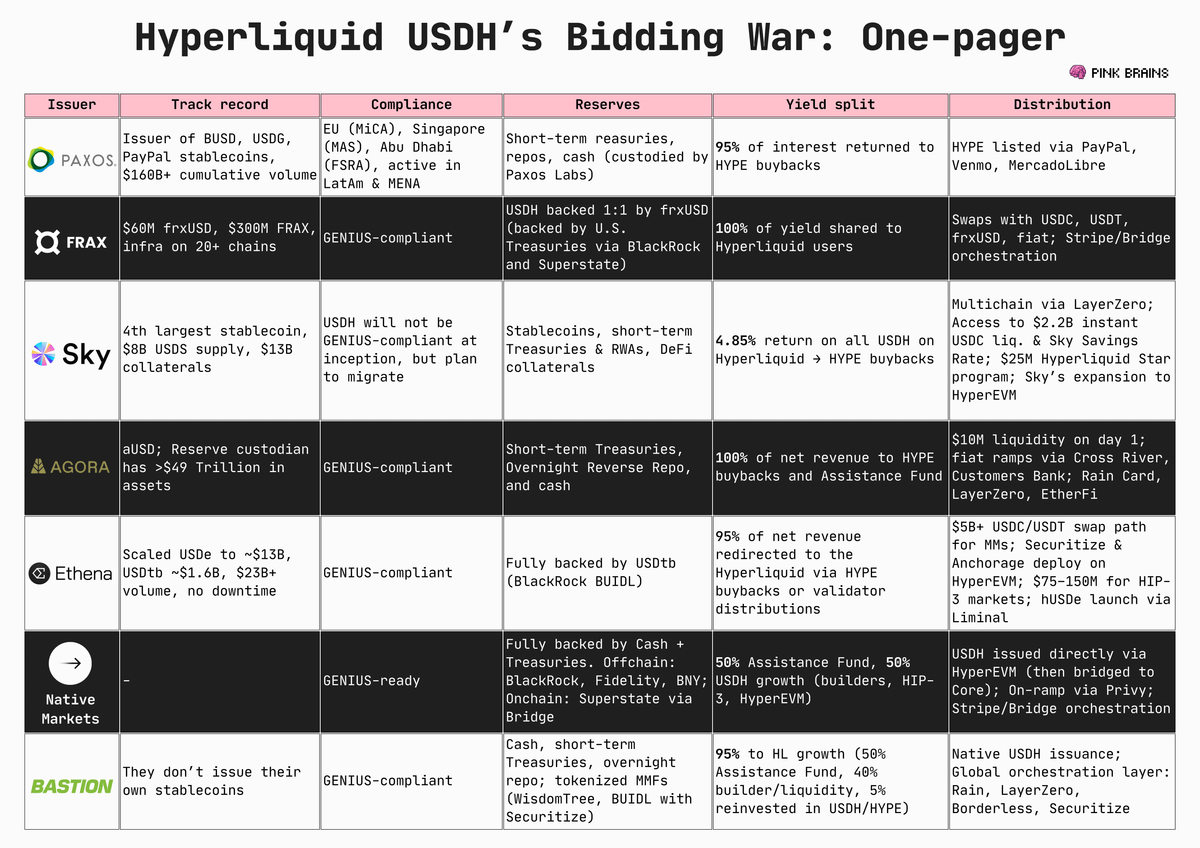

The second central focal point is the validator vote on Hyperliquid (HYPE) to determine ownership of the USDH ticker — one of the platform’s most liquid stablecoins. If control ends up in the hands of a specific group, it could directly impact stablecoin development strategies and trading fees. This battle may reshape capital flows on Hyperliquid and influence the broader DeFi ecosystem.

USDH ticker war. Source:

USDH ticker war. Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Paradigm Shift in Ethereum Execution Layer Scaling: From Defensive Conservatism to Empirical Science-Driven Evolution of the 60M Gas Limit

These efforts have enabled the Ethereum mainnet to move from being cautious about increasing the gas limit to now being able to safely raise it all the way up to 60M gas, or even higher.

Devcon Impressions: While the Community Doubts Ethereum Online, the Offline Atmosphere Is Vibrant and Thriving

Ethereum's innovation remains at the forefront, while other chains seem to be merely "replicating" its path, even when it comes to Meme phenomena.

Bitcoin rebounds to $91,000: Can it sustain the rally?

Driven by factors such as the macro environment and expectations of a Federal Reserve rate cut, the cryptocurrency market has temporarily halted its downward trend.

S&P downgrades USDT to lowest rating, leading stablecoin stirs controversy

S&P downgraded USDT to the lowest rating, citing high-risk reserves and insufficient disclosure, while more transparent centralized stablecoins like USDC received higher ratings.