XRP Price Soars 12% After US Senate Vote - Time to BUY XRP?

XRP Price Soars 12% After U.S. Senate Vote

XRP surged by more than 12%, reaching $2.56, following the U.S. Senate’s 60–40 vote to advance a bill reopening the government after a prolonged 40-day shutdown. The news immediately boosted investor sentiment across both traditional and crypto markets, fueling a renewed wave of buying activity.

The relief in Washington appears to have removed a key element of uncertainty weighing on risk assets. As government operations resume, liquidity flows and spending confidence are expected to improve — which often translates into bullish momentum for assets like Bitcoin ( $BTC ), Ethereum ( $ETH ), and $XRP .

XRP Price Analysis: Key Levels and Bullish Momentum

The 2-hour XRP/USDT chart shows a strong breakout above the $2.45 resistance (yellow line), now flipping it into support. The token is trading well above the 200 SMA ($2.44) and 21 EMA ($2.34) — both confirming a short-term uptrend.

XRP/USD 2-hour chart - TradingView

The Stochastic RSI is near the overbought zone (98.45), signaling strong momentum but also suggesting a potential short cooldown before the next leg higher. As long as XRP remains above $2.45, bulls could target the next resistance zone around $2.70.

On the downside, support lies at $2.20, where previous consolidation occurred — a key area for buyers to defend if a pullback happens.

XRP Price Prediction: Political Calm, Risk Appetite Returns

The Senate’s decision is viewed as a bullish macro trigger that could stabilize financial markets heading into mid-November. Traders are positioning themselves ahead of fresh economic data and upcoming Fed communications, both of which could shape the next move for crypto.

If political stability continues, analysts expect XRP’s bullish momentum to extend toward $2.70–$2.80, possibly retesting its September highs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

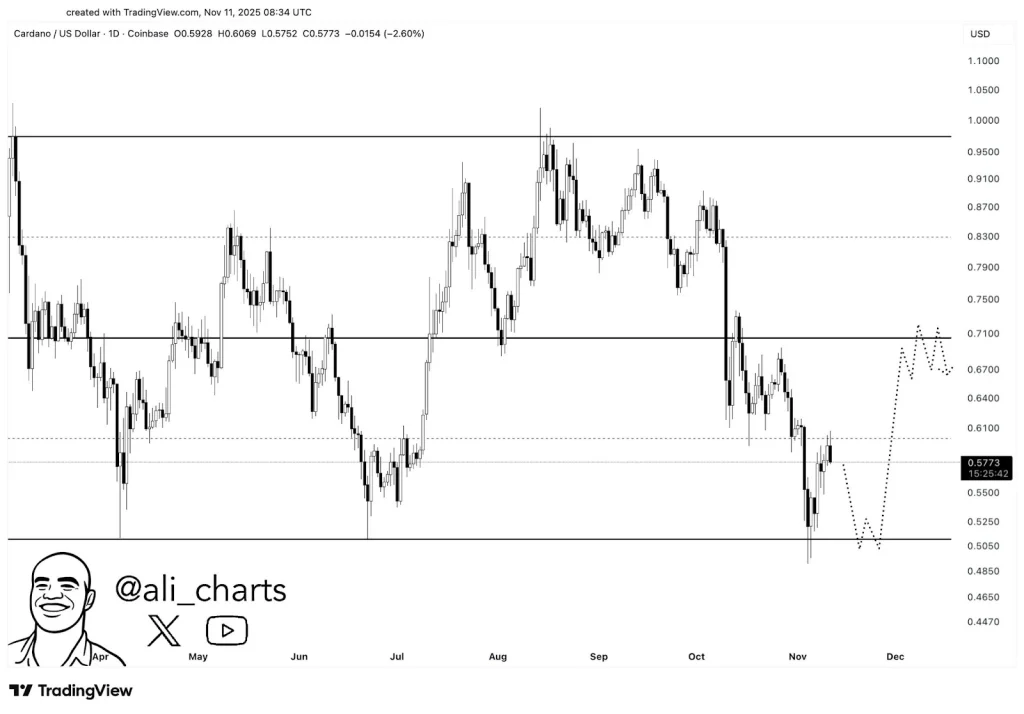

Two Reasons Why Cardano Price Will Hit $0.45 First Before $0.7 Soon

XRP ETF Goes Live Tomorrow, But Bitwise Doubts If It Can Outshine Solana

Bitcoin News Today: Institutions Warm Up to Bitcoin: ETFs Connect the Gap Between Conventional Finance and Crypto

- BlackRock's Bitcoin ETF expands to Australia by mid-2025, boosting institutional adoption through regulated access. - JPMorgan increases IBIT holdings by 64% to $343M, signaling Bitcoin's growing legitimacy as a macro hedge. - U.S. Bitcoin ETFs see $524M net inflows as Ethereum ETFs face outflows, highlighting shifting institutional preferences. - Bitcoin trades near $104K amid corporate treasury losses and volatility, yet institutions innovate with lending programs. - Regulated ETFs bridge traditional-f

Bitcoin News Update: Bitcoin Drops Under $103K Amid Escalating U.S.-China Crypto Tensions

- Bitcoin fell below $103,000 on Nov. 9, 2025, as U.S. government reopening failed to ease market anxieties amid bearish technical indicators and geopolitical tensions. - A brief price spike to $104,000 followed Trump's $2,000 "dividend" announcement, but broader macro pressures quickly reversed the rally. - China accused the U.S. of orchestrating a $13B Bitcoin theft via a 2020 cyber operation, escalating U.S.-China tensions over digital asset sovereignty. - Bitcoin remains rangebound between $98,898 and