Author: Haseeb >|<

Translation: TechFlow

In Defense of “Exponential Growth”

In the past, I often told entrepreneurs that the reaction they’d get after launching a project wouldn’t be “hate,” but “indifference.” By default, no one cares about your new blockchain launch.

But now, I have to stop saying that. This week, Monad just launched, and I’ve never seen a new blockchain trigger so much “hate” upon launch. I’ve been a professional investor in crypto for over 7 years. Before 2023, almost every new chain I saw launched to either enthusiasm or indifference.

But now, as soon as a new chain is born, it’s surrounded by a chorus of “hate.” The number of critics I’ve seen for projects like Monad, Tempo, MegaETH—even before their mainnets have launched—is truly a new phenomenon.

I’ve been trying to analyze: why is this happening now? What does it say about the psychology of this market?

“The Cure Is Worse Than the Disease”

Fair warning: this may be the most hand-wavy article about blockchain valuation you’ll ever read. I have no fancy data metrics or charts to impress you. Instead, I’ll try to push back against the mainstream thinking on Crypto Twitter—a position I’ve found myself on the opposite side of for most of the past few years.

In 2024, I feel like what I’m pushing back against is a kind of “financial nihilism.” Financial nihilism is the belief that these assets are fundamentally meaningless, that everything is ultimately just “meme culture,” and that everything we’re building is essentially worthless.

Fortunately, that “financial nihilism” atmosphere is gone, and we’ve finally moved past that rut.

But now, the mainstream attitude could be called “financial cynicism”: Okay, maybe these things do have some value, maybe it’s not all meme culture, but their valuations are wildly overblown, and Wall Street will eventually figure it out. It’s not that all blockchains are worthless, but their real value is maybe only a fifth or a tenth of their current trading price (have you seen these P/E ratios?). So, you’d better pray Wall Street doesn’t call our bluff, because once they do, it’ll all go up in smoke.

Now, there are many bullish analysts trying to fight this sentiment with optimistic L1 valuation models, desperately boosting P/E ratios, gross margins, and discounted cash flows (DCF), trying to reverse this pessimistic trend.

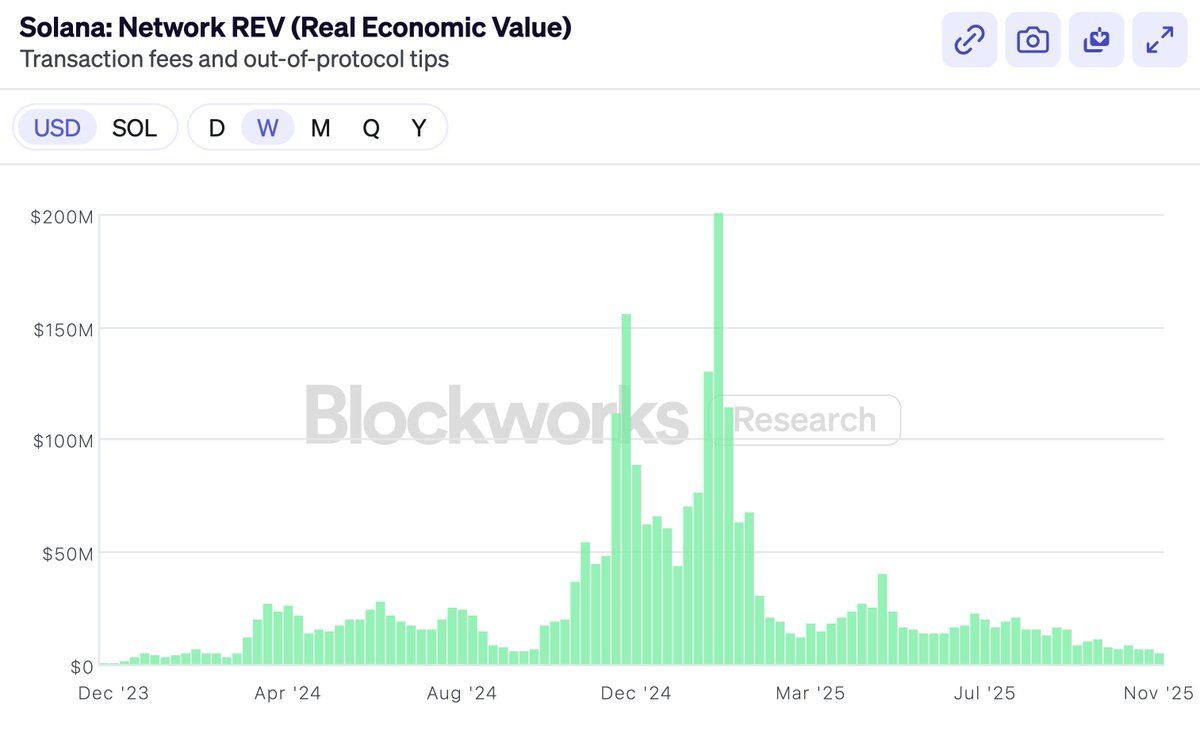

At the end of last year, Solana proudly adopted REV (Realized Economic Value) as a metric that could finally justify its valuation. They proudly announced: We—only we—are no longer bluffing Wall Street!

However, of course, almost as soon as Solana adopted REV, the metric quickly collapsed (though interestingly, $SOL itself performed much better than REV).

This isn’t to say there’s anything wrong with REV (Realized Economic Value) itself. REV is actually a very clever metric. But this article isn’t about which metric to use.

Then came the launch of Hyperliquid. A decentralized exchange (DEX) with real revenue, buyback mechanisms, and a P/E ratio. So, the market chimed in—see, I told you! Finally, for the first time, there’s a truly profitable token with a reasonable P/E ratio. (Don’t mention BNB, we’re not talking about that.) Hyperliquid will eat everything, because clearly Ethereum and Solana aren’t really making money, and now we can stop pretending to value them.

Hyperliquid, Pump, Sky—these tokens centered on buybacks are all excellent. But the market has always had the ability to invest in exchanges. You can always buy Coinbase stock, or BNB, or similar products. We also hold $HYPE, and I agree it’s a fantastic product.

But that’s not why people invest in ETH and SOL. L1 blockchains don’t have the high profit margins of exchanges, and that’s not why people buy them—if they wanted those margins, they could just buy Coinbase stock.

So, if I’m not criticizing the financial metrics of blockchains, maybe you think this article is about blaming the “sins” of the token industrial complex.

Obviously, over the past year, everyone has lost money on tokens, including VCs. This year, alts have performed terribly. So, the other half of mainstream Crypto Twitter is debating who’s to blame. Who got greedy? Was it the VCs? Was it Wintermute? Was it Binance? Was it the yield farming farmers? Or was it the founders?

Of course, the answer, as always, has never changed.

Everyone is greedy. Every single one—VCs, Wintermute, yield farming farmers, Binance, KOLs—they’re all greedy, and so are you. But it doesn’t matter. Because any properly functioning market doesn’t require participants to act against their own interests. If our judgment about the future of crypto is correct, then even if everyone is greedy, investing can still succeed. Trying to explain market downturns by analyzing “who’s greedier” is like holding a pointless witch hunt. I can guarantee, no one just started being greedy in 2025.

So, that’s not what I want to write about either.

A lot of people want me to write an article about why $MON should be worth X or $MEGA should be worth Y. But I’m not interested in that, nor will I recommend you buy any specific asset. In fact, if you don’t have conviction in these projects, you probably shouldn’t buy them at all.

So, will the new challenger chains win? Who knows. But if they do have a chance to win, their pricing will be based on that probability. If Ethereum’s market cap is $30 billions, and Solana’s is $8 billions, then a project with a 1%-5% chance of becoming the next Ethereum or Solana will be priced according to that probability.

Crypto Twitter (CT) is shocked by this, but it’s actually no different from biotech. A drug with less than a 10% chance of curing Alzheimer’s, even with a 90% chance of failing Phase III trials and going to zero, will still get a multi-billion dollar valuation from the market. That’s just math—and as it turns out, the market is very good at math. Binary outcomes are priced by probability, not by current earnings or moral judgment. That’s the “shut up and calculate” style of valuation.

I really don’t think this is an interesting topic to write about. “5% chance of winning? Impossible, it’s obviously 10%!” For any individual token, the market—not an article—is the best way to assess that probability.

So, what I really want to write about is this: Crypto Twitter seems to have stopped believing that public blockchains themselves are valuable.

I don’t think it’s because people don’t believe new chains can win market share. After all, we just witnessed Solana rise from the ashes and dominate market share in less than two years. It’s not easy, but it’s clearly possible.

The bigger problem is that people are starting to believe that even if a new chain wins the competition, there’s no prize worth fighting for. If $ETH is just a meme, if it can never generate real revenue, then even if you win, it can’t be worth $30 billions. The competition itself isn’t worth entering, because all these valuations are fake, and everything will collapse before you can claim the “prize.”

Being bullish on chain valuations has become passé. Of course, that doesn’t mean no one is bullish—obviously, there are always optimists. After all, every seller has a buyer, and even though the “cool kids” on Crypto Twitter love to mock L1s, there are still people willing to buy SOL at $140 and ETH at $3,000.

However, there’s now a widespread belief that all the smart people have given up on buying smart contract chains. The smart people know the game is over. If not now, then soon. Anyone still buying is considered a sucker—like Uber drivers, Tom Lee, or those KOLs talking about the “trillion-dollar market.” Maybe the US Treasury. But “smart money” isn’t coming in anymore.

This is complete nonsense. I don’t believe it, and neither should you.

So, I feel compelled to write a “manifesto for smart people,” explaining why general-purpose public blockchains are valuable. This article isn’t about Monad or MegaETH, but a defense of ETH and SOL. Because if you believe ETH and SOL are valuable, everything else follows naturally.

As a VC, defending the valuation of ETH and SOL isn’t usually my job, but damn it, if no one else will stand up and do it, I’ll write this article.

Feel the Power of “Exponential Growth”

My partner Bo personally experienced the explosive growth of the Chinese internet when he was a VC. Over the years, I’ve heard the “crypto is like the internet” analogy so many times I’m numb to it. But whenever I hear his stories, I’m reminded of how costly it is to get these big trends wrong.

He often tells a story about the early 2000s, when all the early VCs investing in e-commerce (the circle was small back then) would gather for coffee. They’d argue: how big could the e-commerce market really be?

Would it be mostly electronics (maybe only techies would shop online)? Would women use it (maybe they care too much about touch and feel)? What about food (maybe fresh food is impossible to manage)? These questions were crucial for early VCs, because they determined what to invest in and what price to pay.

Of course, the final answer was that all of them were dead wrong. E-commerce ended up selling everything, and the target user was the whole world. But at the time, no one really believed that. Even if someone did, saying it out loud would have sounded absurd.

You just have to wait long enough for “exponential growth” to show you the truth. Even among those who believed in e-commerce, very few thought it would get this big. And those few who truly believed—almost all became billionaires by refusing to sell. As for the other VCs—as Bo told me, since he was one of them—they all sold too early.

In crypto, believing in “exponential growth” has become passé.

But I still believe in exponential growth in crypto. Because I’ve experienced it myself.

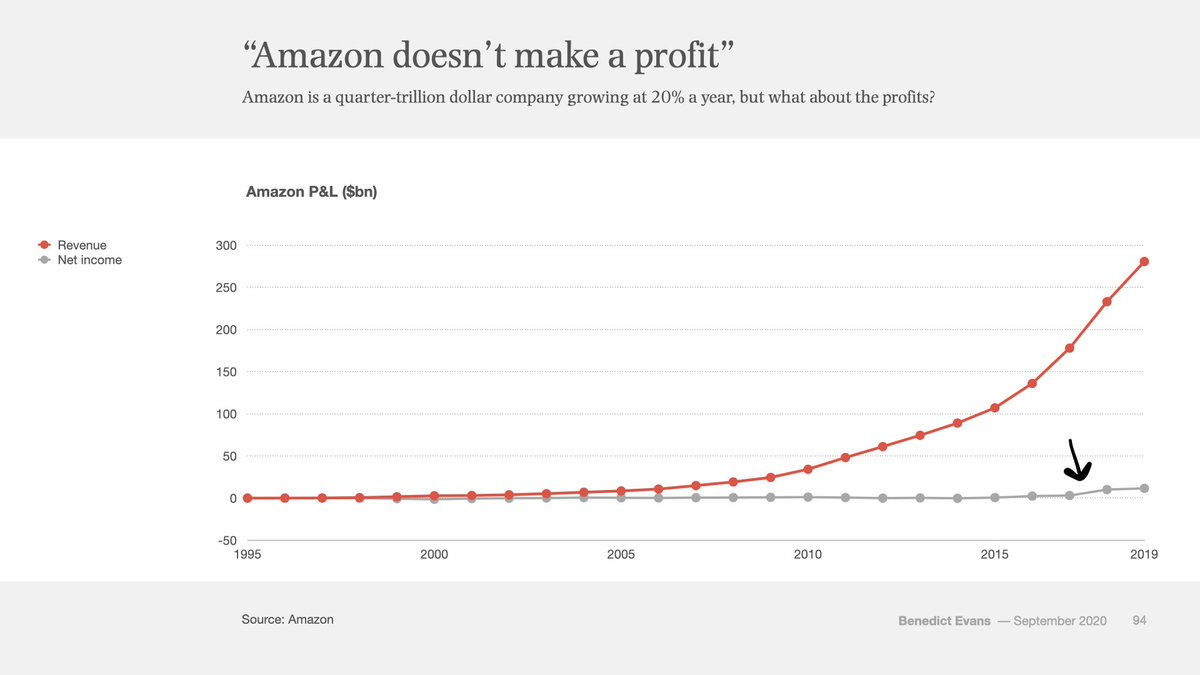

This is Amazon’s P&L from 1995 to 2019—a full 24 years. Red is revenue, gray is profit. See that little blip at the end? The gray line starts to rise—that’s the first time Amazon actually started making money, 22 years after it was founded.

It was only after 22 years that Amazon’s net profit line finally ticked up from zero. And every year before that, there were columns, critics, and short sellers claiming Amazon was a Ponzi scheme that would never make money.

Ethereum just turned 10. And here’s Amazon’s stock performance in its first 10 years:

Ten years of volatility. During this time, Amazon was surrounded by doubters and skeptics. Was e-commerce just a VC-subsidized charity? Were they just selling cheap, low-quality trinkets to bargain hunters—what was the point? How could they ever make real money like Walmart or GE?

If you were talking about Amazon’s P/E ratio back then, you were completely missing the point. P/E ratios are for linear growth, and e-commerce wasn’t a linear trend. So, everyone who spent 22 years arguing about P/E ratios was dead wrong. No matter what you paid, no matter when you bought, you weren’t bullish enough.

Because that’s the nature of exponential growth. When it comes to truly exponential technologies, no matter how big you think it can get, it always gets bigger.

This is exactly what Silicon Valley understands better than Wall Street. Silicon Valley grew up on exponential growth, while Wall Street is used to linear growth. And in the past few years, the center of gravity in crypto has shifted from Silicon Valley to Wall Street. This change is obvious.

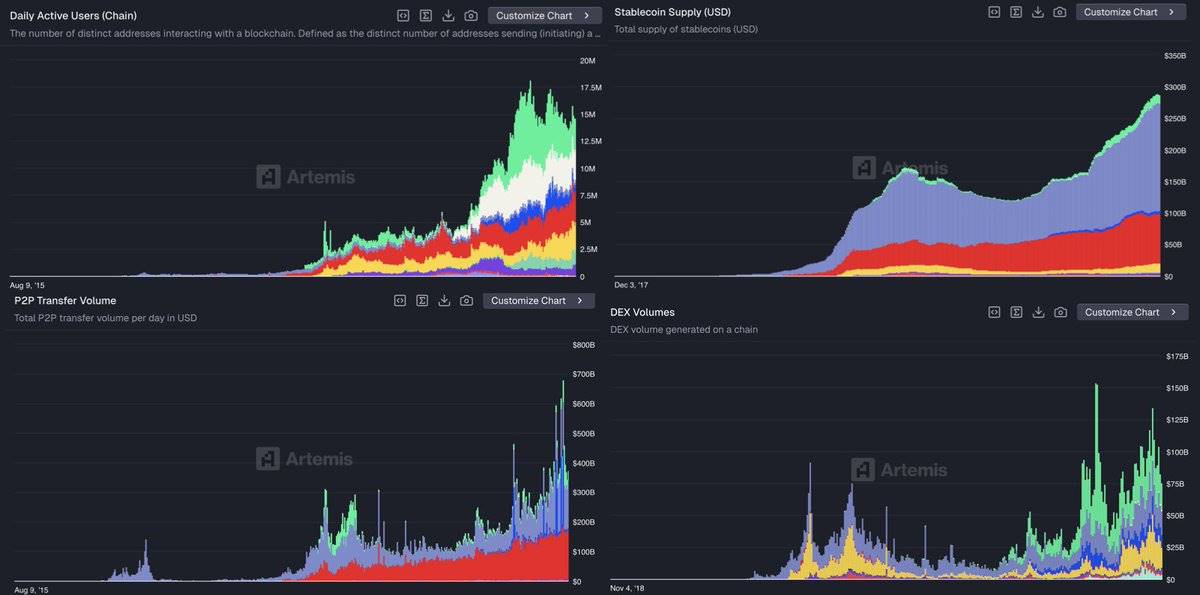

Of course, crypto’s growth doesn’t look as smooth as e-commerce. It’s more volatile, with intermittent explosions. That’s because crypto is tied to money, heavily influenced by macro factors, and faces even more intense regulatory tug-of-war than e-commerce. Crypto strikes at the heart of the nation—money—so its impact on governments is much greater and more unsettling than e-commerce ever was.

But the trend of exponential growth isn’t diminished by this. It may be a rough argument, but if crypto really is exponential, then this rough argument is correct.

Zoom out.

Financial assets crave freedom. They crave openness and interoperability. Crypto turns financial assets into file formats, making sending a dollar or a stock as easy as sending a PDF. Crypto lets everything talk to everything, making it 24/7, global, interconnected, and open.

This model will inevitably win. Openness always wins.

If the internet taught me one thing, it’s this. Incumbents will fight, governments will protest, but in the end, they’ll compromise in the face of the ubiquity, creativity, and sheer efficiency that this technology brings. That’s what the internet did to every other industry. And blockchain will swallow all of finance and money in the same way.

Yes—as long as you wait long enough—everything.

There’s an old saying: “People overestimate what will happen in two years, but underestimate what will happen in ten.”

If you believe in exponential growth, if you zoom out, everything still looks cheap. And what should humble you is that every day, the holders are outlasting the sellers and the doubters. Big capital’s time horizon is much longer than the short-term traders on Crypto Twitter would have you believe. Big capital has learned from history not to give up on big technology bets too easily. You know that inspiring story that first made you buy $ETH or $SOL? Big capital believes that story too—and never stopped believing.