Smart Money Keeps Buying Solana Despite 20% SOL Price Drop

Institutions keep buying Solana as the price dips. With 11 straight days of ETF inflows and new NYSE options, smart money sees long-term value.

Despite a 4% SOL price drop over 24 hours and more than 20% in 11 days, Solana ETFs have continued to attract unprecedented institutional inflows during the same timeframe.

It shows that while retail traders are fading Solana, institutions are quietly buying the dip.

Institutions Keep Accumulating Solana ETFs

As of this writing, Solana trades at $158.01, down nearly 4% on the day and over 20% since October 28, the first day of inflow for Solana ETFs.

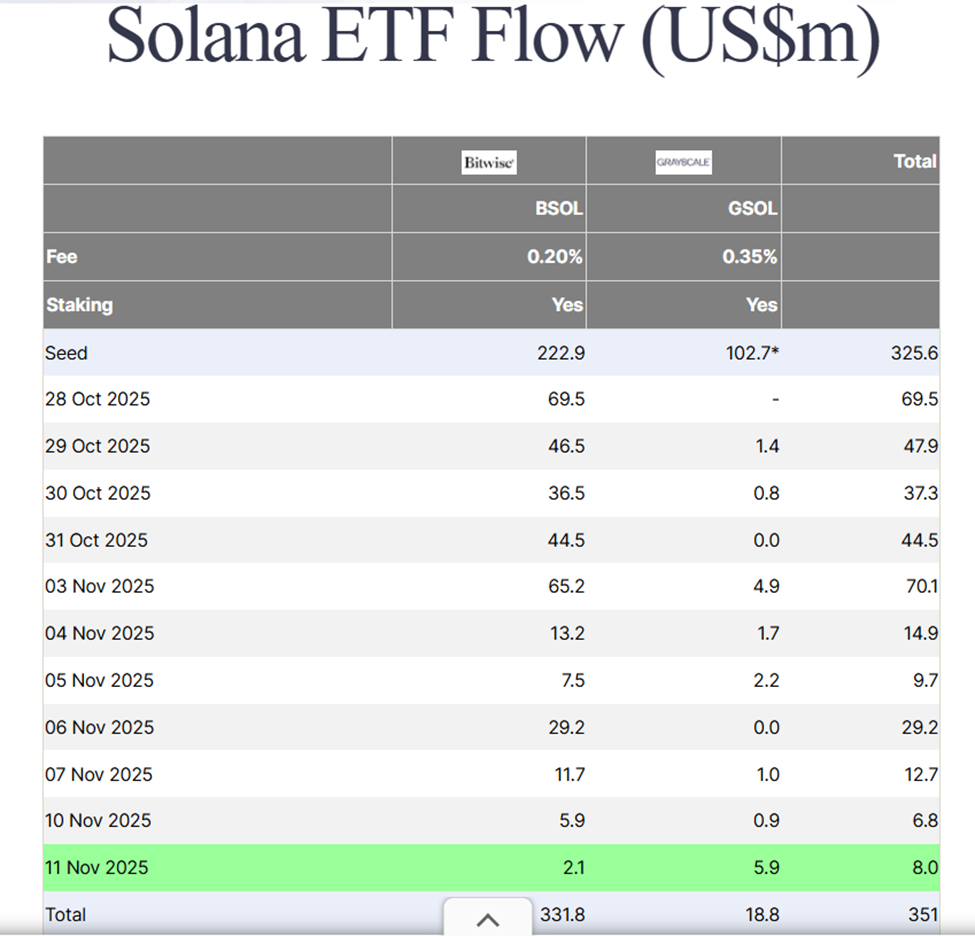

Yet data shows a surge in Solana ETF inflows for the 11th consecutive day, totaling $351 million since launch across Bitwise’s BSOL and Grayscale’s GSOL funds.

Solana ETF Flows. Source:

SoSoValue

Solana ETF Flows. Source:

SoSoValue

The chart above shows the divergence. While Solana has achieved 11 consecutive days of SOL ETF accumulation, the price has declined.

This signals growing confidence among institutions seeking cautious exposure to SOL, while the retail folk book profits.

Analyst AB Kuai Dong highlighted the paradox, noting that Solana’s ETF inflows are rising even faster than SOL’s price drop.

“Good news: SOL ETF sees inflows every day. Bad news: The inflow momentum is even faster than SOL’s drop. Soon, several spot ETFs for XRP and DOGE are coming too—could it be that they’ll also end as soon as they launch?” he posed.

Adding to the bullish institutional narrative, the New York Stock Exchange (NYSE) has officially launched options trading for Solana ETFs, a first for the ecosystem.

The listings for $GSOL and $BSOL open the door to risk management, yield strategies, and price discovery tools once exclusive to traditional markets. Teddy Fusaro, President of Bitwise, called the milestone remarkable, citing institutional-grade benefits that come with ETF options.

“Options are now live on America’s largest Solana ETF, BSOL. Pretty remarkable. Institutional tools for risk management, yield enhancement, and efficient price discovery that are essential at scale,” wrote Fusaro.

This evolution positions Solana as a financial asset with a maturing derivatives market, a development typically seen before major institutional adoption cycles.

Speculation Builds Around XRP and DOGE As ETFs Show Solana’s Strength

While Bitcoin ETFs led the market with $524 million in net inflows on November 11, led by BlackRock’s IBIT, and Ethereum ETFs saw $107 million in outflows for a third straight day, Solana’s ETF market stood out with $8 million in daily inflows, continuing an 11-day streak.

Solana ETF Inflows. Source:

Farside Investors

Solana ETF Inflows. Source:

Farside Investors

The trend highlights institutional diversification beyond Bitcoin and Ethereum, with whales and funds staking and accumulating Solana for yield and long-term positioning. This could mark the early stage of Solana’s institutional adoption curve.

Momentum from Solana’s ETF success has reignited speculation that XRP and Dogecoin ETFs could soon follow. Canary Capital CEO Steven McClurg told the Paul Barron Channel that an XRP ETF would likely double the performance of Solana.

He cited the token’s global liquidity, clearer regulation, and payments utility as key institutional drivers.

Despite its recent price drop, Solana’s fundamentals and institutional traction remain strong. ETF inflows, options trading on the NYSE, and whale accumulation suggest that smart money is positioning for long-term exposure, even as retail sentiment cools.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Regulation and Innovation: The Struggle Over Crypto's Proof of Reserves Will Define Its Future

- Proof of Reserves (PoR) has become a trust cornerstone in crypto, with regulators and exchanges prioritizing transparency post-FTX collapse. - The 2025 "flash crash" and new CLARITY/GENIUS Acts reinforce PoR's role, mandating stablecoin reserves and monthly audits under federal oversight. - BNY's stablecoin fund and 21Shares' ETFs show crypto-traditional finance integration, while a16z warns overregulation risks stifling DeFi innovation. - Technological solutions like zk-STARKs enable private yet verifia

Alibaba’s Tokenized Payment Set to Transform International Trade with Real-Time Settlements

- Alibaba and JPMorgan launch Agentic Pay, a tokenized B2B payment system using deposit tokens for instant cross-border settlements. - The platform integrates AI for automated contract generation, streamlining trade documentation while avoiding stablecoins and crypto volatility. - Backed by bank-held fiat deposits (JPMorgan's JPMD tokens), it aligns with China's regulatory preferences and offers yield-bearing features for institutional users. - Projected to process billions annually, the system could redef

The PLG Dilemma: Why Sales Remains the Overlooked Key to Revenue

- Product-led growth (PLG) prioritizes product adoption but risks undervaluing structured sales strategies, creating a blind spot for non-technical leaders. - Non-technical operators must act as "Translator-in-Chiefs," aligning technical innovation with market demand through three pillars: product architecture understanding, systematized sales forecasting, and CFO-focused financial metrics. - By institutionalizing sales as a revenue blueprint rather than a cost center, PLG startups can transform innovation

Fed’s Internal Differences and Lagging Data Put Dollar at a Turning Point While Euro Strengthens

- EUR/USD climbed to 1.1590 as weak U.S. labor data and Fed policy splits fueled dollar weakness expectations. - Fed officials diverged on rate cuts: Moran favored 50-basis-point cut, Collins opposed, while Musalem noted inflation near 3%. - ECB's projected rate stability through 2027 contrasts with Fed's 125-basis-point easing by 2026, boosting euro despite global risks. - Market pricing for December Fed cuts dropped to 55% as delayed NFP data and mixed CPI components heighten uncertainty. - Technical ind