Key Notes

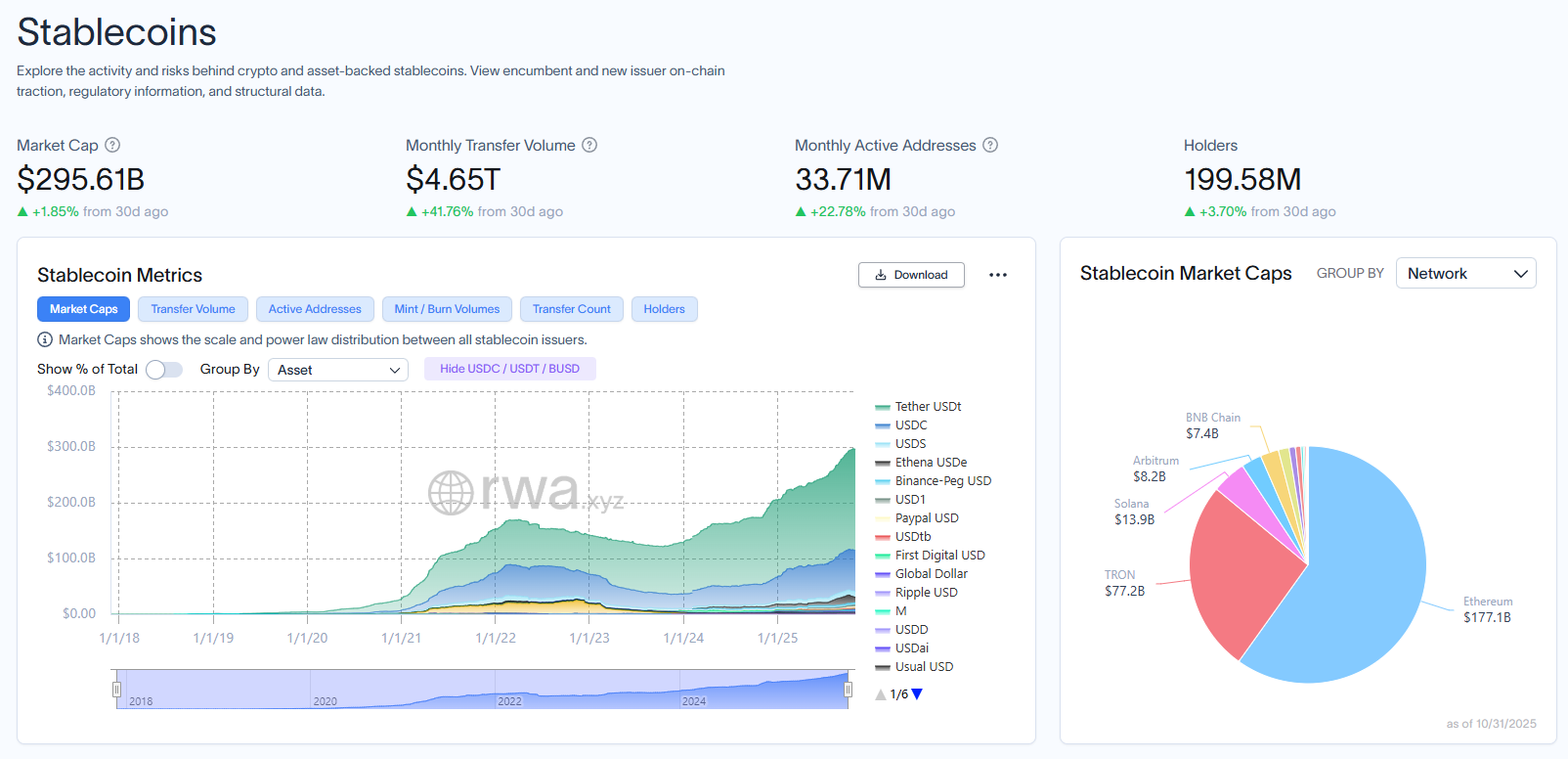

- Monthly active addresses reached 33.71 million by late October, with transfer volume hitting $4.65 trillion in the same period.

- Tether, Circle, Stripe, and Alchemy Pay are building proprietary blockchains to control payment settlement networks.

- Regional stablecoins backed by euros, yen, and other currencies are projected to capture 15-20% market share by 2030.

Alchemy Pay and Gate Research released a comprehensive report on Oct. 31 detailing the stablecoin market’s evolution into what researchers call an “infrastructure competition” phase.

The report documented market capitalization exceeding $280 billion as of August 2025, with the sector entering an “Age of Compliance” driven by new regulatory frameworks.

Competition has shifted from token dominance to control over payment settlement networks, according to the findings.

The global stablecoin market has grown 660-fold since early 2019, according to the report published by Gate Research .

Regulatory implementation of the GENIUS Act, MiCA framework, and Hong Kong’s Stablecoin Ordinance marked the beginning of the compliance era.

Market capitalization reached $295.61 billion by Oct. 31, with monthly active addresses totaling 33.71 million, based on data from RWA.xyz .

Stablecoin dashboard on rwa.xyz.

Traditional Finance Integration Accelerates

PayPal, Visa, and Mastercard have integrated stablecoins into retail, enterprise, and cross-border payment systems, the report noted.

PayPal partnered with Ernst & Young in the first quarter of 2025 to complete cross-border corporate payroll settlement using PYUSD.

Visa launched its Global Stablecoin Settlement service, enabling banking partners to settle cross-border USDC payments directly on public blockchains.

Traditional payment companies including Western Union’s USDPT stablecoin represent the ongoing convergence between legacy finance and digital assets.

Infrastructure Control Becomes Primary Battleground

The report identified four infrastructure competition models reshaping the sector. Tether is developing Plasma for retail payments and Stable for institutional settlement. Circle is building Arc as financial-grade infrastructure for enterprises.

Stripe acquired stablecoin infrastructure firm Bridge and is reportedly developing Tempo, a payments-focused blockchain.

Alchemy Pay launched Alchemy Chain, a Layer 1 blockchain designed for stablecoin settlement with real-time foreign exchange rates.

Tether’s USDT holds 60.66% market share with $179 billion in capitalization, while Circle’s USDC accounts for 24.64% with $72.8 billion, according to RWA.xyz data.

The report noted USDC accounts for a larger share of on-chain payment activity despite its smaller market capitalization.

Compliance requirements are creating competitive advantages as issuers navigate fragmented regulatory environments. Circle’s warning on EU rules highlighted conflicts between MiCA and payment services regulations.

The report forecasts non-USD stablecoins will grow from single-digit market share to 15-20% within five years.

MiCA is driving euro-denominated stablecoin development, while Japan’s Payment Services Act established a framework for yen stablecoins.

Regional currencies are gaining traction as countries seek reduced dollar dependency in domestic payments and trade finance.

The launch of Korean Won stablecoin KRWQ on Base network exemplifies the shift toward regional multipolarity.

The report concluded that stablecoins are transitioning from explosive growth to compliance establishment and from U.S. dollar dominance to a multi-polar landscape.

next