Bitget Daily Digest (Nov 27) | Initial jobless claims for the week ending November 22 came in at 216,000; Nasdaq ISE has proposed raising the IBIT option position limit to 1 million contracts

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZK Atlas Enhancement: Driving Institutional Embrace Amid the Blockchain Scalability Competition

- ZKsync's Atlas Upgrade solves throughput bottlenecks with Airbender RISC-V zkVM, enabling 15,000+ TPS at $0.0001 per transaction. - Modular ZKsync OS reduces gas fees by 70% since 2023, enabling real-time financial applications while maintaining regulatory compliance. - Deutsche Bank and UBS test ZKsync for asset tokenization, highlighting its institutional appeal through privacy-preserving ZK features and sub-second finality. - Upcoming Fusaka upgrade aims to push TPS to 30,000 by December 2025, but reg

Bitcoin Updates: Bitcoin Receives Major-Cap Status as Nasdaq Increases Options Limits Fourfold

- Nasdaq seeks SEC approval to quadruple IBIT options limits from 250,000 to 1 million contracts, aligning Bitcoin ETF with high-liquidity assets like EEM and GLD . - The proposal cites IBIT's $86.2B market cap, 44.6M daily shares traded, and industry support for addressing institutional demand amid Bitcoin's rapid financial instrument maturation. - Experts argue higher limits will reduce spreads, enable sophisticated hedging, and treat Bitcoin as a "mega-cap asset," while Nasdaq also seeks unlimited FLEX

XRP Update: ADGM's Green Light for RLUSD Strengthens UAE's Pursuit of Digital Financial Growth

- Ripple's RLUSD stablecoin secured ADGM approval as an institutional fiat-backed token in November 2025, following DIFC's June 2025 greenlight. - The UAE's dual regulatory endorsements position RLUSD for cross-border settlements, with $1.2B market cap driven by institutional demand for collateral and treasury tools. - ADGM's stringent oversight framework requires full reserve backing and AML compliance, aligning RLUSD with global standards under NYDFS charter . - XRP prices surged 24% in late 2025 amid $1

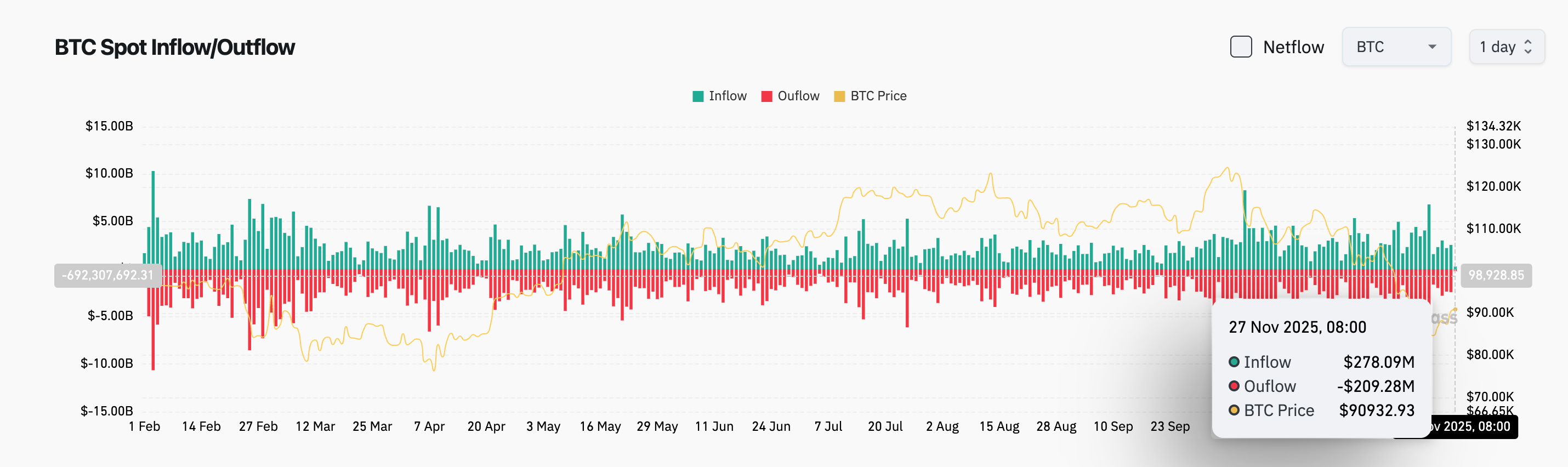

Bitcoin Updates: SpaceX Strengthens Bitcoin Holdings as Institutions Adjust Portfolios

- SpaceX transfers 1,163 BTC ($105M) to new wallets, increasing total holdings to 6,095 BTC ($556.7M) amid Bitcoin's rebound above $91,300. - Institutional Bitcoin interest grows as ETFs see $2.6B outflows, contrasting with SpaceX's secure custody strategy mirroring Tesla's $1.05B BTC treasury management. - Analysts view the activity as routine security adjustments rather than liquidation, highlighting corporate Bitcoin adoption focused on treasury diversification over speculation. - Market debates persist