Web3 Rewards Program Fuels Surge in TWT and 1INCH

- Trust Wallet's TWT and 1INCH tokens gain momentum as Trust Premium loyalty program boosts user engagement and on-chain activity surges. - TWT trading volume rises to $32.98M while 1INCH hits $110.86M weekly volume, supported by technical indicators and ecosystem integrations. - TWT stabilizes above $1 with key resistance at $1.2935, while 1INCH tests $0.2330 level amid bullish MACD and RSI signals. - Trust Premium's tiered rewards and 1inch integration create flywheel effects, linking user activity direc

Trust Wallet Token (TWT) and

Trust Wallet, a top self-custody Web3 wallet serving over 210 million users, introduced Trust Premium on November 4, 2025, to incentivize ecosystem participation. The program uses Trust XPs (Experience Points) and TWT to establish a tiered structure, allowing users to advance from Bronze to Gold by swapping, staking, or holding assets. Higher tiers unlock perks like reduced gas fees, early access to exclusive campaigns, and priority for new features. By holding or locking TWT, users can speed up XP gains and move up tiers faster, directly connecting user activity to token demand, as highlighted by CoinEdition. Trust Wallet CEO Eowyn Chen stressed the program’s alignment with Web3 values: "Your actions, your progress, your rewards—onchain and owned by you."

The program seems to be gaining momentum. Data from Santiment indicates that daily active addresses within Trust Wallet’s ecosystem have climbed since early October, which could enhance TWT’s utility and demand. At the same time, 1INCH’s network growth reached 160 on Thursday, its highest since mid-July, signaling a resurgence in user adoption.

Trading statistics highlight the renewed interest. TWT’s weekly trading volume hit $32.98 million as of November 7, marking its second week of growth, while 1INCH’s weekly volume rose to $110.86 million from $81.21 million the previous week. These numbers reflect growing trader optimism, with price action aligning with important technical thresholds. TWT has maintained support above the $1 psychological mark, backed by its 50-day, 100-day, and 200-day exponential moving averages (EMAs). A move above $1.2935 could set sights on the $1.6508 resistance, a historically significant level, as noted by Invezz.

As for 1INCH, the token has regained the $0.2000 level and is challenging a downward trendline near the 200-day EMA at $0.2330. If it breaks through, targets of $0.2548 and $0.3475 come into play, though the 50-day and 100-day EMAs are still trending lower, suggesting caution. Momentum signals, such as a bullish MACD crossover and an RSI of 59, point to further upside if $0.2330 holds, according to Invezz.

The combination of innovative products and robust on-chain activity sets the stage for ongoing growth for TWT and 1INCH. Trust Premium’s focus on rewarding users and TWT’s role in tier advancement create a feedback loop that increases token utility with greater engagement. For 1INCH, its integration with Trust Wallet boosts its standing in the DeFi space, where user experience and accessibility are becoming increasingly important.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar News Today: Blockchain Opens Up Clean Energy Investment Opportunities While Turbo Taps Into $145B EaaS Sector

- Turbo Energy partners with Stellar and Taurus to tokenize solar energy financing via blockchain, targeting Spain's supermarket sector. - The pilot uses Energy-as-a-Service (EaaS) models with tokenized PPAs, enabling fractional investor ownership and reducing capital barriers. - Blockchain streamlines liquidity and transparency, aligning with a $145B EaaS market growth projection by 2030 driven by sustainable infrastructure demand. - Taurus manages token compliance via its platform, while Stellar's low-co

Ethereum Updates: Major Holders Increase Their Ethereum Stash Fivefold While BTC/ETH ETFs See Outflows—Altcoins Draw in $126 Million

- Bitcoin and Ethereum spot ETFs lost $605M in outflows, contrasting with $126M inflows into Bitwise's Solana ETF (BSOL), highlighting shifting investor priorities toward altcoins. - Ethereum's largest whale quintupled ETH holdings to $138M while closing Bitcoin longs, reinforcing institutional confidence in Ethereum's long-term potential amid stable technical indicators. - Solana's ETF success ($545M total inflows) reflects growing institutional demand for altcoins despite 16% price declines, driven by it

Red Bull Racing’s advantage? An engineer who approaches workflows with the precision of timing laps

Hyperliquid's Growing Influence in Crypto Trading: Can It Maintain Long-Term Investment Appeal?

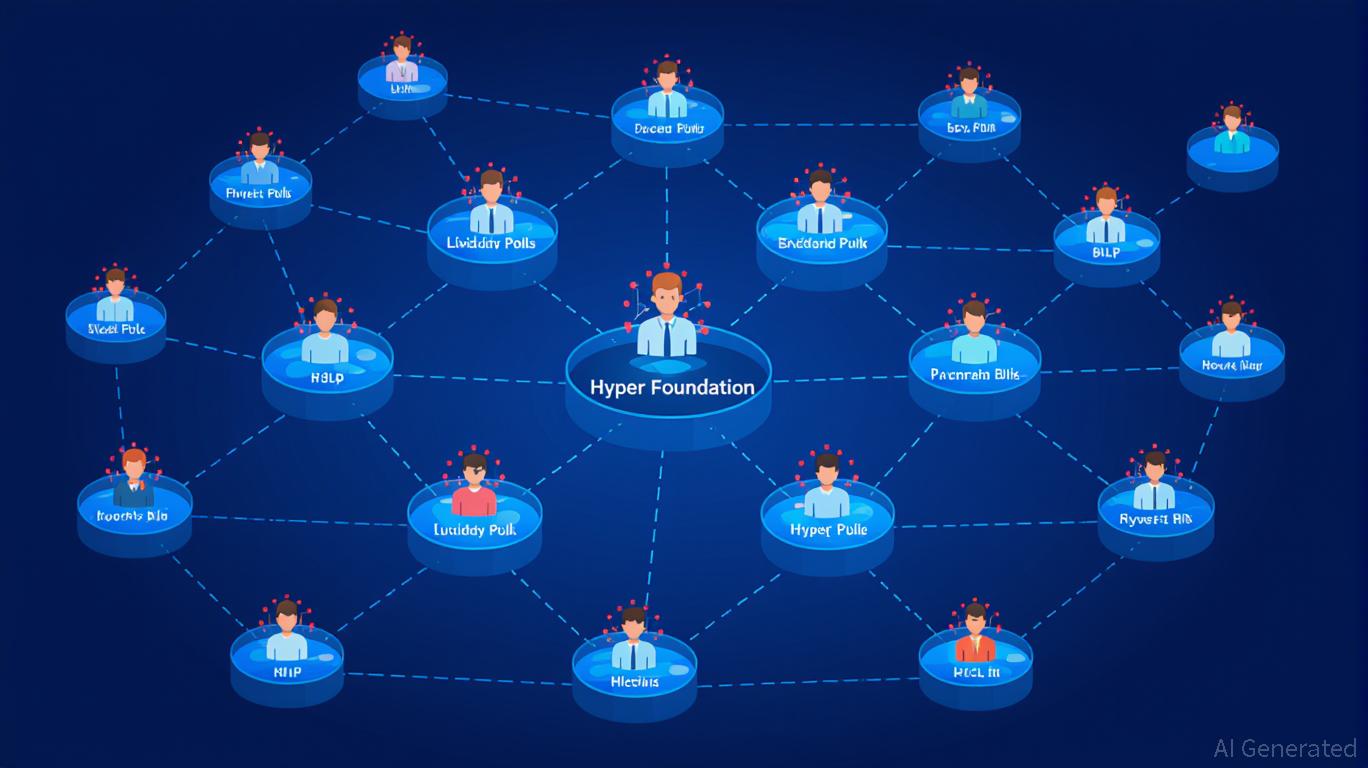

- Hyperliquid dominates 80% of 2025 perpetual contract market via on-chain governance and user-driven liquidity innovations. - Centralized governance (HIP-3 protocol, USDH stablecoin launch) balances permissionless market creation with validator dominance risks. - HLP liquidity model generates $40M during crashes but faces regulatory scrutiny and token economics challenges from 2025 HYPE unlock. - TVL growth to $5B and 518K active addresses highlight adoption, yet governance centralization and institutiona