Key Notes

- The company received $3.48 million from UTXO Management to launch its Bitcoin-only treasury accumulation strategy.

- Aifinyo plans to expand fintech services and targets over 10,000 BTC holdings by 2027 through operational cashflows.

- The firm's executive predicts every major German company will consider Bitcoin reserves within five years as inflation protection.

European fintech company Aifinyo AG announced on Oct. 21 that it was converting its balance sheet to Bitcoin BTC $111 850 24h volatility: 0.9% Market cap: $2.23 T Vol. 24h: $95.54 B , making it the first German firm to adopt a full BTC treasury model.

The pivot was announced in a press release on Oct. 21, and kickstarted by an investment from UTXO Management for approximately $3.48 million allocated to pure-play Bitcoin purchases.

Aifinyo’s Head of Bitcoin Strategy, Garry Krugljakow, said in a statement that the move to establish a Bitcoin treasury or keep Bitcoin on their balance sheet as “inflation protection and strategic reserve” was something that “every DAX company will have to consider” within the next five years.

Germany’s first listed $BTC Treasury company is here🇩🇪 @aifinyo AG now holds €3M in BTC, with future profits & capital raises flowing into more #Bitcoin , making it accretive to shareholders. Profitable & trusted by 8,000+ B2B clients. $EBEN https://t.co/RJRLWvgmFX

— aifinyo (@aifinyo) October 21, 2025

Pure-play Bitcoin Treasury

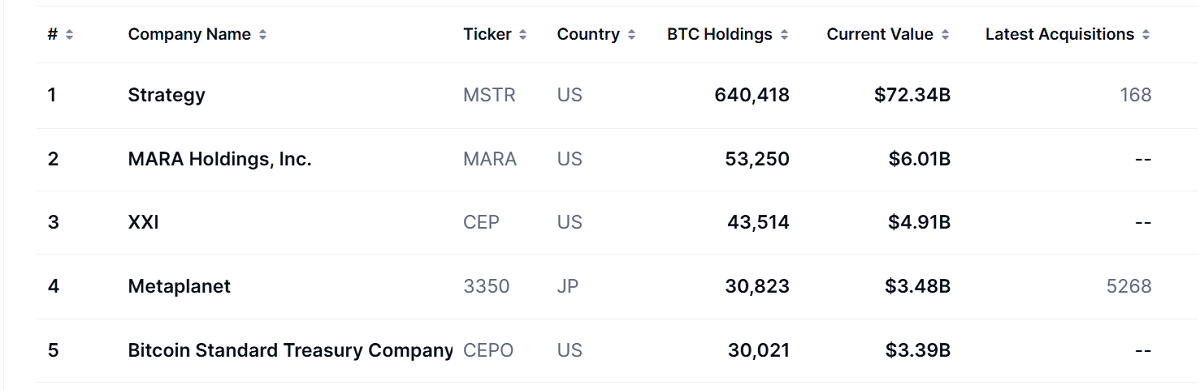

The firm says it will use a pure-play Bitcoin treasury protocol modeled after the one established by Michael Saylor with Strategy, the world’s largest Bitcoin treasury with more than 640,000 BTC on its books.

Per the press release, this strategy will involve continuous Bitcoin accumulation operating cashflows and no trading with the goal of establishing long-term holdings on their balance sheet.

Strategy’s treasury holds more BTC than all other publicly-listed firms in the top 50 combined. Source: Coinmarketcap

Ultimately, Aifinyo says it intends to expand its fintech services further into business accounts and credit cards in 2026 with the stated goal of accumulating over 10,000 Bitcoin by 2027.

Bitcoin Treasuries on the Rise

Fintech firms and related investment firms have shown a massive uptick in interest for Bitcoin and other cryptocurrency treasury models throughout 2025.

As Coinspeaker reported on Oct. 8 , DDC Enterprise Limited secured $124 million in a new equity financing round with funds earmarked for BTC purchases. As of the time of the purchase, the firm reported holdings of 1,058 BTC with an ambitious target of 10,000 BTC by year-end 2025. Coinmarketcap data indicates that DDC holds approximately 1,083 BTC as of Oct. 21.