HBAR Price Falls 18% A Week After Losing Its Month-Long Support

Hedera has suffered a sharp decline over the past week, with its price falling to $0.130 after losing more than 18%. This drop is significant because HBAR broke below a crucial support level that had protected investors’ profits for more than a month. Hedera Is Following The King Hedera’s correlation with Bitcoin currently sits at

Hedera has suffered a sharp decline over the past week, with its price falling to $0.130 after losing more than 18%.

This drop is significant because HBAR broke below a crucial support level that had protected investors’ profits for more than a month.

Hedera Is Following The King

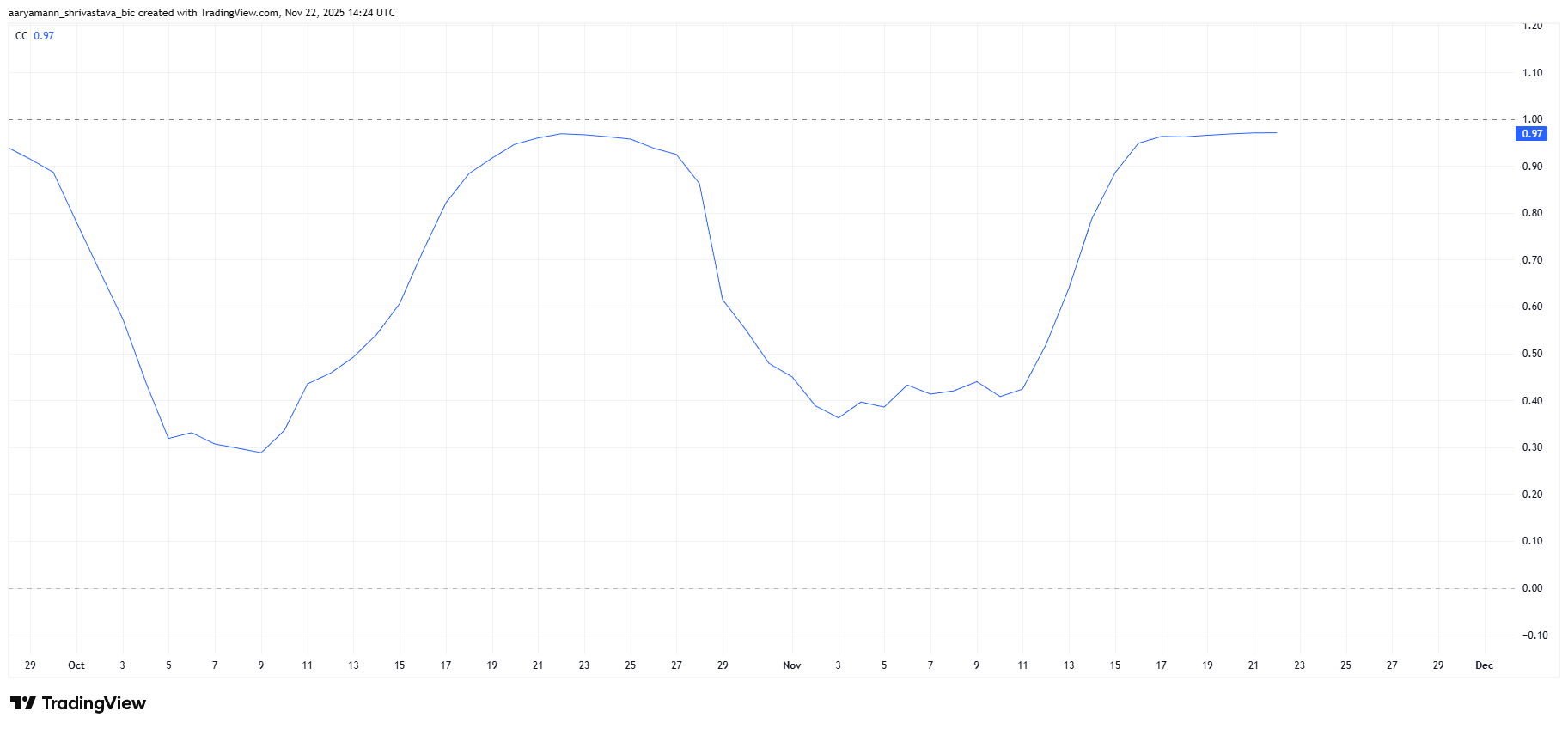

Hedera’s correlation with Bitcoin currently sits at 0.97, one of its highest readings in months. This near-perfect correlation signals that HBAR is heavily mirroring Bitcoin’s price movement.

Such strong alignment becomes especially problematic during periods when BTC faces substantial pressure, as seen this past week.

With Bitcoin dropping to $84,408, HBAR has moved almost in lockstep. The high correlation has erased Hedera’s ability to move independently, making BTC’s decline one of the primary drivers behind the altcoin’s latest losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR Correlation To Bitcoin. Source:

HBAR Correlation To Bitcoin. Source:

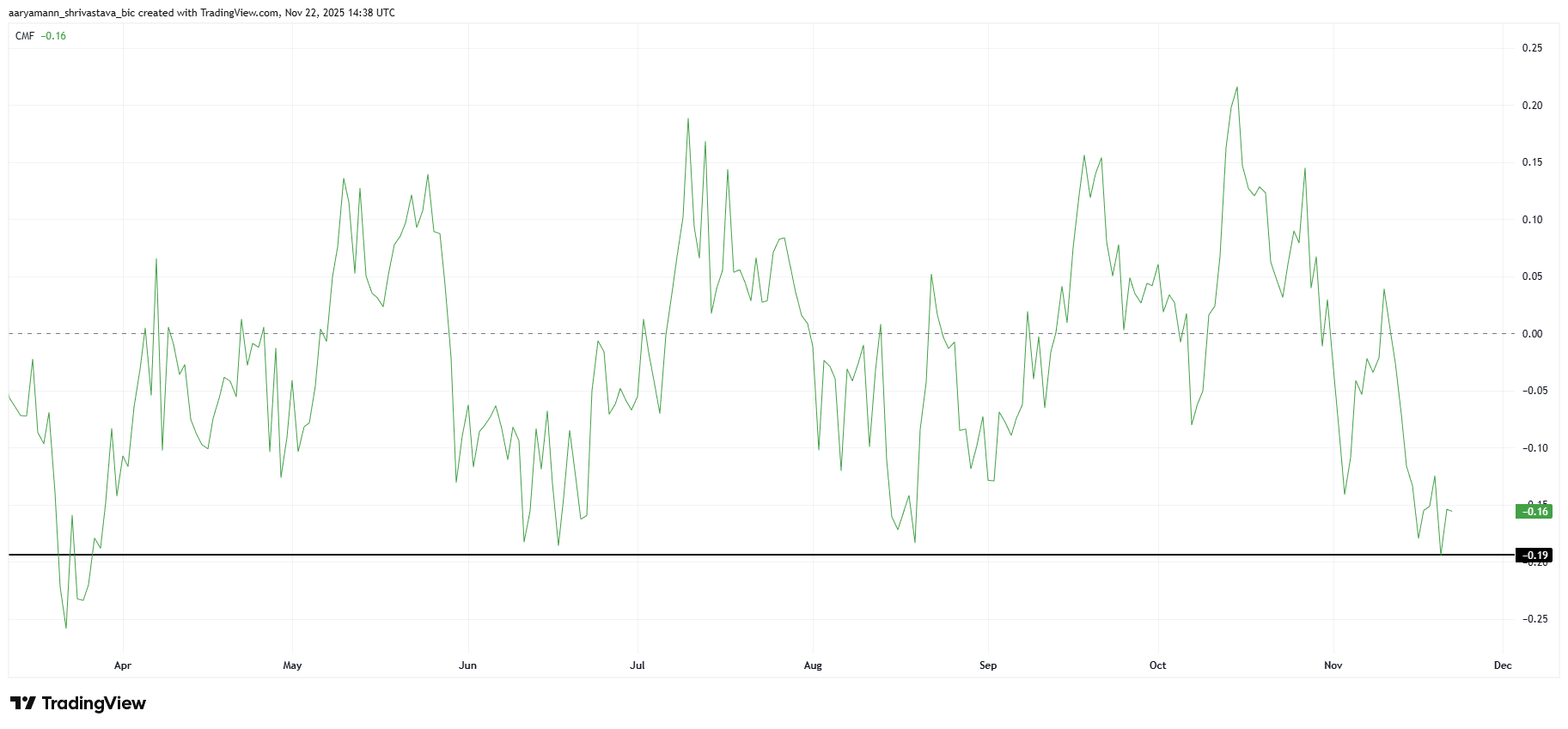

Macro momentum indicators reinforce the bearish picture. The Chaikin Money Flow is sitting near an eight-month low, signaling heavy capital outflows from HBAR.

CMF measures buying and selling pressure, and a deeply negative reading indicates that investors are withdrawing funds at an accelerated pace.

These persistent outflows add pressure to the already declining price trend. As liquidity exits the asset, selling intensifies and recovery efforts weaken.

Unless inflows return, HBAR may continue facing difficulty in regaining upward momentum.

HBAR CMF. Source:

HBAR CMF. Source:

HBAR Price Can Bounce Back

HBAR is down 18% this week after slipping below the crucial $0.162 support level, which had held strong for more than a month.

Losing that support has exposed the altcoin to deeper declines and increased volatility as bearish sentiment grows.

Given that macro conditions have not improved, HBAR could drop to $0.120 from its current price of $0.129.

A fall below $0.120 may trigger additional losses, sending the price toward $0.110 as selling pressure builds.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

If bullish momentum returns, HBAR may attempt a recovery. A move above $0.133 would be the first step toward stabilizing the trend.

Breaking past $0.145 could open the path to $0.154 and higher, invalidating the bearish outlook and restoring investor confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZK Atlas Enhancement: Driving Institutional Embrace Amid the Blockchain Scalability Competition

- ZKsync's Atlas Upgrade solves throughput bottlenecks with Airbender RISC-V zkVM, enabling 15,000+ TPS at $0.0001 per transaction. - Modular ZKsync OS reduces gas fees by 70% since 2023, enabling real-time financial applications while maintaining regulatory compliance. - Deutsche Bank and UBS test ZKsync for asset tokenization, highlighting its institutional appeal through privacy-preserving ZK features and sub-second finality. - Upcoming Fusaka upgrade aims to push TPS to 30,000 by December 2025, but reg

Bitcoin Updates: Bitcoin Receives Major-Cap Status as Nasdaq Increases Options Limits Fourfold

- Nasdaq seeks SEC approval to quadruple IBIT options limits from 250,000 to 1 million contracts, aligning Bitcoin ETF with high-liquidity assets like EEM and GLD . - The proposal cites IBIT's $86.2B market cap, 44.6M daily shares traded, and industry support for addressing institutional demand amid Bitcoin's rapid financial instrument maturation. - Experts argue higher limits will reduce spreads, enable sophisticated hedging, and treat Bitcoin as a "mega-cap asset," while Nasdaq also seeks unlimited FLEX

XRP Update: ADGM's Green Light for RLUSD Strengthens UAE's Pursuit of Digital Financial Growth

- Ripple's RLUSD stablecoin secured ADGM approval as an institutional fiat-backed token in November 2025, following DIFC's June 2025 greenlight. - The UAE's dual regulatory endorsements position RLUSD for cross-border settlements, with $1.2B market cap driven by institutional demand for collateral and treasury tools. - ADGM's stringent oversight framework requires full reserve backing and AML compliance, aligning RLUSD with global standards under NYDFS charter . - XRP prices surged 24% in late 2025 amid $1

Bitcoin Updates: SpaceX Strengthens Bitcoin Holdings as Institutions Adjust Portfolios

- SpaceX transfers 1,163 BTC ($105M) to new wallets, increasing total holdings to 6,095 BTC ($556.7M) amid Bitcoin's rebound above $91,300. - Institutional Bitcoin interest grows as ETFs see $2.6B outflows, contrasting with SpaceX's secure custody strategy mirroring Tesla's $1.05B BTC treasury management. - Analysts view the activity as routine security adjustments rather than liquidation, highlighting corporate Bitcoin adoption focused on treasury diversification over speculation. - Market debates persist