In a dramatic turn of events, over 10% of active cryptocurrency projects have vanished in just a couple of months, signaling a significant market shakeup.

-

FTX repays $5 billion to creditors, injecting liquidity and possibly kickstarting renewed altcoin market activity.

-

10.5% of altcoins vanished since March, clearing room for projects with real utility and staying power.

The crypto market is shedding its excess, leading to a more refined landscape for investing.

As FTX returns another $5 billion to creditors, project shutdowns are clearing out non-viable entities, indicating a move toward a leaner and potentially more resilient market.

With the chaos dialed down, the stage is set for a more refined, mature altseason.

Over 10% of crypto projects have disappeared in recent months, but liquidity from FTX repayments may pave the way for a renewed altcoin market.

$5 billion back in circulation

FTX’s second round of creditor repayments – totaling over $5 billion – has officially begun, marking a significant milestone in the exchange’s ongoing bankruptcy resolution.

Payouts are being processed via BitGo and Kraken, with eligible claimants from both U.S. and international classes receiving significant portions of their locked funds.

While warnings about phishing scams accompanied the rollout, the broader market implications were unmistakable.

This injection of stablecoin liquidity could prompt a fresh wave of trading, especially in altcoins, as investors cautiously realign their strategies.

Altcoin extinction!

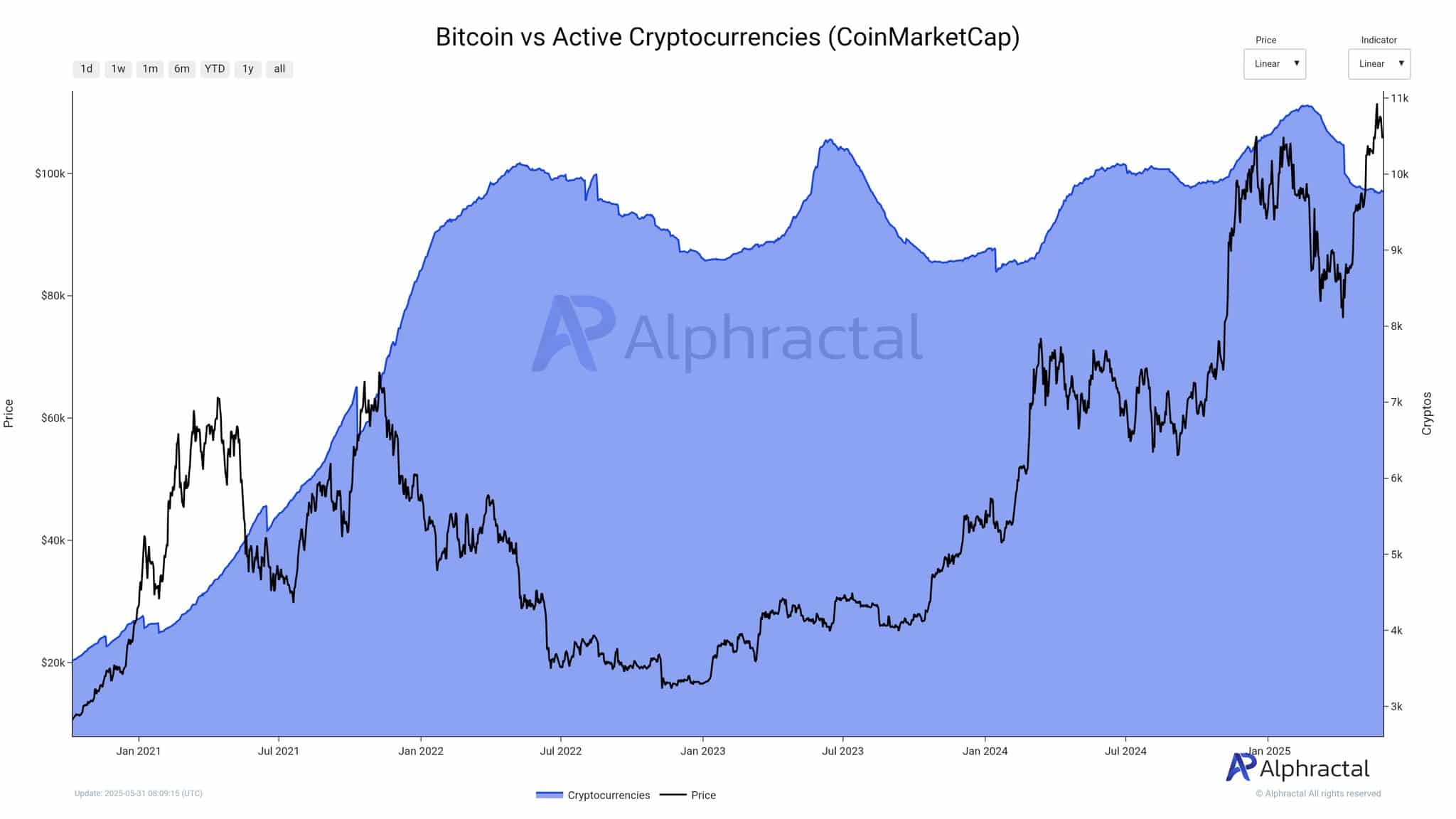

A striking 10.5% of active cryptocurrencies have disappeared in just two months, resulting in over 1,000 projects being delisted or abandoned.

Recent data indicates a sharp decline in the number of listed projects since March 2025, despite Bitcoin’s price continuing to climb.

Source: Alphractal

The factors behind this trend include a combination of failed experiments, rug pulls, illiquid token collapses, and the significant implications of a harsh Q1 bear market. Many teams have either shut down their projects, delisted them, or quietly migrated to new ecosystems.

Although this is painful for speculators chasing hype-driven tokens, this natural selection wave is establishing a cleaner environment for credible altcoins.

Leaner market, stronger foundation

The market has shed numerous non-viable projects, leaving behind those with robust fundamentals. The remaining cryptocurrencies generally boast stronger communities, clearer utility, and healthier liquidity.

This filtering process diminishes distractions from low-effort tokens while redirecting focus toward credible altcoins, facilitating informed investment choices.

Moreover, with $5 billion in fresh capital returning through FTX creditor repayments, the overall market is being fortified.

The alignment of solid fundamentals with real liquidity creates the potential for smarter capital to drive the forthcoming altcoin season, marking a shift away from speculation-driven trends.

Conclusion

As the dust settles on the recent upheaval, the crypto market stands poised for a more stable future. The significant decline in the number of active projects, coupled with an influx of liquid assets, indicates a promising outlook for genuinely valuable altcoins. Investors are encouraged to remain vigilant and focus on projects grounded in utility and community engagement.