U.S. Treasury's cash reserves face variability, say strategists at Bank of America and others: could affect bond markets

A change in leadership at the U.S. Treasury could alter the department's approach to cash held at the Federal Reserve, a move strategists warned could affect the U.S. bond market. Bank of America and Wrightson ICAP LLC, among others, said the Treasury may reduce the amount of money it keeps in its account at the Fed as cash balances - the cushion of money that ensures the U.S. can pay its bills - dwindle. Against the backdrop that the debt ceiling has been restored and cash balances are shrinking, this would allow the government to issue fewer short-term bonds and in turn potentially save taxpayer money.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The US Dollar Index rose by 0.14% on the 14th.

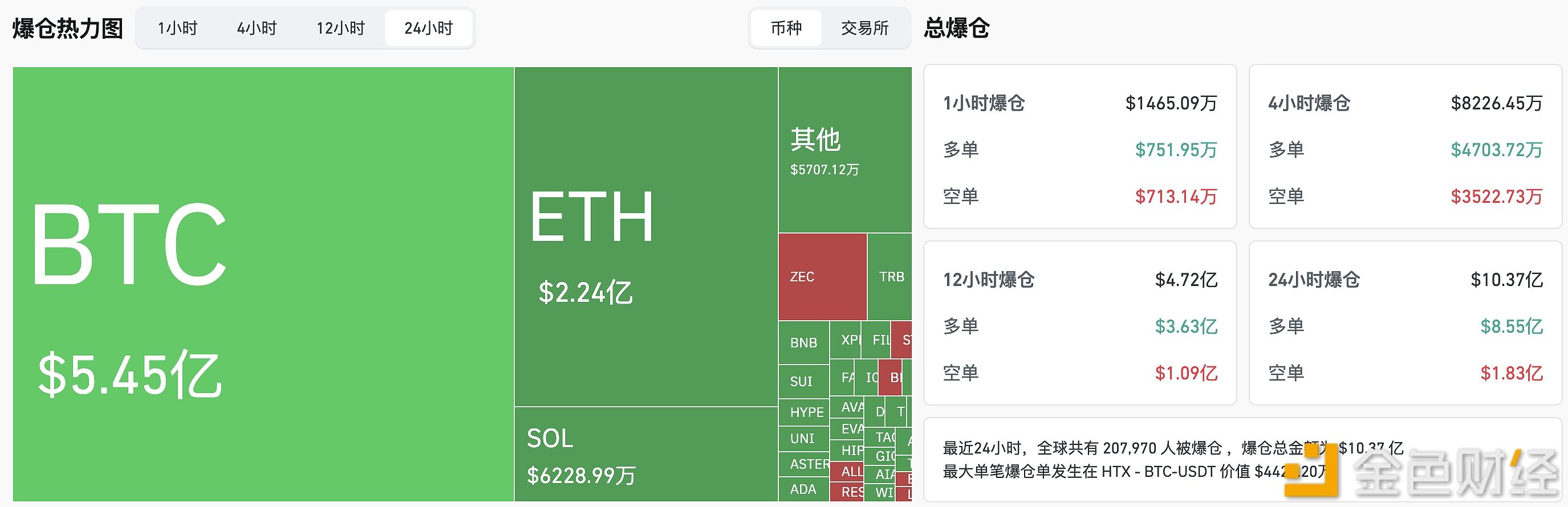

In the past 24 hours, liquidations across the entire network reached $1.037 billion.

Data: 100 WBTC transferred out from Galaxy Digital, worth approximately $9.51 million

Data: 1.927 million ENA flowed into a certain exchange's Prime, worth approximately $5.51 million