Ethereum Nears 10,000 TPS With Brevis’ Breakthrough Real-Time zkEVM ‘Pico Prism’

Quick Breakdown

- Brevis’ Pico Prism zkEVM enables real-time proving using standard gaming GPUs.

- Ethereum could reach 10,000 TPS by 2029 as validators adopt zk-proof verification.

- The innovation paves the way for lightweight node validation, even on smartphones.

Ethereum edges toward 10,000 TPS milestone

Ethereum could soon handle 10,000 transactions per second (TPS) thanks to a major leap in zero-knowledge technology. Scaling firm Brevis announced on Wednesday the launch of Pico Prism, a next-generation zero-knowledge Ethereum Virtual Machine (zkEVM) capable of real-time block proving, a first for the network.

The new system allows Ethereum blocks to be proven almost instantly using standard gaming GPUs, eliminating the need for high-end supercomputers. Brevis revealed that it achieved real-time proving (RTP) of Ethereum’s layer-1 chain using 64 Nvidia RTX 5090 GPUs, the latest in consumer hardware.

Real-time proving revolution

In tests conducted in September, Pico Prism reached 99.6% real-time proving in under 12 seconds, meaning it could confirm blocks faster than Ethereum produces them. Brevis aims to hit 99% proving accuracy with fewer than 16 RTX 5090 GPUs in the coming months — significantly reducing the cost and complexity of validation.

“This marks a major step toward scaling Ethereum by 100x,” the company stated, noting the potential for users to validate the blockchain from a smartphone in the near future.

Path to 10,000 transactions per second

According to Ethereum’s roadmap, transitioning validators from re-execution to verifying zero-knowledge proofs could lift the network’s capacity to 10,000 TPS. Ryan Sean Adams of Bankless predicts Ethereum could reach that target by April 2029, assuming a threefold scaling rate each year.

Meanwhile, Ethereum’s upcoming Fusaka upgrade, set for December 2025, will simplify real-time proving by introducing EIP-7825, which caps per-transaction gas usage and supports parallel proving via subblocks, according to researcher Justin Drake.

The Ethereum Foundation called the development “one big step toward Ethereum’s future,” emphasizing that Pico Prism and similar zk technologies will allow Ethereum to scale globally while maintaining decentralization and trustlessness.

“Ethereum is evolving into a zk-chain,” Adams added, explaining that the main layer will host global DeFi operations at 10,000 TPS, while layer-2 networks will handle broader applications.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Leverage Liquidation Spike: Systemic Threats and Institutional Investor Responses in 2025

- 2025 Bitcoin leverage liquidations exposed systemic risks across DeFi, institutional portfolios, and traditional markets, triggered by macroeconomic tightening and regulatory uncertainty. - Institutions accelerated adoption of AI-driven risk frameworks, with 72% implementing crypto-specific strategies post-crisis to mitigate cascading losses. - MicroStrategy's 60% stock collapse and $3.5B Bitcoin ETF outflow highlighted cross-market contagion, while hedging tools helped institutions navigate volatility.

Bitcoin Price Fluctuations and Institutional Involvement in Late 2025: Optimal Timing for Long-Term Investment

- Bitcoin's 2025 volatility dropped to 43% amid $732B inflows and institutional-grade infrastructure maturing. - Regulatory clarity (MiCA/GENIUS Act) and $115B ETF assets (BlackRock/Fidelity) normalized crypto in institutional portfolios. - $90K price near Fibonacci support zones reflects technical strength and improved liquidity from tokenized assets. - Vanguard's $9T Bitcoin access and Fed policy shifts reinforced crypto's transition from niche to $4T mainstream asset class.

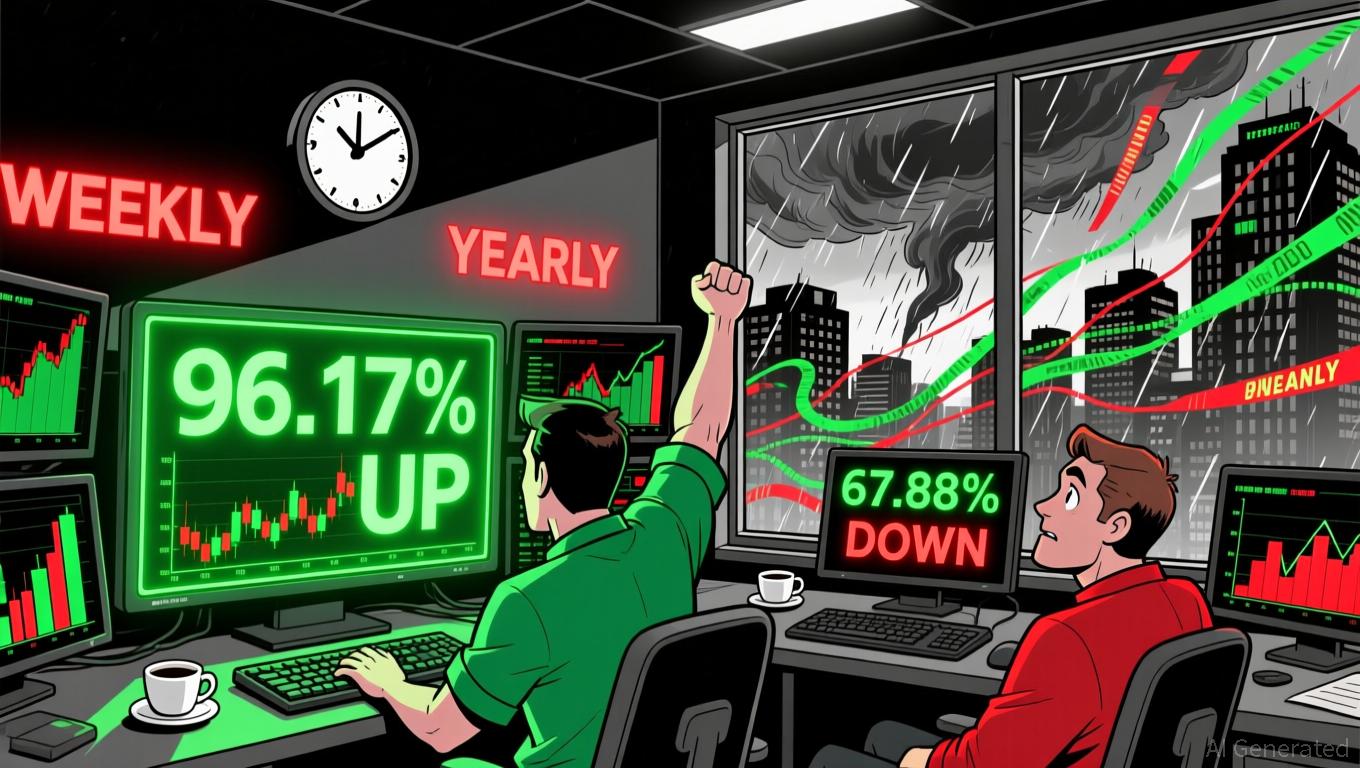

LUNA +96.17% 7D: Surge Attributed to Rumors of SBF Receiving a Pardon

- LUNA surged 96.17% in 7 days amid speculation about Sam Bankman-Fried's potential legal resolution. - The Terra 2.0 token (LUNA) trades at $0.1353, contrasting with LUNC's 70.3% 24-hour gain and $342M market cap. - Market optimism remains cautious as LUNA still faces a 67.88% annual decline and regulatory uncertainties. - SBF's legal developments could influence broader crypto sentiment, though Terra's recovery depends on technical performance.

Bitcoin’s Steep Drop: Uncovering the Triggers and What It Means for Investors

- Bitcoin's 2025 year-end 20% plunge highlights systemic risks and psychological volatility in crypto markets. - Trump's 100% China rare earth tariffs and Fed's 75-basis-point rate hike triggered initial 38% price collapse. - China's crypto ban erased 5% of Bitcoin's value, amplifying global regulatory risks for digital assets. - Algorithmic trading accelerated selloffs by detecting bearish signals faster than human traders could respond. - Investors must prioritize diversification and adapt strategies to