XRP Price Bounces, But One “Unlucky 13″% Threat Still Lingers

The XRP price is up about 2.3% in the past 24 hours and has trimmed its weekly losses to under 7%. The bounce looks healthy at first glance, especially after the bottoming signs we tracked earlier this week. But the structure behind this bounce hasn’t improved enough. A critical risk is back on the table

The XRP price is up about 2.3% in the past 24 hours and has trimmed its weekly losses to under 7%. The bounce looks healthy at first glance, especially after the bottoming signs we tracked earlier this week. But the structure behind this bounce hasn’t improved enough.

A critical risk is back on the table — a setup that could push the XRP price down by over 13%.

Momentum Improves, but Volume and Supply Pressure Compete

XRP’s short-term strength starts with On-Balance Volume (OBV). OBV shows whether real volume is entering or leaving the market. XRP’s OBV has finally moved above its short trend line, hinting that buyers are returning.

But this move carries a warning. OBV tried the same breakout on November 18 and failed. That failure triggered a 19% drop between November 18 and November 21.

The latest push above the line is only marginal, not a clean breakout. If it slips again, the same pattern could repeat.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

XRP Faces Trendline Risk:

TradingView

XRP Faces Trendline Risk:

TradingView

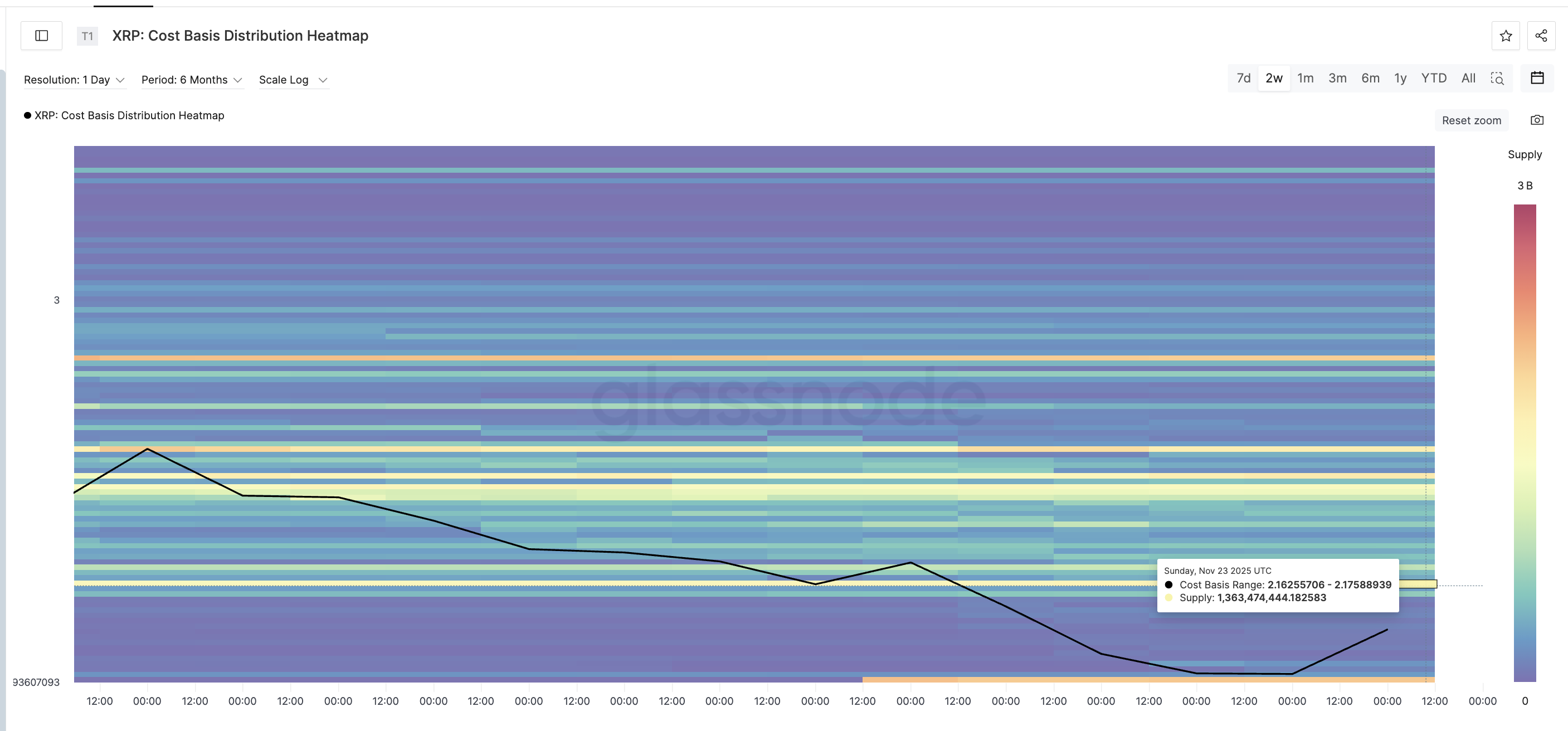

There is also supply pressure overhead. The cost-basis heatmap shows a dense cluster between $2.16 and $2.17, where roughly 1.36 billion XRP sits, worth almost $2.86 billion. These holders sit near breakeven and often sell into small recoveries.

Strong Supply Clusters Sit Overhead:

Glassnode

Strong Supply Clusters Sit Overhead:

Glassnode

If OBV weakens while the XRP price faces this supply zone, the bounce can fade quickly.

Still, OBV moving higher is one of the few positives for now. A decisive break above 6.93 billion on the OBV chart would confirm stronger volume support and improve XRP’s odds of clearing resistance.

XRP Price Action: The Unlucky 13% Risk Still Hangs Over XRP

Even with a mild recovery, the XRP price still trades under the major moving averages. The 100-day exponential moving average (EMA) and the 200-day EMA are both angled down, and the 100-day is now about to cross below the 200-day.

An exponential moving average gives more weight to recent prices, so it reacts faster than a simple moving average. When the 100-day EMA drops under the 200-day EMA, a bearish crossover forms. And it can amplify the downside.

This is the core risk for XRP right now. If the crossover completes, the XRP price could slide toward $1.81, which is the same bottoming zone the recent candles have pointed to. That would be a 13% dip from the current levels. If sellers stay active while the crossover forms, XRP could easily revisit that level. Even the previous OBV breakout failure amplifies the risk of a similar XRP price drop.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

There is one way out, though!

A clean daily close above $2.25 would weaken the crossover setup. That move would also show buyers breaking through the $2.16–$2.17 supply wall, where about 1.36 billion XRP sit. Holding above $2.25 would allow the 100-day EMA to curl upward again and reduce the crossover impact.

Until that happens, the bearish EMA structure keeps the 13% XRP price downside threat alive, even with OBV turning up.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin Faces a Pivotal Week: Optimistic Buying Meets Bearish Whales Amid Economic Uncertainty

- Bitcoin stabilizes near $87,000 after 11-day selloff, with analysts divided on whether the rebound signals a trend reversal or temporary relief. - US ETFs record $1.22B in outflows amid weak institutional demand, compounded by macroeconomic uncertainty and delayed Fed rate-cut expectations. - Technical indicators show mixed signals: RSI suggests waning bearish momentum, while a "Death Cross" pattern historically precedes deep corrections. - Institutional accumulation by mid-sized wallets contrasts with w

Dogecoin News Today: Dogecoin's ETF Ambitions Face Off Against Technical Downturn Amid Market Turbulence

- Dogecoin (DOGE) faces technical collapse after breaking below key support levels and moving averages, driven by 263% above-average volume and algorithmic selling. - Unexpected resilience emerges as DOGE rallies 2.6% post-Musk's D.O.G.E. initiative dissolution and gains 0.7% amid new spot ETF approvals like Grayscale's GDOG . - Broader crypto markets remain bearish with Bitcoin below $85,000 and $120B lost in 24 hours, while DOGE futures open interest surges 3.27% signaling speculative activity. - Analyst

AI’s Core Economic Transformation: Entrée Capital Allocates $300 Million to Advanced Technology

- Entrée Capital launches $300M fund targeting AI, deep-tech, and crypto, boosting total AUM to $1.5B. - Focus on vertical AI, quantum computing, and decentralized infrastructure to transform lagging sectors like manufacturing. - C3.ai deepens Microsoft partnership to integrate enterprise AI tools, enabling unified data operations on Azure. - C3.ai reports 21% YoY revenue growth ($87.2M Q1) as AI demand rises, but analysts warn of market immaturity risks. - Strategic bets on AI-driven innovation highlight

Evaluating the Lasting Investment Impact of Zero-Knowledge Scaling on Ethereum Ecosystems

- ZK-based Layer 2 market grows rapidly, with $28B TVL in 2025 and 60.7% CAGR projected to reach $90B by 2031. - ZKsync, StarkNet, and Polygon zkEVM lead by slashing fees and offering EVM compatibility, attracting institutional partnerships. - ZKsync's Atlas upgrade (15,000 TPS) and GKR protocol (43,000 TPS) highlight efficiency gains via Buterin's "kappa" metric. - Ethereum's Fusaka roadmap, including PeerDAS and Verkle Trees, aligns with ZK scaling goals, boosting STRK and ZK token valuations.