Bitcoin's $100K Question: Here's Why BTC, XRP, SOL May Surge This Week

Bitcoin BTC$103,508.20 has faced a challenging few weeks, retreating sharply from its record highs and weighing on the broader market, including ether ETH$3,526.49, XRP$2.3078, solana SOL$162.78 and others.

However, there's a compelling reason to expect the cryptocurrency to stay above the pivotal $100,000 level and rally this week, and it's tied to a positive shift in the U.S. financial system that signals potential for renewed investor risk-taking.

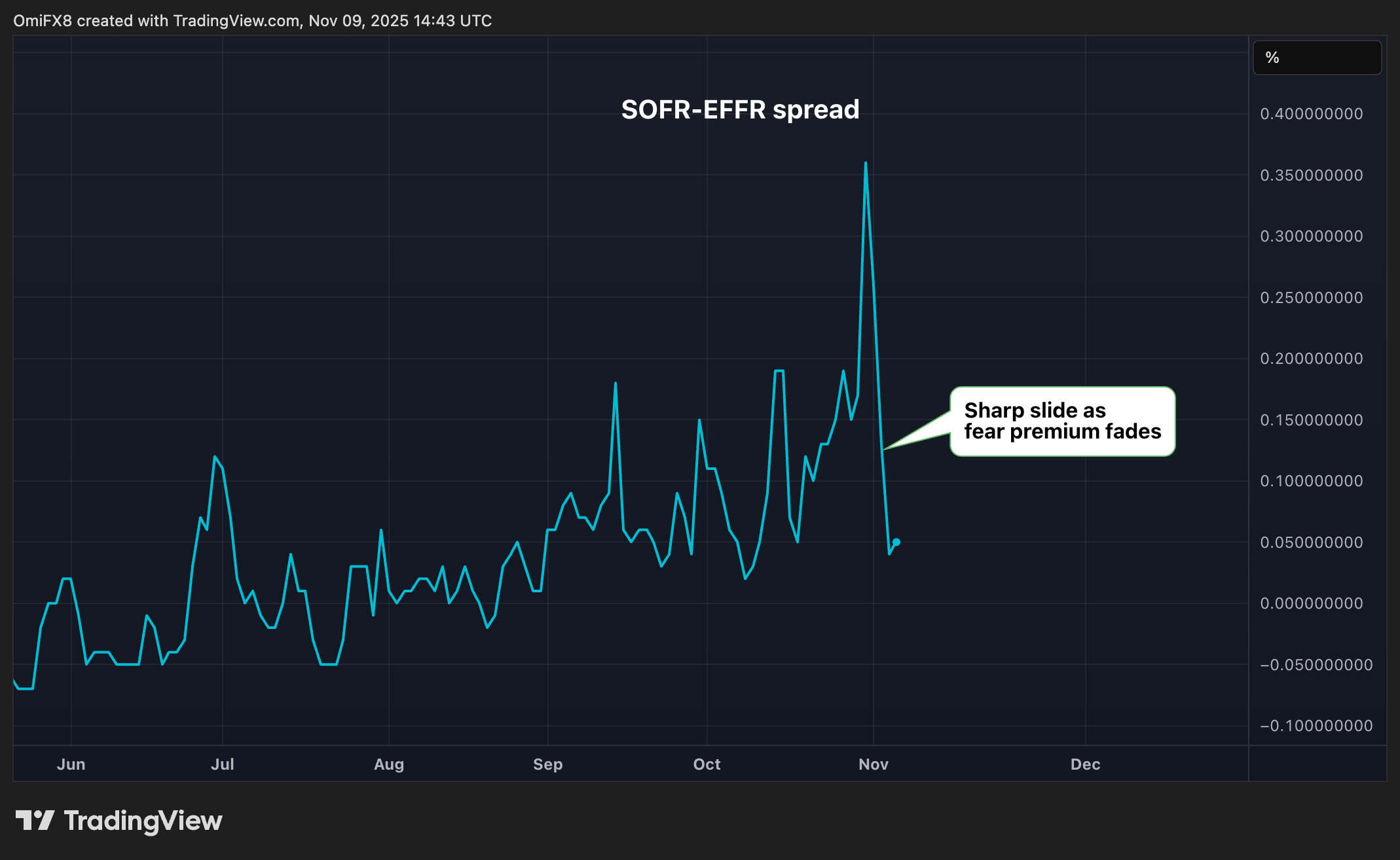

At the heart of the story is the spread between the SOFR and EFFR, which gauges dollar liquidity conditions in the U.S. banking sector. SOFR, the Secured Overnight Financing Rate, is the overnight interest rate that banks pay to borrow cash using Treasuries as collateral. The Effective Federal Funds Rate (EFFR) is the rate at which banks led reserves to each other overnight without collateral.

Usually, this spread hovers in a narrow range, but late last month it surged to the highest since 2019, signaling stress and liquidity tightening in the financial system. The result? the dollar index, which tracks the greenback's value against major fiat currencies, rose and bitcoin fell sharply, breaching the $100,000 level at one point.

But over the last couple of days, the SOFR-EFFR spread has sharply tanked to 0.05 from 0.35, erasing that spike. This reversal hints at easing financial conditions—the fear premium has faded, and liquidity is normalizing.

All else being equal, tightening of this spread signals looser financial conditions, favorable for risk assets like bitcoin. And guess what, BTC is on the rise as of writing, trading above $103,000, representing a 1.6% gain on a 24-hour basis, according to CoinDesk data. ETH, XRP, SOL, BNB have gained 1.5% to 2.5% following BTC's lead.

SRF borrowing slides, DXY rally stalls

Other key indicators also point to easing liquidity stress. For instance, banks' borrowing from the Federal Reserve's standing repo facility (SRF), a key liquidity management tool, has dropped back to zero after peaking at a record $50 billion earlier this month, according to data from ING. Banks had borrowed billions through the SRF as a response to temporary funding pressures.

Concurrently, the dollar index's rally has softened at resistance from the August high of 100.25, causing the upward momentum to stall. A renewed sell-off in the DXY could bode well for BTC, which is seen as a hedge against dollar debasement and a proxy for inflation protection.

All these factors combine to create a compelling case for bitcoin and the wider crypto market to rally in the coming week.

Key risks

Keep an eye on flows into the U.S.-listed spot ETFs, as they will need to show strength following nearly $2.8 billion in outflows over the past four weeks.

A breakout in the DXY above 100.25 could dent BTC's bullish prospects.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Post-Halving Challenges and Rising Energy Expenses Propel Consolidation in Bitcoin Mining

- Bitcoin mining faces intense consolidation as post-halving pressures and energy costs eliminate smaller operators, per Marathon CEO. - JPMorgan highlights U.S. miners' energy-efficient infrastructure as prime M&A targets for hyperscalers and AI firms seeking scale. - Greenidge's modular Pod X technology boosts mining efficiency by 35%, positioning it as a leader in capital-efficient operations. - Bernstein identifies Riot Platforms as top consolidator, citing its aggressive $2B+ acquisition attempts to s

Safety Emergency Grounds Older MD-11 Aircraft Amid Renewed Cost Worries

- FAA's emergency order grounds 50+ MD-11 cargo planes after UPS crash kills 14, citing engine detachment risks. - NTSB reveals cockpit audio showed 37 seconds of pilot struggle before fatal crash during Louisville takeoff. - Boeing backs FAA directive as MD-11s face phaseout due to high maintenance costs and outdated design flaws. - UPS/FedEx report MD-11s handle 13% of combined cargo operations, highlighting aging fleet's critical supply chain role.

Brazil's Approach to Crypto Regulation: Combating Crime and Enhancing Investor Confidence

- Brazil's Central Bank (BCB) introduced strict crypto regulations requiring VASPs to obtain authorization by Feb 2026, with non-compliant firms facing closure by Nov 2026. - Stablecoin transactions are reclassified as FX operations under new rules, subject to transparency requirements and a $100,000 cap on unapproved cross-border transactions. - The framework mandates robust AML controls, cybersecurity, and compliance frameworks for VASPs, aiming to curb fraud and position Brazil as Latin America's crypto

XRP News Update: Altcoin ETFs Move Closer to U.S. Approval After DTCC Surpasses Major Obstacle

- DTCC's approval of Bitwise's CLNK ETF marks a key step toward U.S. altcoin ETFs, with XRP-focused funds from 5 firms now listed. - XRP ETFs like Canary's XRPC and Grayscale's proposed offering highlight growing institutional demand for crypto exposure. - SEC resumes reviews post-government shutdown, accelerating approvals for pending applications including XRP Trust conversion. - Historical ETF inflows and CME's crypto derivatives success suggest regulatory clarity could drive significant capital into al