Dogecoin Is Overvalued, But Monday Could Flip the Script

Dogecoin has been sliding over the past several days as bearish sentiment spreads across the broader crypto market. Despite the decline, the meme coin is currently overvalued due to heightened speculation surrounding the upcoming launch of Grayscale’s Dogecoin ETF (GDOG). This hype may translate into substantial transaction volume on Monday, potentially reshaping DOGE’s short-term outlook.

Dogecoin has been sliding over the past several days as bearish sentiment spreads across the broader crypto market. Despite the decline, the meme coin is currently overvalued due to heightened speculation surrounding the upcoming launch of Grayscale’s Dogecoin ETF (GDOG).

This hype may translate into substantial transaction volume on Monday, potentially reshaping DOGE’s short-term outlook.

Dogecoin Investors Provide Support

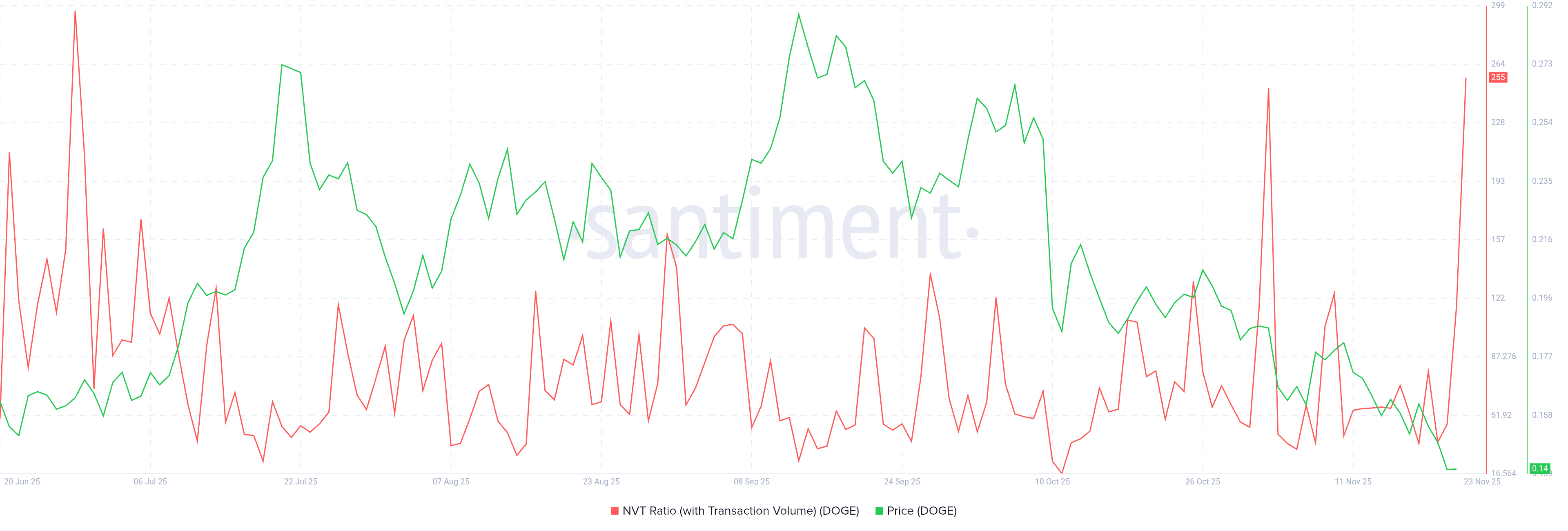

Dogecoin’s NVT Ratio is spiking sharply, signaling a disconnect between valuation and on-chain activity.

The ratio compares market capitalization with transaction volume, and a surge typically indicates limited transactional utility relative to price. While DOGE is attracting strong social attention and broad support, its actual transaction levels are not keeping pace.

This mismatch can often lead to overvaluation, which in bearish conditions may trigger a drop.

However, the timing of this spike aligns with the anticipated launch of Grayscale’s Dogecoin ETF. The ETF is expected to draw notable capital inflows, which could reset the NVT Ratio and restore balance between price and on-chain activity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Dogecoin NVT Ratio:

Santiment

Dogecoin NVT Ratio:

Santiment

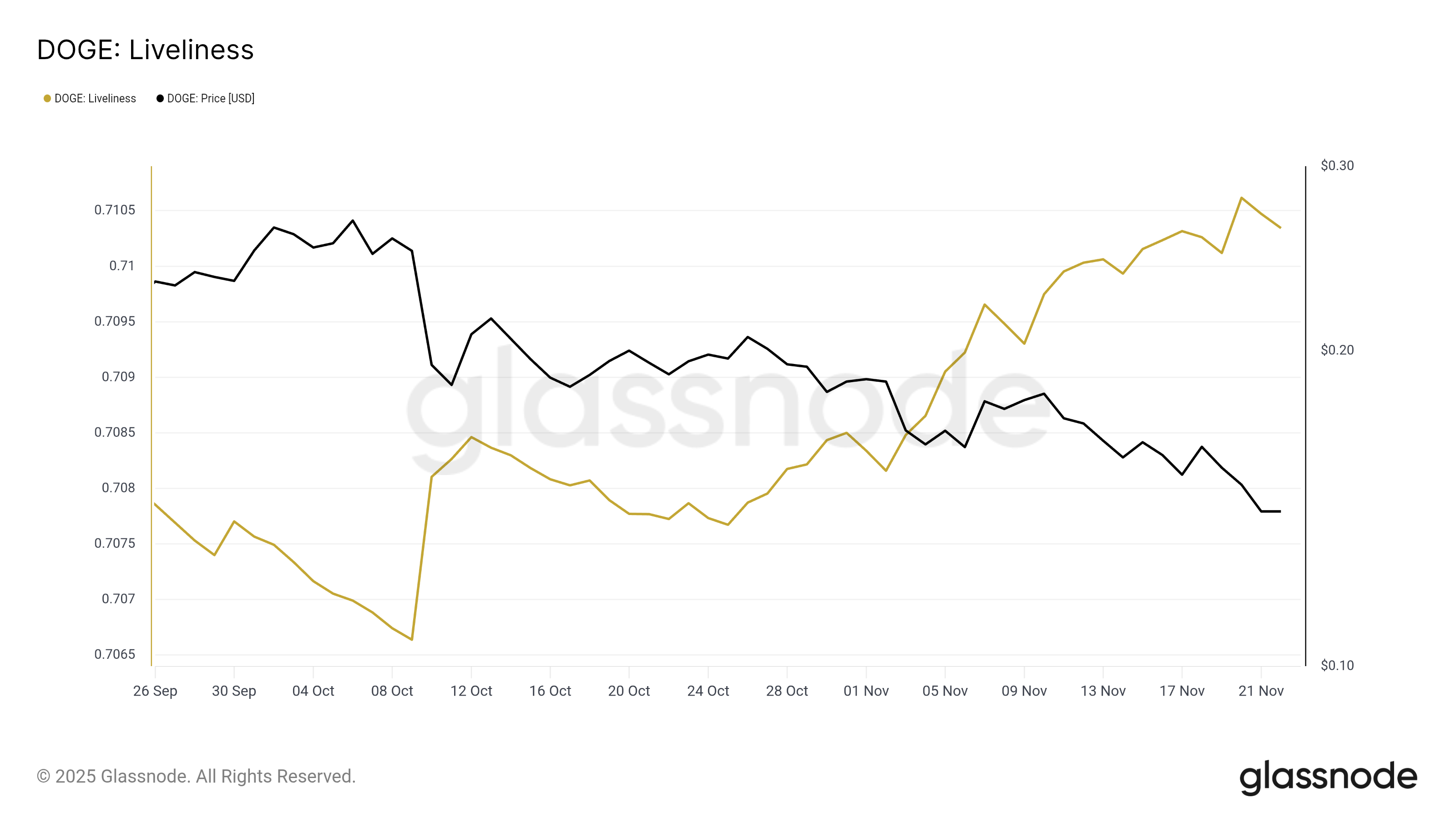

Macro indicators also paint an encouraging picture. Dogecoin’s Liveliness metric has been rising for several days, indicating increased HODLing behavior among long-term holders.

Liveliness rises when coins remain dormant for longer periods rather than being spent, suggesting that key holders are protecting their positions.

This trend is particularly important during downturns. Long-term holders often act as the backbone of price stability, resisting volatility caused by short-term traders.

Their continued conviction reduces the risk of abrupt sell-offs and shows confidence in Dogecoin’s ability to recover once market conditions shift.

Dogecoin Liveliness. Source:

Glassnode

Dogecoin Liveliness. Source:

Glassnode

DOGE Price Could Shoot Up

Dogecoin is trading at $0.143 and holding near the $0.142 support level. The meme coin remains trapped under a month-long downtrend that it has repeatedly failed to break. Current bearish conditions make recovery difficult without a significant catalyst.

The launch of the DOGE ETF could provide that catalyst. A successful debut may lift DOGE above $0.151, opening the path toward $0.165. A move of this scale would invalidate the downtrend and signal a shift in momentum supported by new inflows.

DOGE Price Analysis. Source:

TradingView

DOGE Price Analysis. Source:

TradingView

If the ETF hype fails to translate into buying pressure, Dogecoin could extend its decline. A drop toward $0.130 remains possible.

But if DOGE does not face a drop this sharp, it may continue struggling beneath the $0.151 resistance, prolonging the ongoing downtrend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BNB News Today: BNB Faces Crucial $870 Threshold—Will Bulls Ignite a Rally Toward $1,000?

- BNB rebounds above $860, with technical indicators and Binance's $51.1B stablecoin liquidity supporting a potential $989 rally. - Analysts predict $950–$1,000 by December 2025 if RSI hits oversold levels and a Golden Cross forms. - However, a breakdown below $790.79 risks a decline to $700–750 amid broader crypto market fragility. - Binance's dominance in stablecoin inflows and Ethereum volatility could amplify BNB's movements during uncertainty.

XRP News Update: Reasons XRP Value May Skyrocket: ETFs Drive Significant Increase in Structural Demand

- U.S. SEC approval of spot XRP ETFs in November 2025 triggered $85M in first-week inflows, with Bitwise and 21Shares attracting $168M and $150M in assets. - Whale accumulation of $7.7B in XRP over three months, combined with ETF demand, fuels speculation of a price rebound to $22.5 or higher. - Analyst models predict ETFs could absorb 3B XRP annually, creating structural demand that may drive prices to $220 within two years if 15 ETFs collectively absorb 150M XRP daily. - Institutional adoption in cross-b

Ethereum News Today: Ethereum's Scaling Dilemma: Increasing Gas Capacity While Managing Financial Risks

- Ethereum doubled its block gas limit to 60 million, enhancing scalability through coordinated upgrades like EIP-4844 and future danksharding. - Vitalik Buterin emphasized targeted cost adjustments for operations like SSTORE to balance throughput and network security as scaling progresses. - The expansion aims to compete with Solana and Layer 2 solutions while preparing for the Fusaka upgrade, which could strengthen ETH's value proposition. - Despite technical improvements, Ethereum faces bearish market d

Bitcoin Updates Today: Bitcoin Rallies Amid Fed Optimism, Yet Caution as Bearish Indicators Suggest Potential Volatility

- Bitcoin surged above $91,000 on Nov. 27, 2025, driven by rising Fed rate-cut expectations and SpaceX's $105M BTC transfer. - Bearish technical signals persist as Bitcoin breaks below 50-week EMA and key trendlines, with critical resistance at $90,822–$101,000. - Institutional confidence remains strong despite volatility, with SpaceX consolidating BTC holdings and a whale selling $18.35M profit. - Fed's potential 67.1% chance of 25-basis-point cut could weaken the dollar but risks delayed easing if inflat