Aster Whales Bought 51 Million Tokens – Will Price Rally?

Aster whales added over $53 million in ASTER this month, signaling growing confidence. With the Squeeze Momentum Indicator turning bullish, the altcoin could soon break above $1.25 if support near $1.00 holds.

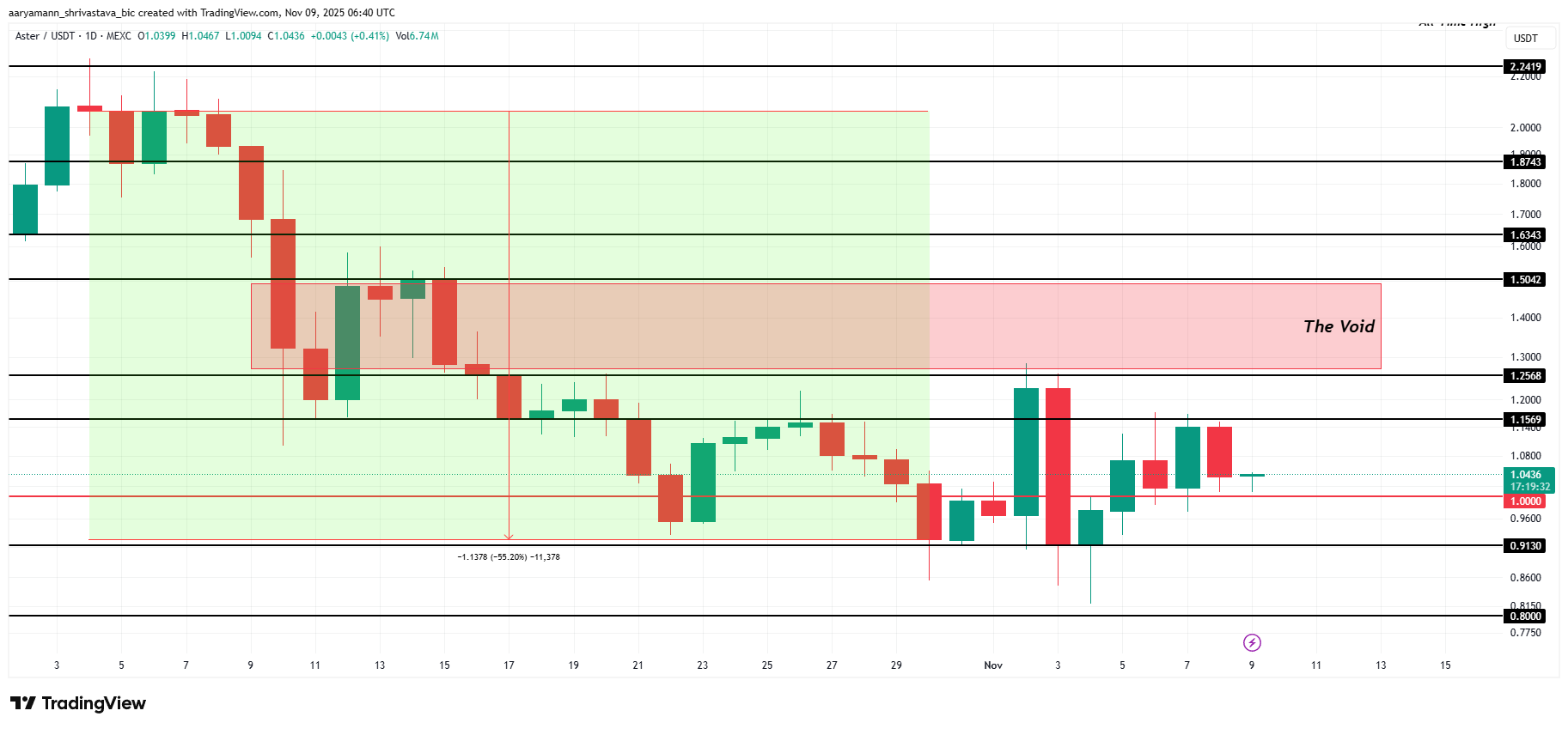

Aster (ASTER) has been trading sideways for nearly a month, showing limited volatility as it struggles to break through resistance.

The altcoin remains trapped under “The Void,” a previously untested resistance zone that must be cleared for meaningful recovery. However, whale accumulation hints at rising optimism among large investors.

Aster Whales Could Trigger The Recovery

Whales have become increasingly active over the past few weeks, signaling growing confidence in Aster’s long-term outlook.

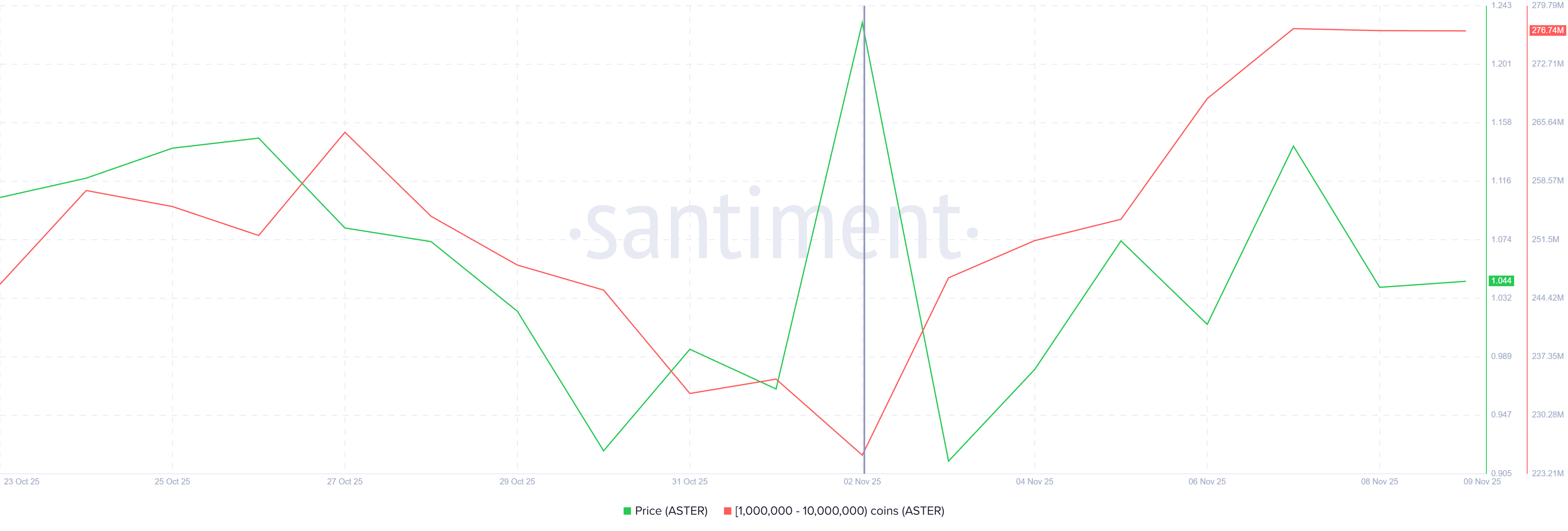

On-chain data reveals that addresses holding between 1 million and 10 million ASTER have accumulated over 51 million additional tokens since the start of November, equating to roughly $53 million in value.

This surge in large-wallet accumulation suggests whales are positioning for potential upside. Historically, such accumulation phases precede sharp rallies, as these investors tend to buy at perceived market bottoms.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Aster Whale Holding. Source:

Aster Whale Holding. Source:

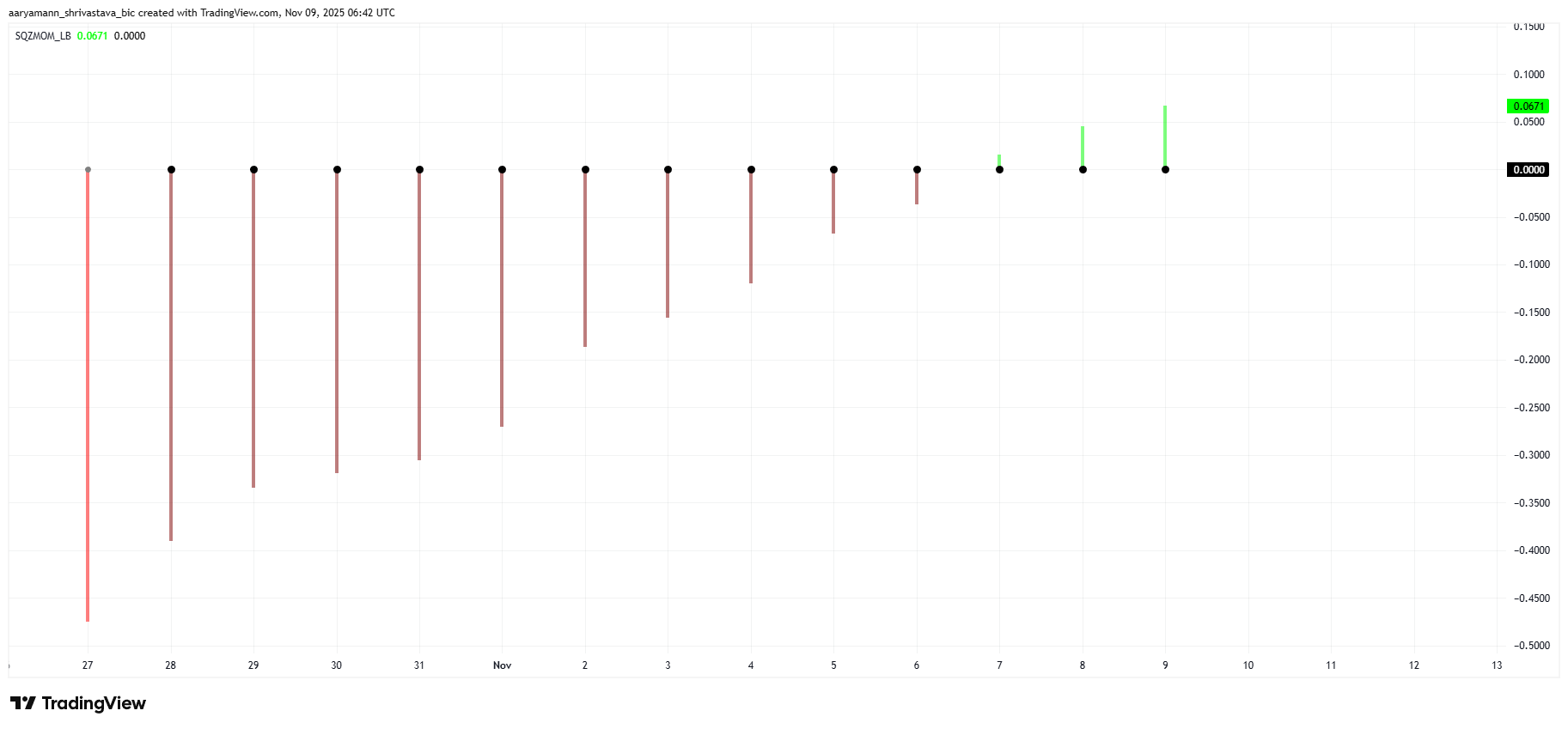

The Squeeze Momentum Indicator currently indicates a developing squeeze, marked by black dots that typically precede a significant price move. This setup often signals a volatility breakout, suggesting that Aster could soon see stronger directional movement. Currently, the indicator’s green bars indicate that bullish momentum is building within this phase.

If this bullish volatility expands, ASTER could finally escape its tight range, with buying pressure propelling it toward higher price levels. However, squeezes can occasionally flip bearish if market sentiment weakens or broader conditions turn negative.

ASTER Squeeze Momentum Indicator. Source:

ASTER Squeeze Momentum Indicator. Source:

ASTER Price Faces Resistance

ASTER’s price stands at $1.04, maintaining a stable position above the $1.00 psychological level. While this support has held firm, the more critical floor lies at $0.91, which has underpinned price action throughout the recent consolidation phase.

$0.91 and $1.25 make up the consolidation range for ASTER. Above $1.25 lies “The Void”, a previously untested resistance zone, breaching which is necessary to recover October’s 55% losses. The above-mentioned factors suggest this is likely for ASTER, which could push the price past $1.50 and towards $1.63.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

If market sentiment weakens, however, Aster could extend its sideways pattern or fall below $0.91. Such a drop could trigger a decline toward $0.80, invalidating the current bullish thesis and delaying recovery prospects.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin Faces $103k Impasse as Bearish Signals Clash with Bullish Expectations

- Bitcoin fell near $103,000 on Nov. 8, 2025, amid Fed rate-cut uncertainty, trading in a $99,376–$103,956 range as technical indicators showed bearish consolidation. - Analysts highlighted key support at $98,900 and resistance at $104,000, with bullish sentiment driven by Cathie Wood’s $1M price target and Eric Trump’s “world-class asset” endorsement. - Strategy expanded its STRE offering to €620M to fund BTC purchases, holding 3.05% of circulating supply despite Bitcoin’s dip below $100,000. - Market cau

Ethereum Update: Validator Departures Point to a Streamlined and More Effective Network Ahead

- Ethereum's validator count fell below 1 million in November 2024, signaling structural shifts in staking dynamics and raising network security concerns. - Exit queues now take 37 days for withdrawals, driven by large-scale exits from Lido, Kiln, and leveraged staking unprofitability due to 2.9% annualized yields. - Experts predict consolidation toward professional operators, accelerated by Ethereum's Pectra upgrade allowing 2,048 ETH per validator. - Despite validator declines, Ethereum hosts $201B in to

ZEC Value Jumps 4.8% on NOV 12 2025 as Institutions Embrace and Privacy Advances Emerge

- Zcash (ZEC) surged 4.8% on Nov 12, 2025, to $464.06, with a 725.75% annual gain despite recent volatility. - Institutional adoption, including Grayscale's $137M ZCSH investment, and U.S. regulatory clarity via the Clarity and Genius Acts boosted ZEC's legitimacy. - DeFi integration via zenZEC and 30% shielded pool adoption highlight Zcash's privacy-driven appeal, supported by Electric Coin Company's ecosystem upgrades. - Whale activity and $500 support level analysis suggest potential for a $1,500 price

BCH Shares Rise 0.55% Today Following Governance and Earnings Announcements

- BCH stock rose 0.55% in 24 hours amid governance reforms approved at an Extraordinary Shareholders’ Meeting on Nov 10, 2025. - The bank reported slower growth due to reduced inflation-adjusted income and subdued loan expansion, with over 60% revenue from net interest income. - Governance amendments aim to enhance oversight, but technical analysis highlights risks from interest income reliance and macroeconomic exposure. - A backtest error occurred due to zero-price data, with three recovery options propo