European Central Bank Official Warns About the Impact of a Potential Stablecoin Sell-Off

A European Central Bank official warns that a large wave of stablecoin redemptions could pressure the ECB to adjust interest rates. With stablecoins surpassing a $300 billion market cap, officials fear rising financial-stability and monetary-sovereignty risks as adoption accelerates.

A mass redemption of stablecoins could force the European Central Bank (ECB) to adjust its monetary policy, a senior official warns.

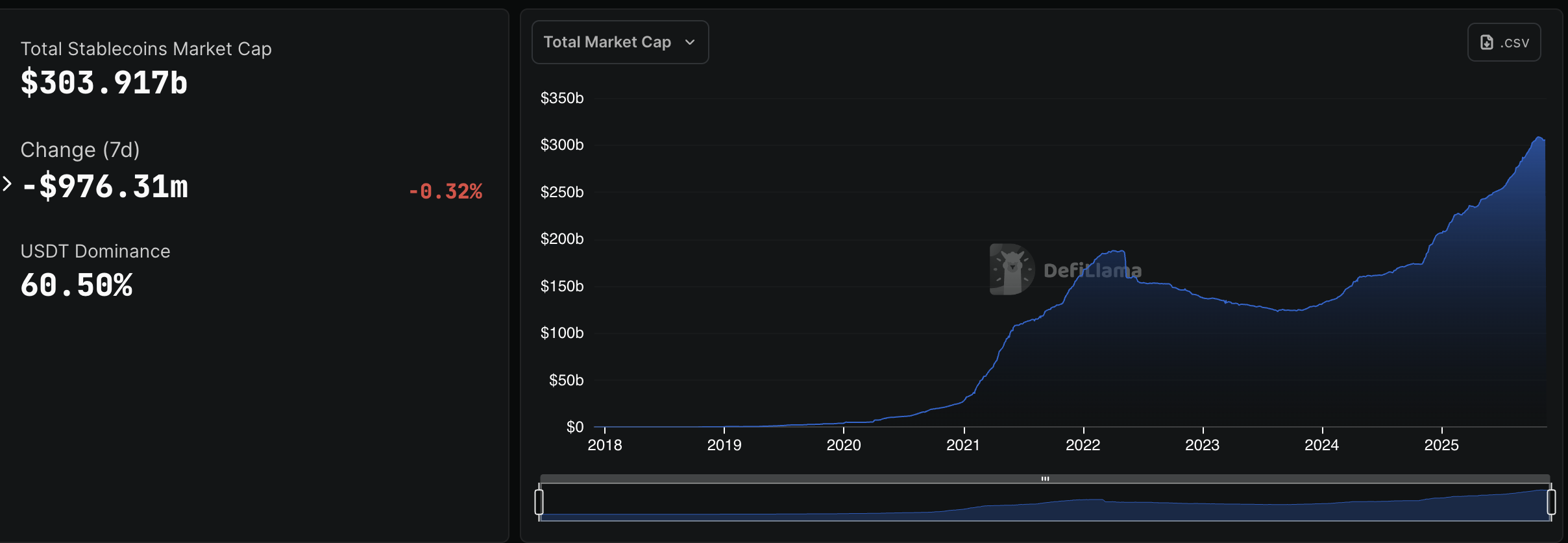

Concerns are mounting about the risks posed by stablecoins, which have experienced strong growth, with their market cap exceeding $300 billion in 2025.

European Central Bank Raises Concerns Over Stablecoins

Olaf Sleijpen, President of De Nederlandsche Bank and a member of the European Central Bank’s Governing Council, has warned that the rapid expansion of stablecoins could have serious implications for Europe’s economy. Speaking about the accelerating growth of dollar-based stablecoins, he noted that if their adoption continues at the current pace, they could eventually reach a level where they become systemically important.

Furthermore, he emphasized that a wave of large-scale redemptions, essentially a run on stablecoins, could trigger market turbulence that extends far beyond the crypto sector.

“If stablecoins are not that stable, you could end up in a situation where the underlying assets need to be sold quickly,” Sleijpen told the Financial Times.

In such a scenario, he said that the ECB might be forced to reconsider its monetary policy stance. According to Sleijpen, the central bank could be pushed to adjust interest rates.

Nonetheless, it is unclear whether that would mean tightening or loosening policy. He emphasized that authorities would first rely on financial stability tools before turning to interest rate changes.

Hypothetically, if investors rush to redeem stablecoins, issuers might need to liquidate Treasury holdings quickly. Sharp sell-offs could drive up US government debt yields, leading to spillover effects in Europe’s bond markets.

When bond yields rise, financial conditions tighten, which can slow economic activity and affect inflation. The ECB might then have to adjust rates not for domestic reasons, but to counter instability from the crypto sector.

Previously, Jürgen Schaaf, an adviser in the ECB’s Market Infrastructure and Payments Division, issued a similar warning. He cautioned that if stablecoins become widely used in the euro area for payments, savings, or settlement, they could gradually weaken the ECB’s ability to steer monetary conditions.

Schaaf noted that this shift could mirror the dynamics seen in dollarised economies, where users gravitate toward the dollar for perceived safety or better returns.

According to Schaaf, a dominant role for dollar stablecoins would ultimately reinforce America’s financial and geopolitical position, enabling cheaper debt financing and expanding its global influence. Meanwhile, Europe would face relatively higher borrowing costs, reduced monetary policy flexibility, and greater strategic dependence.

“The associated risks are obvious – and we must not play them down. Non-domestic stablecoin’s challenges range from operational resilience, the safety and soundness of payment systems, consumer protection, financial stability, monetary sovereignty, data protection, to compliance with anti-money laundering and counter-terrorism financing regulations,” he added.

Stablecoin Adoption Accelerates Amid Market Expansion

The warnings from European officials come at a time when the stablecoin industry is experiencing rapid expansion amid major regulatory shifts. According to data from DefiLlama, the sector’s market capitalization has grown by nearly 48% this year alone. It now sits at over $300 billion.

Stablecoin Market Performance. Source:

DefiLlama

Stablecoin Market Performance. Source:

DefiLlama

Tether continues to dominate the market with a market capitalization of approximately $183.8 billion. Its investment footprint has also grown significantly. The firm is the 17th-largest holder of US government debt worldwide — ahead of countries such as South Korea.

Additionally, stablecoin usage has accelerated. Monthly settlement volumes increased from $6 billion in February to $10.2 billion in August, a rise of approximately 70%.

Business-to-business activity has been particularly strong. It doubled to $6.4 billion per month and now represents almost two-thirds of all payment flows in the sector.

Forecasts suggest the expansion is far from over. Citigroup estimates that the global stablecoin market could swell to around $3.7 trillion by 2030. The US Treasury Department projects the market could reach $2 trillion as early as 2028.

If these projections materialize, stablecoins would become deeply integrated into global finance, amplifying both their economic relevance and the regulatory challenges surrounding them.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Xapo's Enhanced Bitcoin Fund Signals Growing Institutional Confidence in Digital Assets

- Xapo Bank expanded its Byzantine BTC Credit Fund after $100M in institutional allocations, reflecting growing demand for Bitcoin-backed yield products. - The fund uses Hilbert Group's institutional-grade lending process to generate low-risk returns for Bitcoin holders through collateralized loans. - Xapo's expansion follows 2022 lending sector collapse, leveraging regulatory compliance in Gibraltar/Cayman to rebuild institutional trust in Bitcoin collateral. - The product differentiates from ETFs/stablec

Bitcoin News Update: Movements of Investors' USDT Indicate Bitcoin Highs and Periods of Profit Realization

- Bitcoin's price inversely correlates with USDT outflows, as investors shift liquidity between assets during market cycles. - S&P Global downgraded USDT's stability rating to "weak" due to 5.6% Bitcoin allocation and opaque reserves amid U.S. regulatory reforms. - The GENIUS Act and EU's MiCA framework are reshaping stablecoin markets, forcing Tether and Circle to launch jurisdiction-specific, cash-backed alternatives. - Institutional ETF activity, including Texas's Bitcoin purchases and fragmented inflow

The New Prospects for Economic Growth Infrastructure in Webster, NY

- Webster , NY, leverages $9.8M FAST NY grants and PPPs to transform Xerox campus into a high-tech industrial hub. - Infrastructure upgrades including roads, sewers, and electrical systems aim to attract advanced manufacturing and renewable energy firms. - Governor Hochul's strategy drives $51M in upstate investments, creating 250+ jobs via projects like the $650M fairlife® dairy plant. - Redevelopment boosts industrial land availability and residential property values by 10.1%, with mixed-use zoning enhan

The Impact of Artificial Intelligence on Contemporary Portfolio Management: Potential Benefits and Challenges

- AI redefines portfolio management with real-time analytics and dynamic asset allocation, shifting from static human-driven strategies to data-centric systems. - Generative AI tools like ChatGPT automate financial workflows, enabling hyper-personalized strategies and boosting business outcomes through optimized digital presence. - Risk modeling evolves via AI's pattern detection, but challenges persist in transparency and bias, requiring explainable AI frameworks and human oversight. - Institutions integr