JPMorgan Closed His Accounts, But You Don’t Throw Out a Bitcoin CEO by Accident

Strike CEO and Twenty One Capital co-founder Jack Mallers says JPMorgan Chase abruptly shut down his personal bank accounts and refused to explain why. The move has sparked new concerns over the “debanking” of crypto executives at a time when Wall Street banks are facing mounting pressure over their relationships with digital-asset firms. Mallers Says

Strike CEO and Twenty One Capital co-founder Jack Mallers says JPMorgan Chase abruptly shut down his personal bank accounts and refused to explain why.

The move has sparked new concerns over the “debanking” of crypto executives at a time when Wall Street banks are facing mounting pressure over their relationships with digital-asset firms.

Mallers Says JPMorgan Gave No Reason: “We Aren’t Allowed to Tell You”

In a series of posts on X (Twitter), Mallers revealed that Last month, JPMorgan Chase threw him out of the bank, citing a bizarre incident that disregarded his family’s three-decade-long relationship with the bank.

Allegedly, each time he asked for an explanation, the bank reportedly repeated the same line: “We aren’t allowed to tell you.”

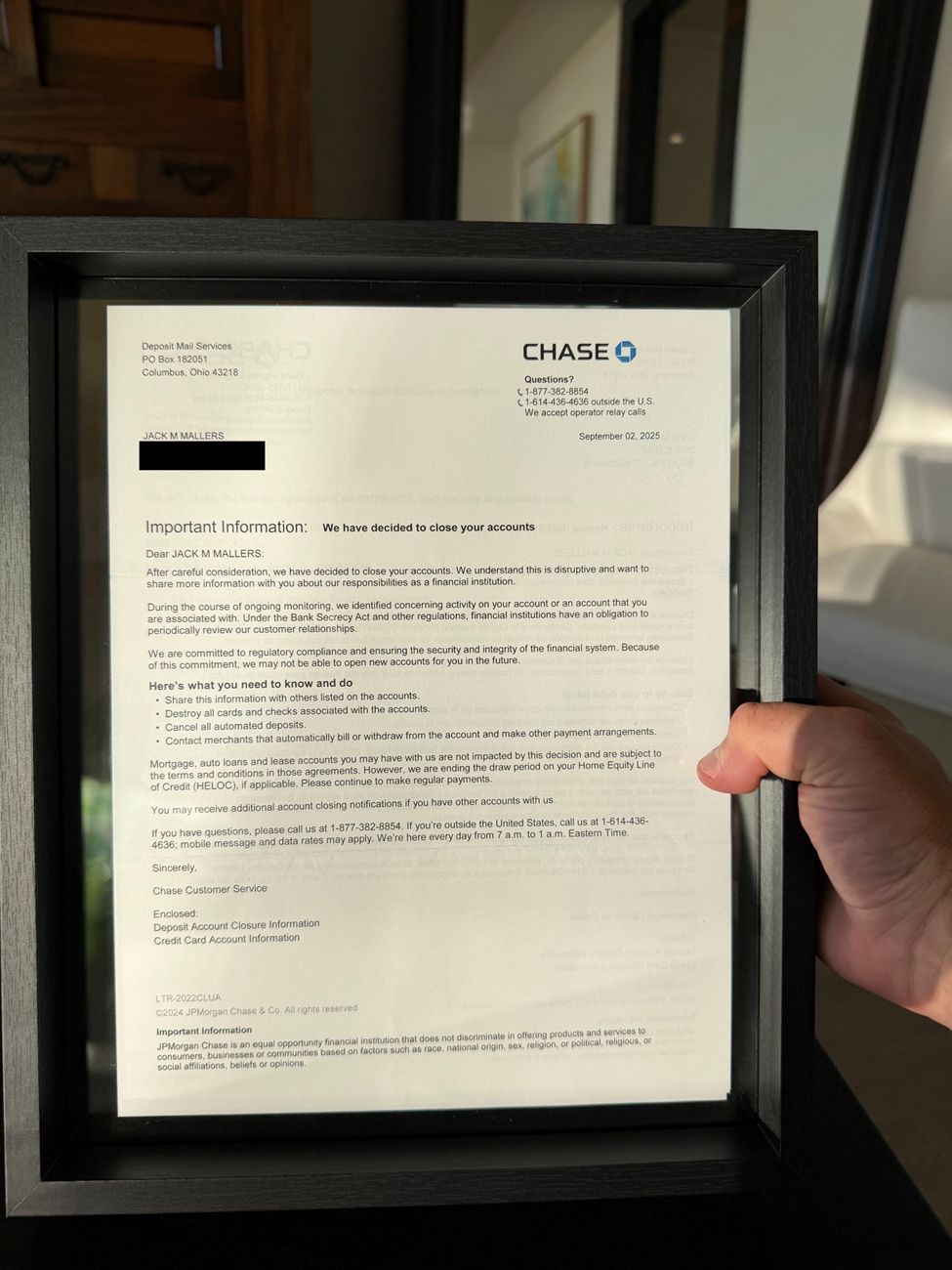

Mallers also shared an image of a letter he claims came from JPMorgan, stating that the bank had identified “concerning activity” and warning that it may not open new accounts for him in the future.

Alleged letter from JPMorgan to Jack Mallers. Source:

Alleged letter from JPMorgan to Jack Mallers. Source:

The incident has since triggered speculation online, with many users suggesting that “Operation Chokepoint 2.0” may still be active. Notably, this rhetoric suggests that banks are under quiet pressure to sever ties with cryptocurrency businesses.

According to Tether CEO Paolo Ardoino, the move was likely for the best, with Mallers advocating for freedom from centralized entities.

His comments added fuel to the broader debate about whether traditional banks can coexist with Bitcoin-native leaders who view decentralization as a form of resistance, not disruption.

Debanking Flashpoint Comes as JPMorgan Faces MicroStrategy Fallout

The timing of Mallers’ account closure is notable. JPMorgan is currently under scrutiny for its research surrounding a potential MSCI reclassification that could result in MicroStrategy being expelled from major equity indexes.

MSCI is considering a rule that excludes companies whose digital assets comprise more than 50% of total assets, placing MicroStrategy, which holds 649,870 BTC at an average price of $74,430, directly in its crosshairs.

JPMorgan analysts estimate this could trigger $2.8 billion in passive fund outflows tied to MSCI alone, and up to $8.8 billion if other index providers adopt similar criteria.

The backlash intensified following new Senate findings showing JPMorgan under-reported suspicious Jeffrey Epstein transactions for years. Senator Ron Wyden accused the bank of enabling Epstein’s crimes, renewing calls for criminal investigation.

For critics, Mallers’ treatment fits into a pattern of questionable judgment and selective enforcement. It also reflects the reality that when Bitcoin CEOs are pushed out of banks without explanation, the implications extend far beyond a single closed account.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Xapo's Enhanced Bitcoin Fund Signals Growing Institutional Confidence in Digital Assets

- Xapo Bank expanded its Byzantine BTC Credit Fund after $100M in institutional allocations, reflecting growing demand for Bitcoin-backed yield products. - The fund uses Hilbert Group's institutional-grade lending process to generate low-risk returns for Bitcoin holders through collateralized loans. - Xapo's expansion follows 2022 lending sector collapse, leveraging regulatory compliance in Gibraltar/Cayman to rebuild institutional trust in Bitcoin collateral. - The product differentiates from ETFs/stablec

Bitcoin News Update: Movements of Investors' USDT Indicate Bitcoin Highs and Periods of Profit Realization

- Bitcoin's price inversely correlates with USDT outflows, as investors shift liquidity between assets during market cycles. - S&P Global downgraded USDT's stability rating to "weak" due to 5.6% Bitcoin allocation and opaque reserves amid U.S. regulatory reforms. - The GENIUS Act and EU's MiCA framework are reshaping stablecoin markets, forcing Tether and Circle to launch jurisdiction-specific, cash-backed alternatives. - Institutional ETF activity, including Texas's Bitcoin purchases and fragmented inflow

The New Prospects for Economic Growth Infrastructure in Webster, NY

- Webster , NY, leverages $9.8M FAST NY grants and PPPs to transform Xerox campus into a high-tech industrial hub. - Infrastructure upgrades including roads, sewers, and electrical systems aim to attract advanced manufacturing and renewable energy firms. - Governor Hochul's strategy drives $51M in upstate investments, creating 250+ jobs via projects like the $650M fairlife® dairy plant. - Redevelopment boosts industrial land availability and residential property values by 10.1%, with mixed-use zoning enhan

The Impact of Artificial Intelligence on Contemporary Portfolio Management: Potential Benefits and Challenges

- AI redefines portfolio management with real-time analytics and dynamic asset allocation, shifting from static human-driven strategies to data-centric systems. - Generative AI tools like ChatGPT automate financial workflows, enabling hyper-personalized strategies and boosting business outcomes through optimized digital presence. - Risk modeling evolves via AI's pattern detection, but challenges persist in transparency and bias, requiring explainable AI frameworks and human oversight. - Institutions integr