-

Recent geopolitical tensions, including Trump’s consideration of new sanctions on China, have disrupted traditional financial markets and triggered significant liquidations in the crypto space.

-

With rising tensions, Asian investors are increasingly turning to Bitcoin as a potential hedge against dollar dependency, aligning with a broader de-dollarization trend.

-

A prominent analysis from COINOTAG suggests that while current volatility may deter some, the long-term outlook for cryptocurrencies could be positive due to their emerging role as alternative assets.

Amid escalating US-China tensions, Bitcoin gains traction as a hedge against instability, potentially reshaping investment paths in a de-dollarizing world.

The Impact of US-China Relations on Cryptocurrency Markets

The ongoing rift in US-China relations, exemplified by Trump’s proposed sanctions, has contributed to a turbulent environment for traditional finance and cryptocurrencies alike. The prospect of heightened restrictions has rattled investor confidence, leading to notable declines in various markets.

Trump’s sanctions could specifically target tech giants such as Huawei, leading analysts to speculate on the broader economic implications for global markets. A recent statement highlighted: “The US plans wider sanctions on China’s technology sector, affecting subsidiaries within the US jurisdiction,” leading to significant reactions in both equity and crypto markets.

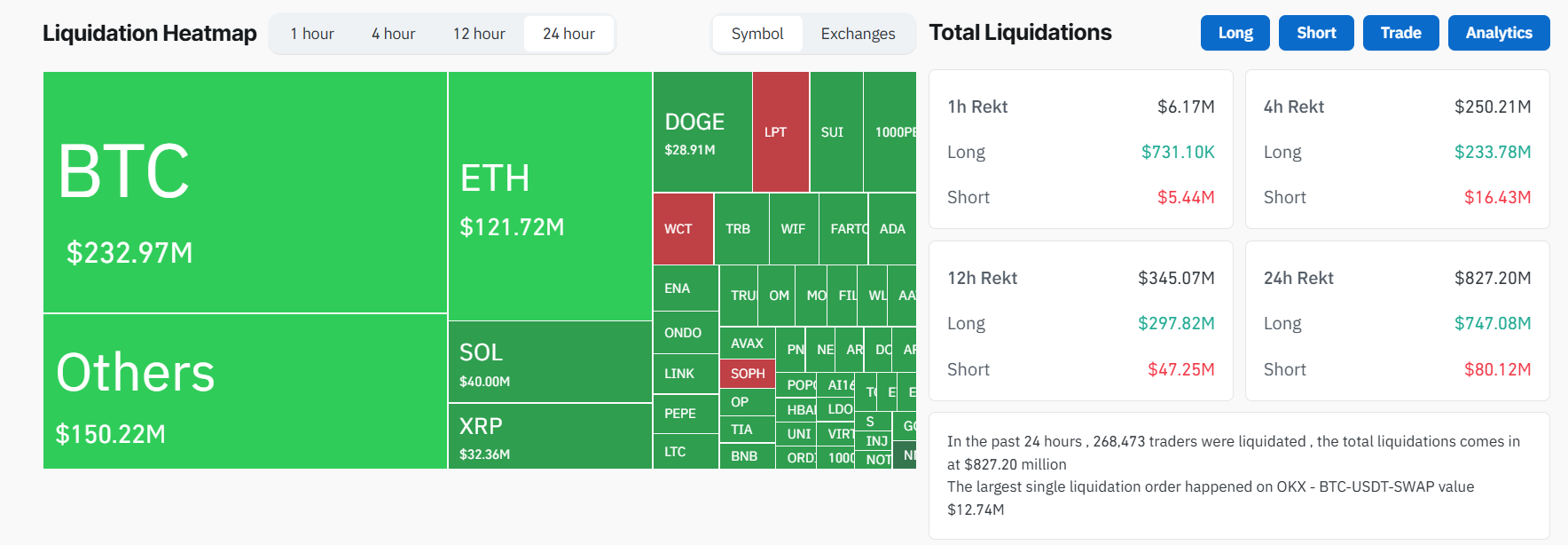

Following the announcement, Bitcoin saw its value plummet below $105,000, and total liquidations in the crypto market reached approximately $827 million. This downward trend underscores the ripple effects of trade tensions on the cryptocurrency sector, prompting many to reassess their investment strategies.

Exploring the De-Dollarization Trend

The concept of de-dollarization has garnered increased attention, particularly as countries look to reduce their dependency on the US dollar amidst escalating sanctions and trade wars. Experts argue that cryptocurrencies like Bitcoin may provide a viable alternative for investors in Asia.

As Asian economies begin to diversify away from dollar assets, factors such as inflation and financial instability will likely drive increased interest in cryptocurrencies. The ongoing trade disputes may push investors to view Bitcoin as a “safe haven” asset, especially if traditional markets remain volatile.

Notably, responses to the recent sanctions indicate that while immediate impacts may be negative, long-term repercussions could lead to a greater acceptance and utilization of cryptocurrencies. This potential shift is highlighted in reports suggesting that “Bitcoin could serve as a strategic asset for navigating turbulent economic conditions.”

Market Reactions and Future Considerations

As investors process the implications of potential sanctions, it is crucial to monitor their reactions within the crypto landscape. Speculation regarding additional sanctions may further drive market volatility, prompting traders to maintain a cautious approach.

The recent downturn illustrates how intertwined cryptocurrency markets are with broader economic sentiments, particularly concerning US policies. Traders are keeping a close eye on shifts in sentiment, as emerging market trends often dictate short-term trading behavior.

Concluding Thoughts on Cryptocurrency and Geopolitical Dynamics

In conclusion, while Trump’s consideration of sanctions on China’s tech industry introduces short-term challenges for both traditional and crypto markets, the long-term landscape may shift favorably for cryptocurrencies. In an increasingly uncertain economic climate, the adoption of Bitcoin may rise as investors seek diversification from traditional fiat currencies.

Ultimately, the road ahead remains unclear, and how cryptocurrencies adapt to these changing dynamics will depend heavily on political, economic, and market developments. Investors should stay informed and consider how geopolitical factors might influence their strategies moving forward.