MMT Price Fluctuations in Late 2025: Interpreting Macroeconomic Changes and Institutional Trends in Cryptocurrency

- Fed's 2025 rate cuts to 4.00%-4.25% fueled crypto rallies, with Bitcoin surging 86.76% post-inflation data. - Institutional buyers adopted dual-track strategies, boosting MMT holdings by 84.7% and accumulating 388 BTC via MSTR. - Crypto-traditional correlations evolved: ICP showed 0.63 S&P 500 link while gold (-0.48) highlighted diverging dynamics. - MVRV-Z (2.31) and aSOPR (1.03) metrics suggest Bitcoin remains in speculative but non-bubble territory amid institutional inflows. - MarketBeat analysis emp

By late 2025, the cryptocurrency market has turned into a contested arena where established players and newcomers clash. With the Federal Reserve adopting a more accommodative stance and institutional funds influencing risk asset prices, the movement of

Macroeconomic Catalysts: Fed Policy and Inflation Dynamics

The Federal Reserve’s rate cut to a 4.00%-4.25% range in September 2025 signaled a pivotal shift toward riskier assets. As reported by

These changes extend beyond

Institutional Buying: A Dual-Track Strategy

Institutional investors in late 2025 are taking a two-pronged approach to both crypto and traditional markets. For

However, blockchain data paints a more detailed picture. Indicators like MVRV-Z (2.31) and aSOPR (1.03) point to high, but not excessive, Bitcoin valuations, suggesting that while speculation is present, it hasn’t reached unsustainable levels, the

Cross-Asset Correlations: Crypto's Evolving Identity

The relationship between digital and traditional assets is crucial for understanding MMT’s price swings. ICP’s moderate 0.63 correlation with the S&P 500 shows that cryptocurrencies are increasingly seen as unique but related investment options, according to the

This trend is further strengthened by institutional investments. As firms like Broadway Wealth Solutions Inc. and Ashton Thomas Securities LLC direct funds into MMT and crypto ETFs, the boundaries between asset types become less distinct, the

The Road Ahead: Balancing Volatility and Conviction

For those investing in late 2025, it’s essential to monitor both macroeconomic developments and institutional trends. While the Fed’s ongoing rate cuts create a supportive environment, the durability of crypto’s rally will hinge on whether institutional interest remains consistent or fades quickly. MMT’s price range of $4.31 to $4.90 over the past year reflects this ongoing uncertainty, as the

The main message is straightforward: in a time of changing monetary policy and rising institutional involvement, short-term price swings are to be expected. Yet for investors with a long-term perspective, the evidence indicates that crypto assets—and funds like MMT—are increasingly being treated as strategic investments rather than mere speculative plays.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar News Today: Blockchain Opens Up Clean Energy Investment Opportunities While Turbo Taps Into $145B EaaS Sector

- Turbo Energy partners with Stellar and Taurus to tokenize solar energy financing via blockchain, targeting Spain's supermarket sector. - The pilot uses Energy-as-a-Service (EaaS) models with tokenized PPAs, enabling fractional investor ownership and reducing capital barriers. - Blockchain streamlines liquidity and transparency, aligning with a $145B EaaS market growth projection by 2030 driven by sustainable infrastructure demand. - Taurus manages token compliance via its platform, while Stellar's low-co

Ethereum Updates: Major Holders Increase Their Ethereum Stash Fivefold While BTC/ETH ETFs See Outflows—Altcoins Draw in $126 Million

- Bitcoin and Ethereum spot ETFs lost $605M in outflows, contrasting with $126M inflows into Bitwise's Solana ETF (BSOL), highlighting shifting investor priorities toward altcoins. - Ethereum's largest whale quintupled ETH holdings to $138M while closing Bitcoin longs, reinforcing institutional confidence in Ethereum's long-term potential amid stable technical indicators. - Solana's ETF success ($545M total inflows) reflects growing institutional demand for altcoins despite 16% price declines, driven by it

Red Bull Racing’s advantage? An engineer who approaches workflows with the precision of timing laps

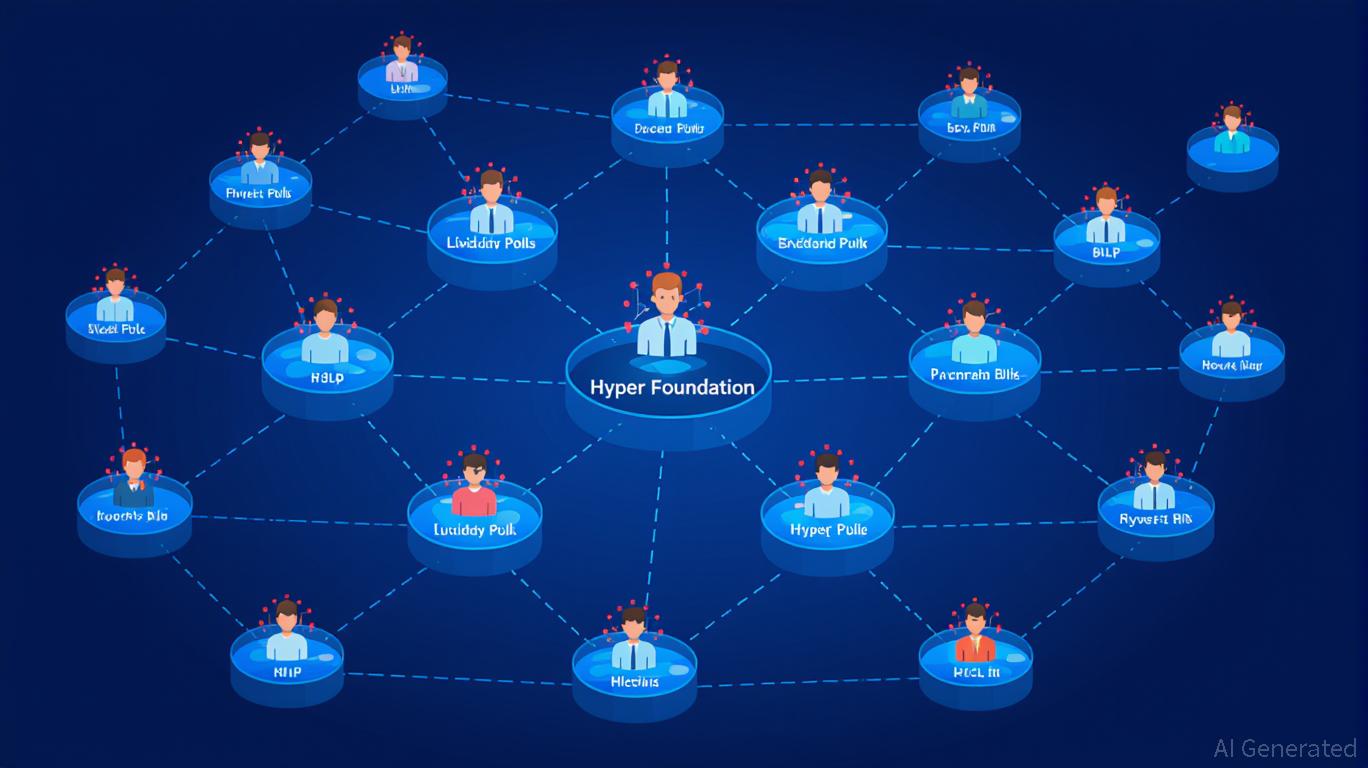

Hyperliquid's Growing Influence in Crypto Trading: Can It Maintain Long-Term Investment Appeal?

- Hyperliquid dominates 80% of 2025 perpetual contract market via on-chain governance and user-driven liquidity innovations. - Centralized governance (HIP-3 protocol, USDH stablecoin launch) balances permissionless market creation with validator dominance risks. - HLP liquidity model generates $40M during crashes but faces regulatory scrutiny and token economics challenges from 2025 HYPE unlock. - TVL growth to $5B and 518K active addresses highlight adoption, yet governance centralization and institutiona