Date: Fri, Nov 14, 2025 | 08:32 AM GMT

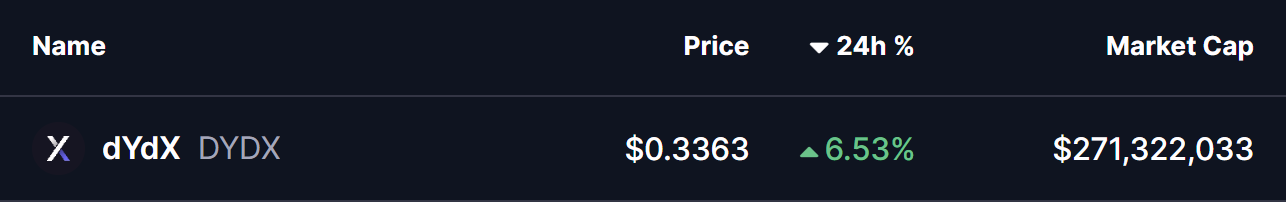

The broader cryptocurrency market continues to remain under heavy selling pressure as Bitcoin (BTC) and Ethereum (ETH) recorded sharp declines of over 6% and 9% respectively in the past 24 hours. Despite the turbulence, dYdX (DYDX) is displaying notable strength after its latest announcement that 75% of dYdX protocol fees will be used to buy back DYDX tokens on the open market.

DYDX is trading in the green with a 6% gain today, but what stands out more than the short-term bounce is its technical structure, which suggests the possibility of a upside breakout forming in the sessions ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Inverse Head and Shoulders in Play

On the daily chart, DYDX has formed a clean inverse head and shoulders pattern, a well-known bullish reversal formation that typically signals the transition from a downtrend to an uptrend once the neckline breaks.

During the formation of the right shoulder, DYDX dropped toward the $0.2856 region, where buyers stepped back in and initiated a recovery. Since then, the price has steadily climbed toward the $0.3363 level, showing consistent buying pressure even while the broader market struggles.

dYdX (DYDX) Daily Chart/Coinsprobe (Source: Tradingview)

dYdX (DYDX) Daily Chart/Coinsprobe (Source: Tradingview)

DYDX is now approaching a crucial neckline resistance between $0.3438 and $0.3580 — an area that has previously acted as a strong rejection zone. A successful break above this region would complete the pattern and signal the start of a potential bullish trend reversal.

What’s Ahead for DYDX?

If DYDX breaks and closes above the $0.3438–$0.3580 neckline and confirms the move through a retest, the measured projection from the inverse head and shoulders suggests an upside target near $0.447. A breakout toward this level would mark an estimated 33% potential upside from the neckline, aligning with the typical follow-through observed in this pattern.

However, confirmation is essential. A clean breakout candle with sustained momentum above the neckline will be the key factor that validates the bullish reversal. Failure to break this level may keep DYDX trapped within the current consolidation zone, delaying any major directional move.