Aster DEX’s Latest Protocol Enhancement and Liquidity Rewards: Advancing On-Chain Solutions and Optimizing DeFi Capital Utilization

- Aster DEX's 2025 protocol upgrade enables ASTER token holders to use their tokens as 80% margin collateral for leveraged trading, with a 5% fee discount for collateral users. - The upgrade triggered a 30% ASTER price surge and $2B 24-hour trading volume spike, attracting institutional attention including Coinbase's listing roadmap inclusion. - By converting ASTER into a functional collateral asset, the platform enhances capital efficiency while reducing liquidation risks through reduced margin requiremen

On-Chain Innovation: ASTER as Collateral and Fee Reduction Tool

With the November 2025 protocol update, Aster DEX now allows ASTER holders to use their tokens as collateral for perpetual contracts, offering an 80% margin ratio

This approach tackles a major challenge in DeFi: native tokens often lack real utility. By making ASTER a core part of the trading ecosystem, Aster DEX boosts capital efficiency. Users can access liquidity without selling their tokens, and lower margin requirements make leveraged trading more accessible. As noted by Coinotag, the upgrade coincided with a 30% jump in ASTER’s price and an 800% increase in daily trading volume to $2 billion, partly fueled by Binance founder Changpeng Zhao’s $2 million ASTER purchase just days earlier

Capital Efficiency and Liquidity Provision

The protocol update brings several improvements to DeFi capital efficiency. Firstly, by letting ASTER serve as collateral, the protocol temporarily removes tokens from circulation during trading, which can help stabilize prices and reduce volatility for liquidity providers

According to Bitget, these changes had an immediate impact: after the upgrade, Aster DEX’s trading volume soared to $2 billion in a single day, and the platform drew institutional interest, with Coinbase adding ASTER to its official listing roadmap

Privacy and Institutional Adoption: The Impact of Zero-Knowledge Proofs

Aster DEX’s commitment to privacy makes it more attractive in a DeFi environment often troubled by front-running and excessive transparency. The platform is preparing to launch Aster Chain in the first quarter of 2026, which will use zero-knowledge proofs (ZKPs) to safeguard transaction privacy and block front-running

The timing of the collateral upgrade—shortly after CZ’s ASTER acquisition—has led to speculation about coordinated market activity. Although both parties deny collaboration, the sequence of events increased ASTER’s visibility, resulting in a 3.51% price rise after Coinbase announced its listing roadmap inclusion

Risks and Future Outlook

Despite these positive developments, certain risks persist. Leveraged trading naturally heightens exposure to price swings, and poorly managed liquidations could threaten platform stability

Nevertheless, the upgrade’s focus on DeFi’s core goals—lower transaction fees, greater liquidity, and versatile tokens—positions Aster DEX as a strong contender in the decentralized derivatives space. As Aster Chain’s launch approaches, key indicators to monitor will include sustained trading volumes, institutional participation, and the token’s ability to retain its price advantage amid rising demand.

Conclusion

Aster DEX’s latest protocol update marks a new chapter in DeFi, blending utility, privacy, and capital efficiency within a unified platform. By turning ASTER into a practical asset and encouraging its use through fee incentives and collateral options, the platform tackles major inefficiencies in decentralized trading. For investors, this upgrade serves as a compelling example of how on-chain innovation can enhance both token value and overall DeFi liquidity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar News Today: Blockchain Opens Up Clean Energy Investment Opportunities While Turbo Taps Into $145B EaaS Sector

- Turbo Energy partners with Stellar and Taurus to tokenize solar energy financing via blockchain, targeting Spain's supermarket sector. - The pilot uses Energy-as-a-Service (EaaS) models with tokenized PPAs, enabling fractional investor ownership and reducing capital barriers. - Blockchain streamlines liquidity and transparency, aligning with a $145B EaaS market growth projection by 2030 driven by sustainable infrastructure demand. - Taurus manages token compliance via its platform, while Stellar's low-co

Ethereum Updates: Major Holders Increase Their Ethereum Stash Fivefold While BTC/ETH ETFs See Outflows—Altcoins Draw in $126 Million

- Bitcoin and Ethereum spot ETFs lost $605M in outflows, contrasting with $126M inflows into Bitwise's Solana ETF (BSOL), highlighting shifting investor priorities toward altcoins. - Ethereum's largest whale quintupled ETH holdings to $138M while closing Bitcoin longs, reinforcing institutional confidence in Ethereum's long-term potential amid stable technical indicators. - Solana's ETF success ($545M total inflows) reflects growing institutional demand for altcoins despite 16% price declines, driven by it

Red Bull Racing’s advantage? An engineer who approaches workflows with the precision of timing laps

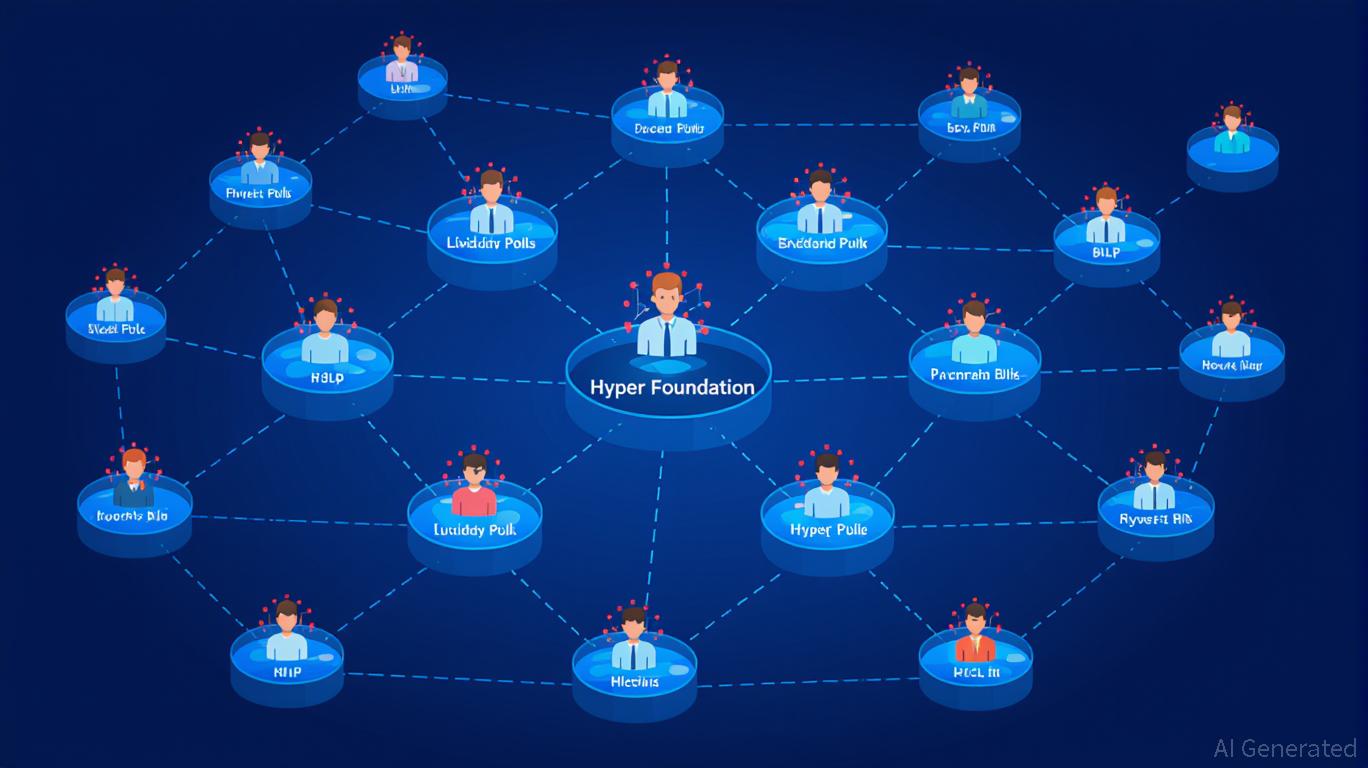

Hyperliquid's Growing Influence in Crypto Trading: Can It Maintain Long-Term Investment Appeal?

- Hyperliquid dominates 80% of 2025 perpetual contract market via on-chain governance and user-driven liquidity innovations. - Centralized governance (HIP-3 protocol, USDH stablecoin launch) balances permissionless market creation with validator dominance risks. - HLP liquidity model generates $40M during crashes but faces regulatory scrutiny and token economics challenges from 2025 HYPE unlock. - TVL growth to $5B and 518K active addresses highlight adoption, yet governance centralization and institutiona