- Bullish traders keep buffering selloffs, preventing Ethereum’s market cap from losing its second rank to other crypto competitors.

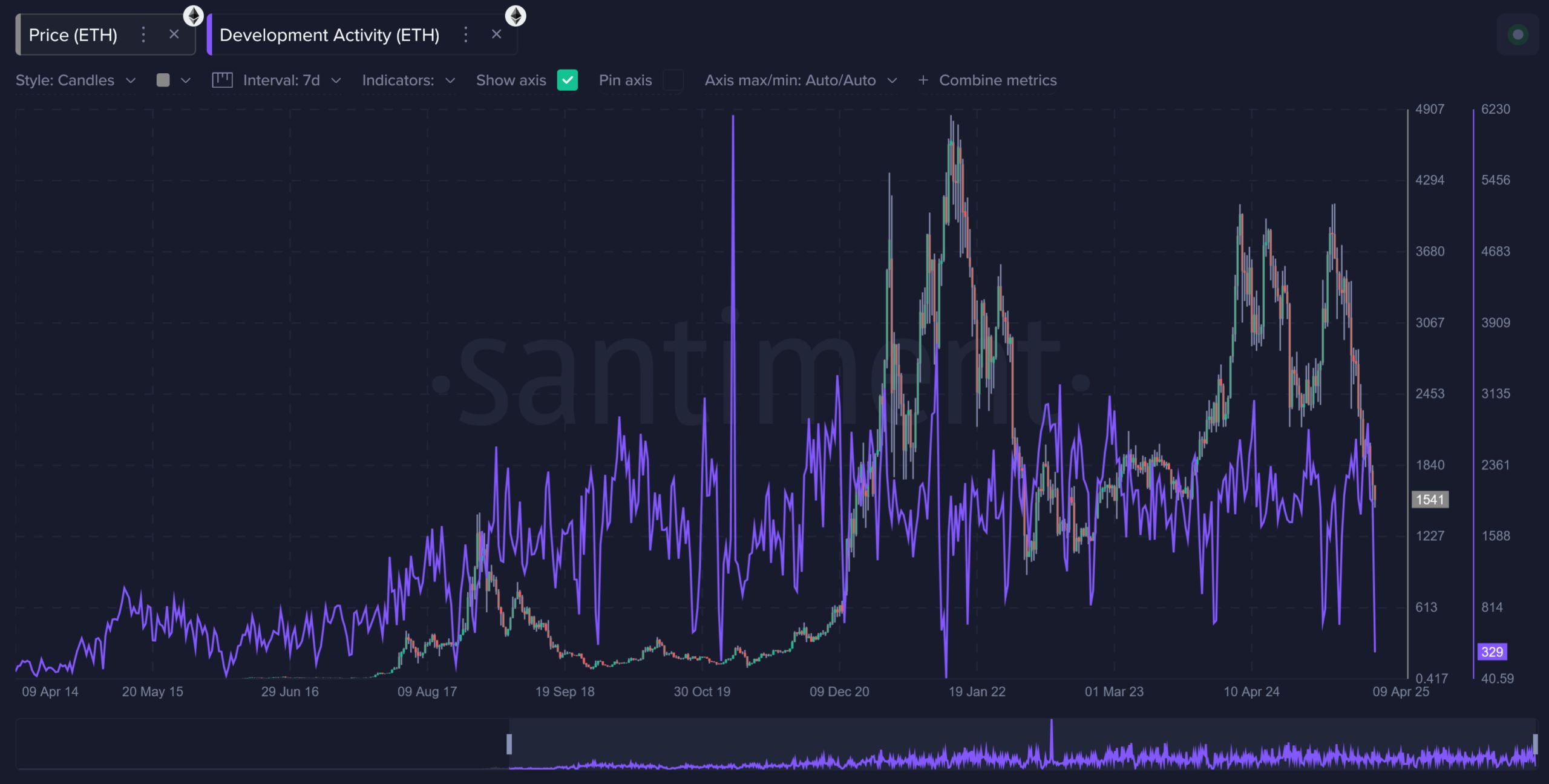

- Even with ongoing struggles versus Bitcoin, Ethereum’s development activity promotes future growth prospects across varying digital asset applications.

The crypto insights platform Santiment reports that Ethereum might see a positive case in 2025, despite the current mood in the market. Their data suggests that many traders expect the asset to underperform, creating what Santiment describes as a setup where the majority’s negative outlook could be overturned.

Ethereum’s role as a top smart contract chain has encouraged devoted teams to keep improving its platform. These contributors address questions about network speed and costs, which remain areas of concern for some traders. However, the ongoing development work indicates that Ethereum will likely stay active for the foreseeable future.

Source: Santiment

Source: Santiment

Santiment’s figures rank Ethereum seventh among the most active digital assets in recent developer contributions. Even though Ethereum’s market price has faced challenges when measured against Bitcoin, bullish traders continue to offset heavy sell volume. According to Santiment, if this buying power vanished, Ethereum would have lost its standing as the second-largest crypto long ago.

At the time of writing, Ethereum trades at around $1,561, up 2.3% over the last day. ETHNews analysts believe that if current growth efforts persist, Ethereum may surprise skeptical market participants in the years ahead.

This broader view emerges as Ethereum builds on its heritage as a platform with consistent engagement, while bearing in mind that crypto prices often behave contrary to popular opinion.

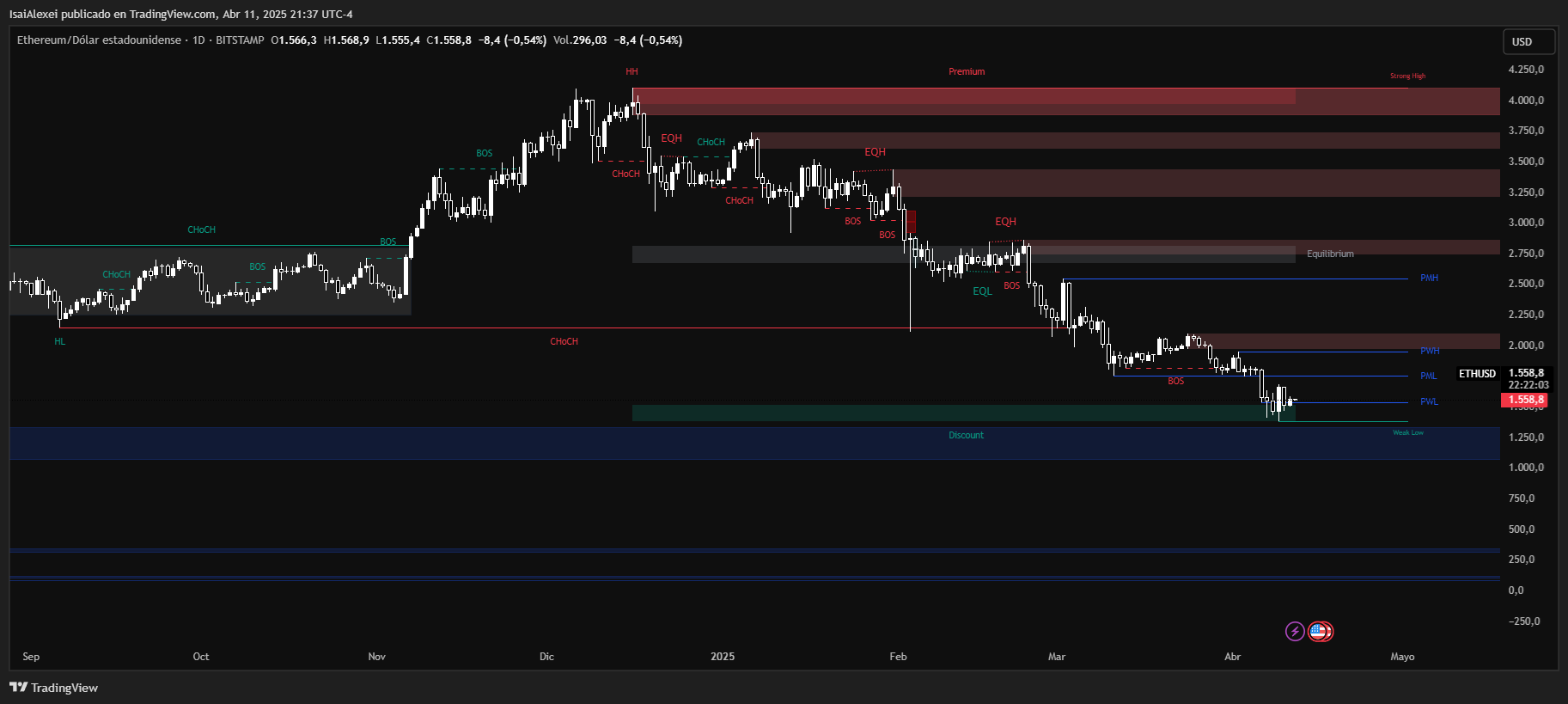

Source: Tradingview

Source: Tradingview

Ethereum (ETH) is currently trading at $1,559.22, showing a slight daily dip of -0.45%, continuing a broader downtrend that has seen a 14.19% drop over the past week and over 53% year-to-date decline. This sustained bearish pressure has pushed ETH close to a critical support zone around $1,425, which could act as a springboard for a rebound if demand increases.

Source: Tradingview

Source: Tradingview

Market volume sits at $13.79 billion in 24 hours, reflecting moderate activity, with no major breakout triggers yet.