A 300% Spike in Selling Pressure Could Threaten the Ethereum Price Bounce

Ethereum price bounced almost 10% from this week’s lows near $2,600, and the price is up about 1% today. The move looks positive, but the recovery may not last. Two major bearish signals have emerged simultaneously. Together, they threaten to end the bounce before it grows. Holder Selling Surges 300% as a Death Cross Forms

Ethereum price bounced almost 10% from this week’s lows near $2,600, and the price is up about 1% today. The move looks positive, but the recovery may not last.

Two major bearish signals have emerged simultaneously. Together, they threaten to end the bounce before it grows.

Holder Selling Surges 300% as a Death Cross Forms

Two connected signals now point to deeper weakness.

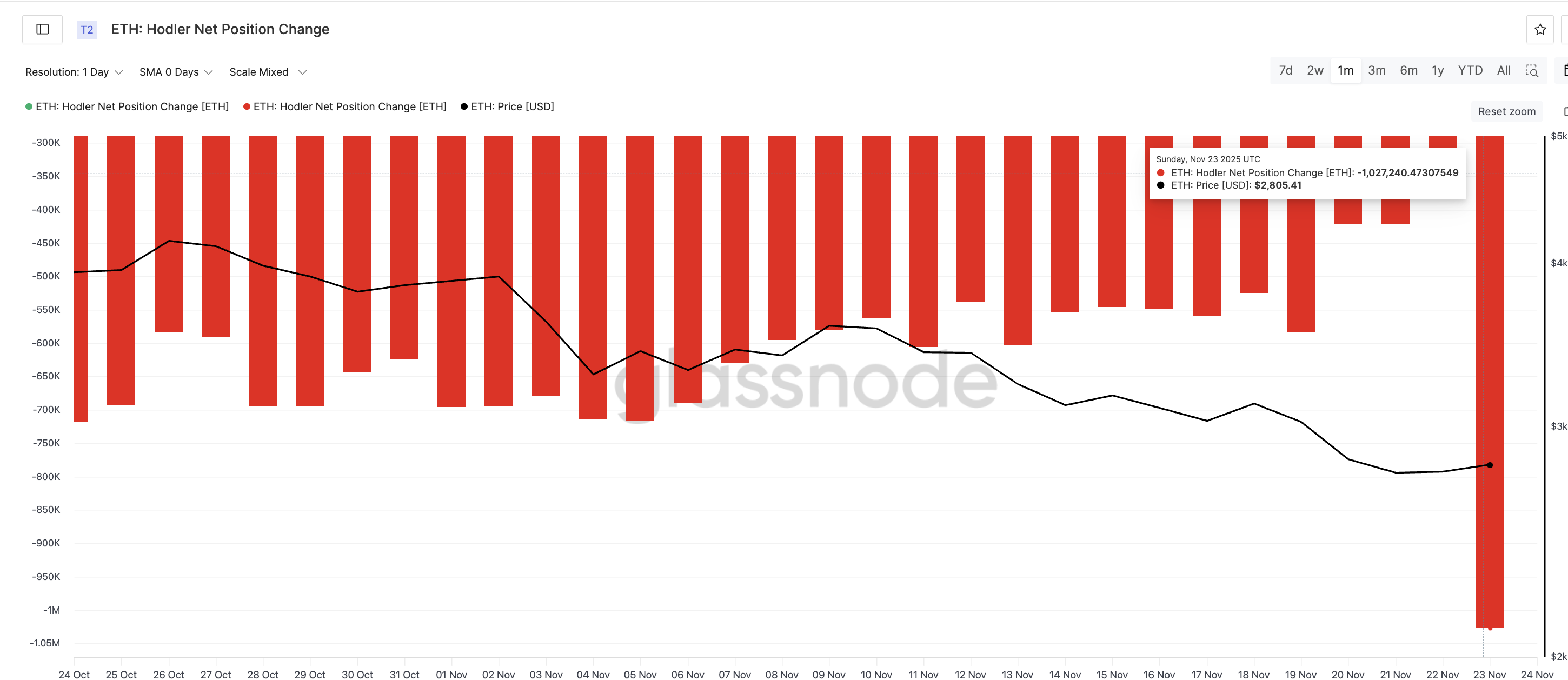

The first comes from long-term investors, often called hodlers. These are wallets that usually hold ETH for more than 155 days. When hodlers increase their selling, it usually shows fear or a shift in long-term belief.

On November 22, net selling from these wallets was about 334,600 ETH. On November 23, it jumped to 1,027,240 ETH — a 300% spike in one day. This is a major exit from long-term holders and adds heavy supply at a time when ETH already trades in a broader downtrend.

ETH Sellers Have The Upper Hand:

Glassnode

ETH Sellers Have The Upper Hand:

Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At the same time, a death cross has almost formed. A death cross appears when the 50-day exponential moving average (EMA) drops under the 200-day EMA. An EMA gives more weight to recent prices, so it reacts faster than a simple moving average.

When the 50-day EMA crosses below the 200-day, it signals strong downward momentum. That could hit the ETH prices significantly if the selling pressure continues to rise.

Bearish Risks Build:

TradingView

Bearish Risks Build:

TradingView

Here is the key connection:

Hodler selling is rising sharply at the exact moment the EMA structure is turning bearish. That means the selling pressure is reinforcing the death-cross signal instead of slowing it down. When these two appear together, recoveries usually fail and prices retest lower supports.

Ethereum Price Action: Downside Risk Still Outweighs the Bounce

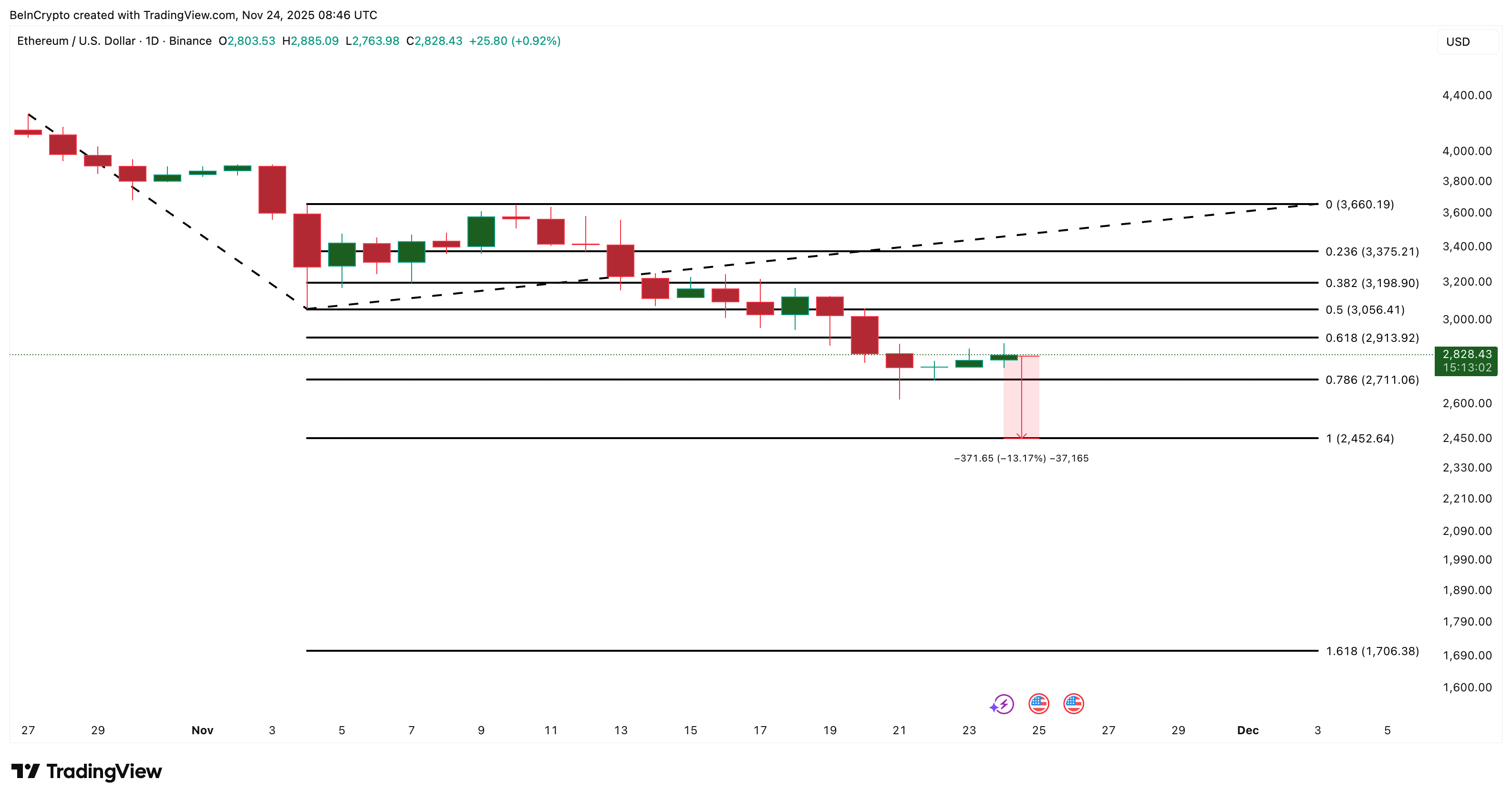

Ethereum now trades near $2,820, but the chart shows more pressure above than support below.

The first level ETH must defend is $2,710, the 0.786 Fibonacci zone. Losing this level opens a drop toward $2,450, which marks roughly a 13% downside from current levels. If the death cross completes while hodler selling continues, ETH can fall directly toward this level and even under it if the market conditions weaken.

Ethereum Price Analysis:

TradingView

Ethereum Price Analysis:

TradingView

Below $2,452, the next deeper support sits near $1,700 — the broader extension from the descending structure. This only activates if the trend accelerates and sellers remain dominant.

Upside remains limited unless the ETH price can reclaim:

- $3,190, the first meaningful resistance

- $3,660, the stronger ceiling that signals an early trend shift

Under current conditions, hitting these levels looks difficult because both bearish signals — the surge in hodler selling and the death-cross setup — remain active.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Xapo's Enhanced Bitcoin Fund Signals Growing Institutional Confidence in Digital Assets

- Xapo Bank expanded its Byzantine BTC Credit Fund after $100M in institutional allocations, reflecting growing demand for Bitcoin-backed yield products. - The fund uses Hilbert Group's institutional-grade lending process to generate low-risk returns for Bitcoin holders through collateralized loans. - Xapo's expansion follows 2022 lending sector collapse, leveraging regulatory compliance in Gibraltar/Cayman to rebuild institutional trust in Bitcoin collateral. - The product differentiates from ETFs/stablec

Bitcoin News Update: Movements of Investors' USDT Indicate Bitcoin Highs and Periods of Profit Realization

- Bitcoin's price inversely correlates with USDT outflows, as investors shift liquidity between assets during market cycles. - S&P Global downgraded USDT's stability rating to "weak" due to 5.6% Bitcoin allocation and opaque reserves amid U.S. regulatory reforms. - The GENIUS Act and EU's MiCA framework are reshaping stablecoin markets, forcing Tether and Circle to launch jurisdiction-specific, cash-backed alternatives. - Institutional ETF activity, including Texas's Bitcoin purchases and fragmented inflow

The New Prospects for Economic Growth Infrastructure in Webster, NY

- Webster , NY, leverages $9.8M FAST NY grants and PPPs to transform Xerox campus into a high-tech industrial hub. - Infrastructure upgrades including roads, sewers, and electrical systems aim to attract advanced manufacturing and renewable energy firms. - Governor Hochul's strategy drives $51M in upstate investments, creating 250+ jobs via projects like the $650M fairlife® dairy plant. - Redevelopment boosts industrial land availability and residential property values by 10.1%, with mixed-use zoning enhan

The Impact of Artificial Intelligence on Contemporary Portfolio Management: Potential Benefits and Challenges

- AI redefines portfolio management with real-time analytics and dynamic asset allocation, shifting from static human-driven strategies to data-centric systems. - Generative AI tools like ChatGPT automate financial workflows, enabling hyper-personalized strategies and boosting business outcomes through optimized digital presence. - Risk modeling evolves via AI's pattern detection, but challenges persist in transparency and bias, requiring explainable AI frameworks and human oversight. - Institutions integr