Positive Progress in the Misappropriation of TUSD Reserve Assets by Custodian: Institutional Reflections Behind Justin Sun’s Successful Rights Protection Assistance

Recently, the incident involving the illegal misappropriation of $500 million in reserve assets of TrueUSD (TUSD) by its custodian, which was supported by TRON founder Justin Sun through Techteryx, has reached a temporary conclusion with Techteryx’s successful rights defense; the global injunction and freezing order issued by the Dubai International Financial Centre Court (“DIFC Court”) has achieved a significant milestone in the global recovery of TUSD reserve assets.

In late October 2025, the DIFC Court made a key ruling, issuing a global freezing order on funds involving approximately $456 million of TUSD reserves. Previously, these funds were transferred to a Dubai entity by the custodian without adequate disclosure, triggering a trust crisis.

The DIFC Court’s decision means that the misappropriated reserve funds are now formally under legal protection, injecting a strong boost of confidence into TUSD’s ongoing stability and the trust it receives from the market.

In the history of stablecoins, such cross-border judicial interventions are not uncommon, but the scale and structural complexity of the TUSD case make it a key event for the industry to re-examine “off-chain reserves” and custody risks.

1. Reserve Funds Illegally Transferred: Black Box Structure of Trust Loopholes and Cross-Border Fraud

By design, as a USD-pegged stablecoin, TUSD’s reserves must be stored in highly liquid, redeemable forms and managed by third-party custodians.

In 2020, after Techteryx completed its acquisition of TUSD, following the principle of business continuity and under the arrangement of the original operator TrueCoin (TUSD side), the management of the reserves was entrusted to Hong Kong digital asset trust institutions First Digital Trust (FDT) and Legacy Trust, which should have followed the standard practice of “segregated accounts and prudent custody.”

However, according to documents from the Hong Kong High Court and materials publicly disclosed by the Dubai court, the above trust institutions acted in complete contradiction to their public commitments of “transparent custody” in their actual handling of funds.

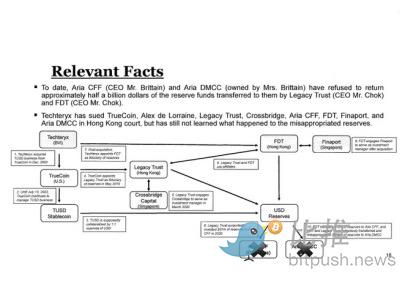

TUSD Reserve Relationship Diagram

Subsequently, on the advice of FDT, Techteryx “invested” hundreds of millions of dollars of reserves into a Cayman fund, Aria Commodity Finance Fund (“ACFF”). Between 2021 and 2023, without Techteryx’s authorization and by forging documents and fabricating investment instructions, FDT and Legacy Trust continued to transfer the funds into the account of Dubai private company Aria DMCC. The account holder is a family member of ACFF’s fund manager Matthew Brittain, meaning the reserve assets ultimately ended up in the hands of a private entity related to the management.

After Techteryx discovered the illegal misappropriation and transfer of these funds, in order to protect the interests of TUSD holders, Justin Sun personally provided $500 million in financial support to Techteryx.

The DIFC Court stated in its judgment that the defendants could not reasonably explain why the funds flowed into related companies without authorization, there was no evidence supporting the true ownership of the funds, and there was a real risk of “further transfer.” Therefore, freezing the funds was the only way to “stop the bleeding first, then adjudicate.”

2. Taking Responsibility at a Critical Moment, Setting a New Industry Benchmark

To prevent off-chain risks from spreading to holders, before the judicial process could complete the recovery and freezing of the involved assets, Justin Sun indeed chose to intervene with the approach of “ensuring stable operations first, then pursuing accountability and recovery.” The core goal was not to replace the custodian’s responsibility, but to contain the risk within the custody side, so that TUSD’s redemption order would not be disrupted by reserve disputes.

Similar approaches have played a key role in traditional financial history as well.

For example, in 2008, JPMorgan, under the coordination of the US Treasury, urgently acquired Bear Stearns. At the time, Bear Stearns was facing collapse due to a rapid liquidity crisis, and its default could have quickly spread to the broader financial system. JPMorgan completed the takeover in a very short time, stabilizing the asset safety and market order for related counterparties.

The TUSD case has similar characteristics:

The custody system failed structurally off-chain, leaving users most vulnerable.

In such situations, a third party stepping in at a crisis point to take over funds not only protects users’ redemption rights but also buys time for subsequent cross-border accountability.

Therefore, the significance of Justin Sun’s actions lies not only in the specific amount of support, but more importantly in establishing a previously unclear logic of responsibility for the stablecoin industry:

When off-chain custody systems encounter problems, stablecoins should first protect users rather than directly passing the risk onto the market.

This principle has rarely been realized in the crypto industry before, and the TUSD incident provides a real-world case for the industry to reference.

3. Institutional Gaps Exposed: The Custody Side Is the Real Weak Point of Stablecoins

At the press conference on April 3, Justin Sun bluntly stated that the incident had essentially touched the bottom line of integrity in the financial system.

He said: “These assets are public funds. To protect the public interest and maintain Hong Kong’s reputation as an international financial center, I decided to provide liquidity support. I was shocked by the scale of the fraud and feel a great sense of responsibility.”

These statements brought the stablecoin custody issue into mainstream public discourse, allowing regulators to more directly see the potential impact of off-chain institutional gaps on real users.

In August 2025, Hong Kong’s Stablecoin Ordinance officially came into effect, with the Hong Kong Monetary Authority beginning to manage stablecoin issuance through a licensing system, bringing “fiat-referenced stablecoins” under regulatory oversight. The core of the ordinance emphasizes basic principles on the issuance side: stablecoins must have redeemable fiat backing, maintain full reserves, and ensure smooth redemption.

However, under Hong Kong’s current system, the execution details on the custody side are still being improved in stages: What qualifications should reserve custodians meet? How should account segregation be enforced? Is investment by custodians allowed? How should cross-border entrustment and look-through audits be implemented? These are all more complex than “issuance compliance” and more prone to gaps between regulation and reality.

Hong Kong Legislative Council member Johnny Ng has also commented on the custody system. He pointed out that since Hong Kong has not yet established a complete custody regulatory framework, many Web3 companies use trust companies as the basis for third-party custody. If operated properly, trusts can serve as a supplementary institutional arrangement; but in the absence of mandatory regulation and review mechanisms, this institutional gap can also be exploited by bad actors, ultimately undermining confidence in Hong Kong as a financial center.

Therefore, how reserves are custodied and how regulatory look-through is achieved are key areas Hong Kong urgently needs to address next.

4. The Next Phase of the Stablecoin Industry

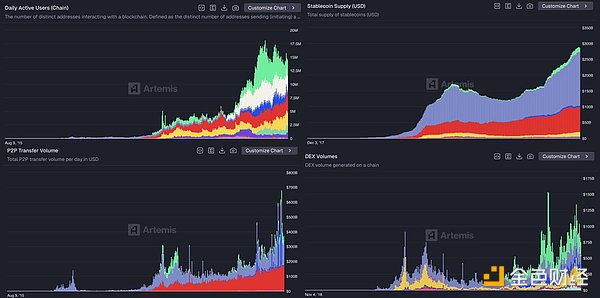

With increased volatility in the current crypto market, many investors are shifting their strategies from chasing high returns to prioritizing risk control and survival. As funds flow back into stablecoins, the stablecoin sector itself is also diverging: traditional fiat-collateralized assets still provide basic liquidity, while “yield-bearing stablecoins” designed around real-world yield, on-chain credit, and risk tranching are rapidly increasing.

But regardless of structural innovation, one consensus is unavoidable:

Transparency, verifiability, and accountability are the true “bottom line” for stablecoins.

The victory in the TUSD reserve misappropriation case is an important milestone for the industry to re-recognize this bottom line.

Especially today, the cross-border flow of digital assets far outpaces the regulatory response speed of traditional financial systems. When funds can cross multiple jurisdictions in minutes, transparent, enforceable, and accountable protection mechanisms become the most critical yet scarce “underlying infrastructure” in the stablecoin system.

From a global perspective, mainstream regulators are all striving to catch up with this change:

-

The United States, through the GENIUS Act, has brought stablecoin custody and reserve disclosure under the federal regulatory framework;

-

The European Union’s MiCA has officially come into effect, standardizing the issuance and custody of “asset-backed stablecoins”;

-

Dubai’s DIFC has demonstrated its judicial capability for cross-border asset protection in this case.

Regulatory logic is extending from traditional finance to digital assets, also forcing the industry to accelerate self-repair. More and more projects are proactively improving transparency, from more frequent reserve disclosures and third-party audits, to public custody addresses, Merkle Tree reserve proofs, and new models of “off-chain assets + on-chain verification.” The industry is filling past blind spots and redefining the standard of “trustworthiness.”

Against this backdrop, the TUSD case is not only a legal determination of criminal behavior, but also a mirror reflecting the institutional void in off-chain custody, as well as the direction the industry must embrace in the future: moving from self-discipline to institutionalization, from opacity to verifiability, and from single-jurisdiction to cross-border collaboration.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nobel laureate criticizes: "Trump trade" is collapsing

Unlock cross-chain liquidity, Avail Nexus helps you seamlessly experience Monad applications

Monad is dedicated to achieving ultimate performance, while Avail Nexus focuses on unlimited scalability and seamless access.

Even the ex-boyfriend of ChatGPT's creator was robbed of over 10 million dollars—how crazy are foreign robberies?

Crypto enthusiasts no longer dare to flaunt their wealth.