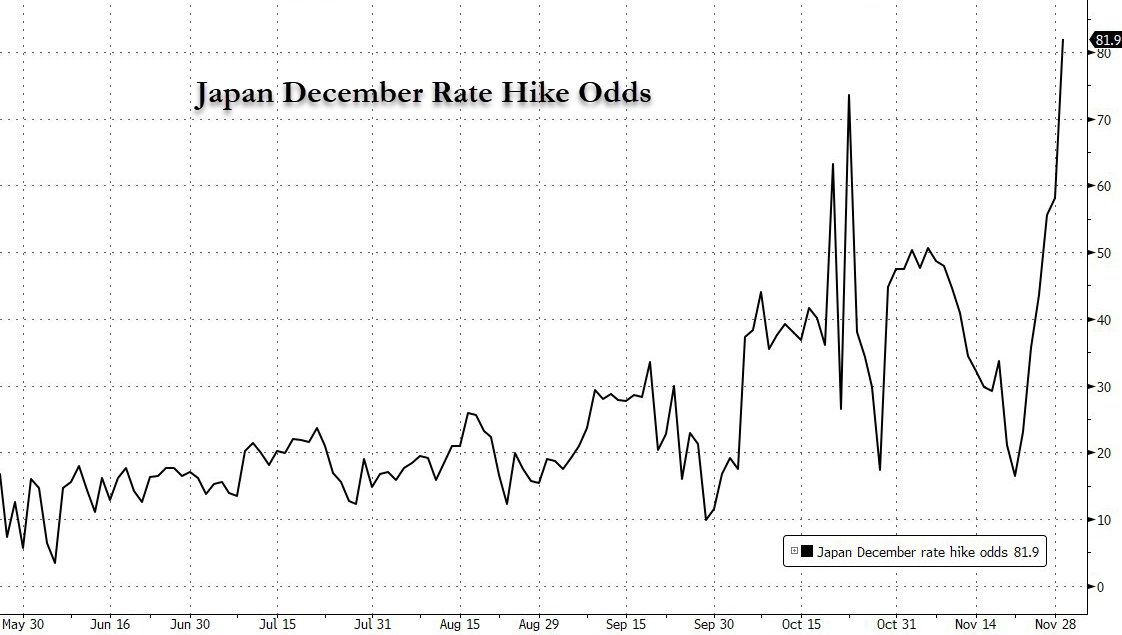

On December 1, Bank of Japan Governor Kazuo Ueda made a rare direct reference to the upcoming monetary policy meeting scheduled for December 18-19 in a speech, stating that a decision would be made "as appropriate" at that time. This statement has been interpreted by investment banks as a strong signal of a policy shift, causing market expectations for a December rate hike to surge—the probability of a rate hike jumped from 20% ten days ago to 80%.

Japanese government bond yields climbed across the board to recent highs, the narrowing US-Japan interest rate spread pushed the USD/JPY exchange rate lower, and Bitcoin, as a barometer for "carry trades," almost gave back all its gains from the past ten days within a few hours. The Bank of Japan's potential move is becoming yet another burden on the cryptocurrency market, with growing concerns that if the BOJ unexpectedly raises rates before Christmas amid year-end liquidity shortages, it could trigger a market shock similar to the "carry trade massacre" of December 2022.

The "Detonator" of Yen Carry Trades

The core logic of the so-called yen carry trade lies in leveraging the long-term low or even negative interest rates of the yen. Investors borrow yen at extremely low costs and invest in higher-yielding risk assets such as Bitcoin, high-yield bonds, and tech stocks, profiting from both the interest rate differential and asset appreciation. Over the past decades, the Bank of Japan's loose monetary policy has provided fertile ground for such trades, and the abundance of low-cost yen has become a key source of liquidity for the cryptocurrency market.

Although Governor Kazuo Ueda had previously hinted at a hawkish stance, this time his direct reference to a specific meeting date has been interpreted as the clearest policy shift signal since he took office. The market reaction was immediate: as expectations rose, Japan's two-year government bond yield climbed to its highest level since 2008, and the yen strengthened against the dollar, indicating a rapid rise in yen funding costs and a sharp squeeze on carry trade profits.

For investors, when funding costs exceed expected asset returns, unwinding carry trades becomes inevitable—that is, selling risk assets like Bitcoin to repay yen loans. This concentrated unwinding is translating into selling pressure in the cryptocurrency market. As Jasper De Maere of crypto trading firm Wintermute put it: "Japan's low interest rates facilitated carry trades, and now these trades are being unwound, with all risk assets being sold off."

Bitcoin Faces "Liquidity Drain" Shock

The wave of yen carry trade unwinding is undoubtedly adding insult to injury for the Bitcoin market, which is already in a liquidity contraction cycle. On December 1, Bitcoin almost gave back all its gains from the past ten days within a few hours, ultimately falling 4.52% in a single day. This volatility resonated precisely with the BOJ's policy signal and the global bond market sell-off. This is not an isolated incident but a concentrated manifestation of capital withdrawal logic—when low-cost funds begin to flow back to Japan, the cryptocurrency market is suffering a "hemorrhagic blow," especially as year-end liquidity is already drying up, amplifying the impact of capital outflows.

This shock is reflected on two levels: first, direct selling pressure. Many institutions and individual investors involved in carry trades are selling Bitcoin en masse, causing prices to plunge rapidly. On December 1, Bitcoin fell below $86,000 intraday, a result of concentrated selling and programmatic stop-losses. Data shows that on that day, total crypto contract liquidations across the network reached as high as $788 million, with over 80% being long liquidations—such extreme long-side stampedes are often triggered by the chain reaction of carry trade unwinding.

Secondly, liquidity is further drying up. Since November, the Bitcoin market has suffered multiple liquidity blows:

US spot Bitcoin ETFs recorded a net outflow of $3.5 billion in November, the largest monthly outflow since the beginning of the year. Since October 31, Bitcoin ETFs have seen four consecutive weeks of net outflows, totaling $4.34 billion. BlackRock's IBIT, the largest Bitcoin ETF by net assets, saw $2.34 billion in outflows in November and recorded its largest single-day outflow since inception on November 18, reaching $523 million.

The withdrawal of yen carry trade funds is equivalent to pulling another key chunk of liquidity from an already tight pool. When buying interest is insufficient, even small sell-offs can trigger large price swings. The 4.52% single-day drop in Bitcoin on December 1, in the absence of major negative news, is a direct reflection of liquidity fragility.

More worryingly, this shock is not a one-off event. As long as expectations for a BOJ rate hike remain, the process of unwinding carry trades may continue. If the BOJ does announce a rate hike at the December 18-19 meeting, confirming a long-term policy shift, it could trigger a "carry trade massacre" similar to December 2022, prompting a larger-scale yen repatriation and a comprehensive escalation of selling pressure on Bitcoin.

How Long Will Bitcoin's "Winter" Last?

The impact of BOJ rate hike expectations on Bitcoin is so significant because the market is currently in a fragile state with multiple bearish factors intertwined. In addition to yen carry trade unwinding, uncertainties in Federal Reserve policy, institutional capital outflows, and technical breakdowns together form Bitcoin's "pressure matrix."

On the macro level, the Federal Reserve's stance of "higher rates for longer" is still fermenting. Although there are some market expectations for a Fed rate cut in December, the US core PCE inflation rate in October remains above the 2% target, and Powell's previous statement that "rates will remain high for longer" has shattered hopes for a rapid rate cut. In this context, Bitcoin, as an asset with no intrinsic value anchor, struggles to compete with profit-backed tech stocks for capital, and the capital repatriation triggered by a BOJ rate hike further exacerbates this "capital shortage."

From a market structure perspective, both the technical and sentiment indicators for Bitcoin are weak. Bitcoin has fallen from its October peak of $126,000 to around $86,000, with technical indicators sending clear bearish signals—the Relative Strength Index (RSI) is near oversold territory, but the MACD line remains deeply negative, confirming that the downtrend has not reversed. The sentiment indicator "Fear & Greed Index" has dropped to the 20 range, indicating "extreme fear." This panic amplifies the selling pressure from carry trade unwinding, creating a vicious cycle of "selling—decline—more panic."

However, the market is not without hope. Data shows that Bitcoin's MVRV ratio (market value to realized value) has dropped to 1.76, a low since 2023. Historically, when this ratio falls below 2, it is often accompanied by a short-term rebound; some long-term holders have started to accumulate in the $92,000-$95,000 range, indicating that bottom-fishing capital is gradually entering the market. Whether these positive signals can translate into a trend reversal, however, still depends on macro policy variables—especially the BOJ's December meeting outcome and subsequent Fed statements.

Survival Logic for Cryptocurrencies Amid Policy Shifts

The wave of carry trade unwinding triggered by BOJ rate hike expectations is essentially a microcosm of the tightening global liquidity environment in the cryptocurrency market. The era of asset prices being driven up by low-cost capital is coming to an end. Whether it's the Fed's "high rates for longer" or the BOJ's "exit from easing," global capital flow logic is being reshaped. For Bitcoin, this means the market will shift from "liquidity-driven" to "value-driven," and speculative logic that relies solely on capital hype is failing, while crypto assets with real-world applications may stand out amid differentiation.

In the short term, Bitcoin will still have to endure the dual pressures of yen carry trade unwinding and Fed policy uncertainty, with the $85,000 support level becoming a key defense line. For investors, in this macro policy-driven market volatility, abandoning short-term speculation and focusing on the underlying value and long-term trends of assets may be the core strategy to weather the current "winter." The "ebb" of yen carry trades is making the true ecology of the cryptocurrency market increasingly clear.

![Crypto News Today [Live] Updates On December 2,2025 : Federal Reserve News, Bitcoin Price Today, Ethereum Price And XRP Price](https://img.bgstatic.com/multiLang/image/social/cc963d16638fb3fac964f28463fe5c9a1764673944776.webp)