News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Solana (SOL) faces short-term bearish technical signals but maintains strong long-term fundamentals in 2025. - Price consolidation between $125–$210 and a bearish wedge pattern suggest potential support retests at $138–$152. - Institutional adoption, Alpenglow upgrades, and 83% developer growth position Solana for 2026–2030 expansion. - Energy efficiency (2,707 joules/tx) and $9.3B DeFi TVL reinforce its scalability against legacy blockchains. - Analysts project $723.30 price target by 2030, driven by re

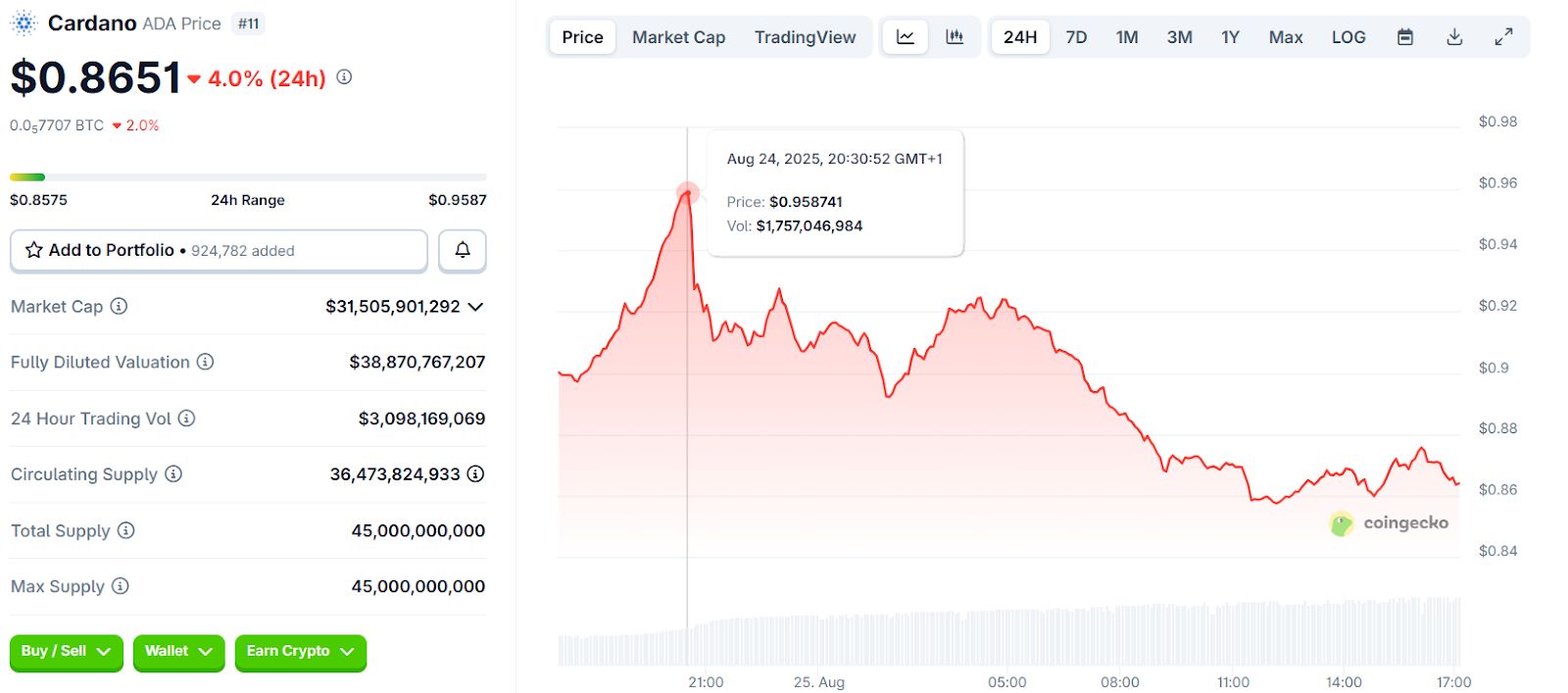

- Bitcoin’s $110,000 support level faces a critical battle between bulls and bears in late August 2025, following a 11% correction from its $124,000 peak. - Institutional buying via ETFs and corporate treasuries has removed 1.98 million BTC from the market, while whale activity highlights short-term selling and long-term accumulation. - On-chain metrics show bearish pressure (TBSR at 0.945) but undervaluation (MVRV -3.37%), while retail fear (Fear & Greed Index at 47) contrasts with institutional confidenc

If we measure success by speculation, we are building sandcastles. If we measure success by infrastructure, we are laying the cornerstone.

In the long run, cash is a very poor investment.

- 04:17Matrixport: Bitcoin stabilizes in the short term, but market sentiment remains cautious ahead of the meetingAccording to ChainCatcher, Matrixport stated that as the FOMC meeting approaches, market sentiment remains highly attentive. Although the price of bitcoin has temporarily stabilized, it is difficult to regard this as the starting point of a new upward trend. Current options pricing still implies about a 5% downside, and capital continues to hedge against potential pullback risks. At the end of the year, the market is generally in a phase of deleveraging and reducing positions, with short-term rebounds more often seen as opportunities to reduce holdings rather than new long signals. From a seasonal perspective, market liquidity is usually tight around Christmas, which is not conducive to a sustained rally. The current long-short dividing line is roughly at $91,500, and the overall probability scenario is still that volatility will continue to converge, with the possibility of a strong breakout immediately after the FOMC meeting being relatively limited.

- 04:16Matrixport: The crypto market is unlikely to see sustainable gains as retail participation weakensJinse Finance reported that Matrixport released today’s chart stating, “Currently, retail participation in the crypto market remains relatively low. Taking the historically retail-dominated Korean market as an example, today’s trading volume is significantly lower compared to the peaks in 2023 and December 2024: back then, daily trading volumes could reach several billions of dollars, whereas now it barely hovers around 1 billion dollars, reflecting that retail funds, which mainly engage in short-term trading, have yet to return in a significant way. In such a market environment, some newly launched or expanding trading platforms continue to struggle to see sustained growth in trading volume. Some previously high-profile listing plans have also noticeably slowed their pace. In the absence of a broader return of retail investors, even if the Federal Reserve chooses to cut interest rates in the future, monetary policy easing alone is unlikely to drive a truly sustainable rally. To put it more bluntly, without trading volume, market sentiment is hard to accumulate; without sentiment, trading volume is also difficult to expand.”

- 04:16MetaMask launches perpetual contract feature, supporting trading of multiple US stocks and stock marketsJinse Finance reported that the MetaMask wallet mobile app has now opened long and short trading functions for multiple US stocks and other stock markets. The perpetual contract trading service is now officially live on the MetaMask wallet mobile app, with technical support provided by the Hyperliquid protocol. Its newly revamped mobile interface is designed specifically for traders, allowing users to open perpetual contract positions within seconds. MetaMask wallet also stated that users can now top up their perpetual contract accounts with any token on any Ethereum Virtual Machine (EVM) compatible chain, and can directly go long or short on more than 150 tokens as well as multiple US stocks and other stock market assets on their mobile devices. In its update announcement, MetaMask wallet emphasized that this service does not require the use of centralized exchanges or additional connections to decentralized applications (DApps).