Zcash Price Struggle Below $400 Is Down To Bitcoin, Here’s How

Zcash price has faced renewed selling pressure after a sharp 16% decline in the last 24 hours, pulling the altcoin down from its attempted move above $400. The rejection has delayed ZEC’s attempt to reclaim higher levels, and the extended wait could introduce further challenges for traders if market sentiment weakens again. Zcash Pulls Away

Zcash price has faced renewed selling pressure after a sharp 16% decline in the last 24 hours, pulling the altcoin down from its attempted move above $400.

The rejection has delayed ZEC’s attempt to reclaim higher levels, and the extended wait could introduce further challenges for traders if market sentiment weakens again.

Zcash Pulls Away From Bitcoin

The correlation between Zcash and Bitcoin has been slipping in recent days, dipping back below the zero line. A negative correlation means ZEC is no longer moving in tandem with BTC’s price direction.

While this may initially seem neutral, it introduces an unusual risk dynamic. If Bitcoin rallies, Zcash may fail to benefit from broader market optimism.

Conversely, if Bitcoin falls sharply, ZEC could unexpectedly move higher, but with no guarantee of sustained strength.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ZEC Correlation To Bitcoin. Source:

ZEC Correlation To Bitcoin. Source:

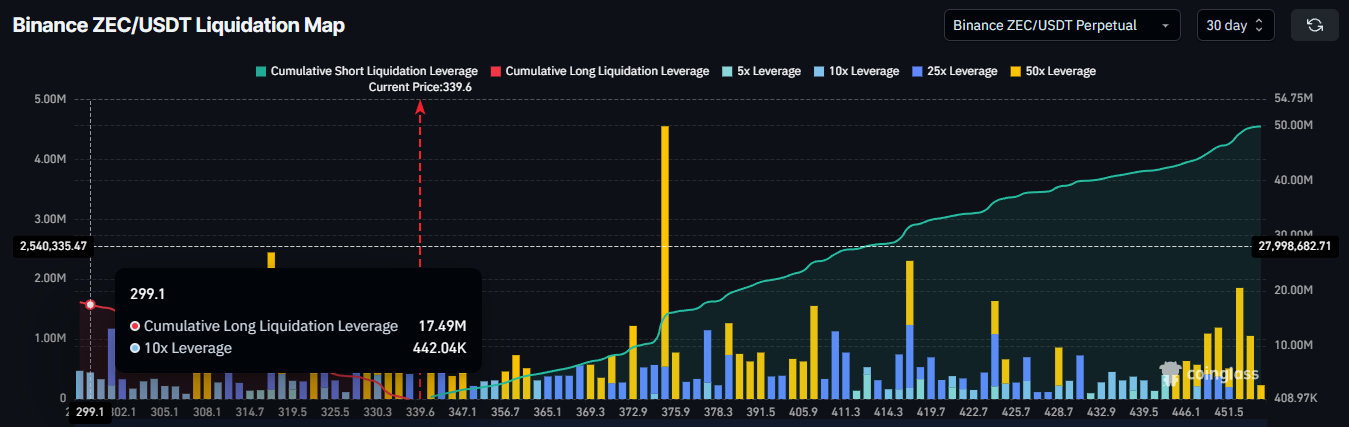

The liquidation map adds another layer of caution for ZEC holders at the moment. Long traders are facing elevated liquidation risk, with nearly $17.49 million in long contracts exposed if ZEC drops to $300 or below.

These potential liquidations represent a major pressure point for bullish sentiment.

If prices approach this threshold, cascading liquidations could accelerate downward movement. Such events often prompt traders to exit long positions and discourage new long exposure, contributing to a feedback loop that reinforces bearish momentum.

Zcash Liquidation Map. Source:

Zcash Liquidation Map. Source:

ZEC Price Faces Resistance

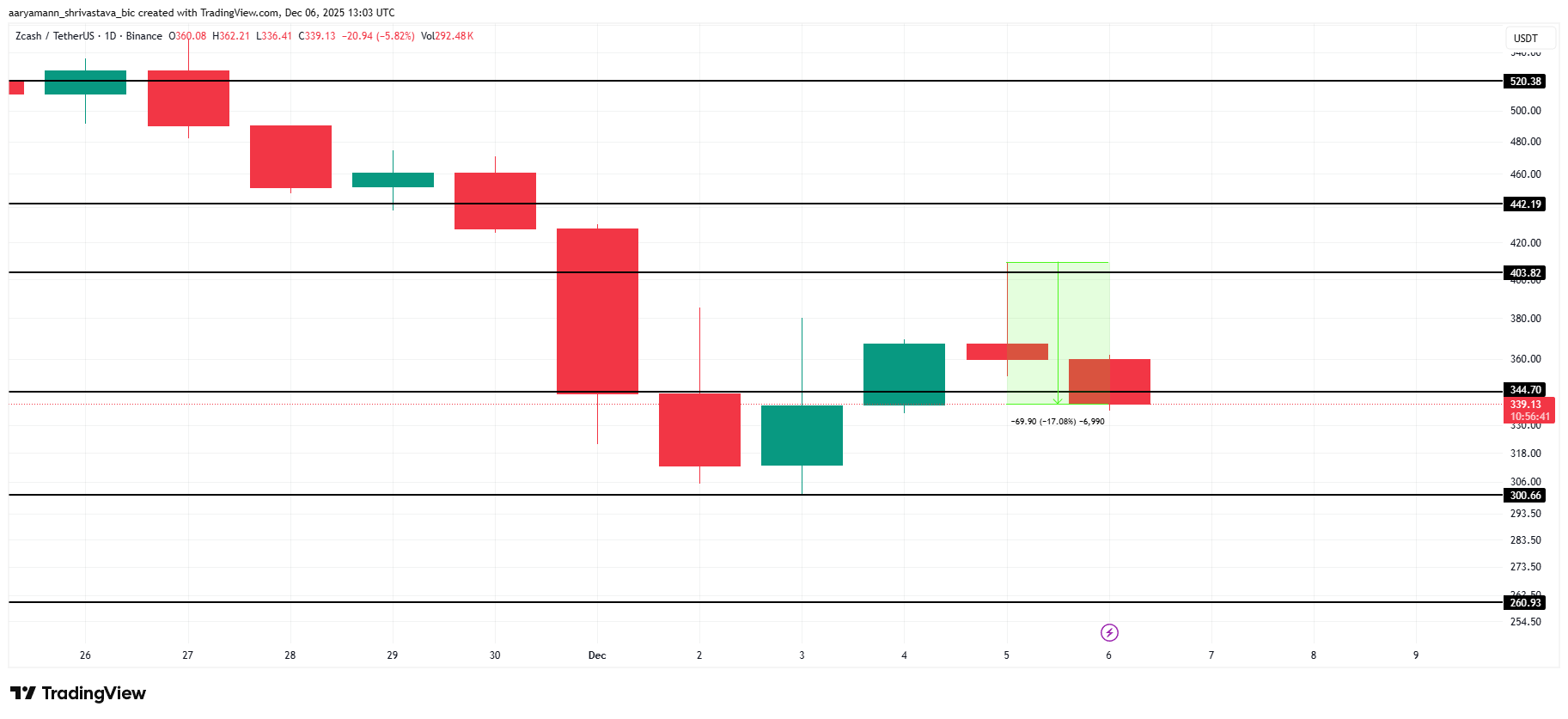

ZEC is trading at $339 and is hovering around the $344 support level after its steep decline from intra-day highs. The sharp sell-off and weakening market structure suggest that further downside is possible in the near term.

If bearish momentum continues, ZEC could fall toward the critical $300 support. Losing this level would likely trigger the $17.49 million liquidation cluster. This could potentially push the price down to $260 as forced selling intensifies.

ZEC Price Analysis. Source:

ZEC Price Analysis. Source:

However, if momentum shifts and buyers return, ZEC could stabilize at $344 and attempt a recovery toward $403. A successful breakout above this level would invalidate the bearish thesis and restore confidence among long traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The USE.com Presale Heats Up as Early Contributors Position for a High-Impact Exchange Launch

The Rapid Downturn of COAI: An In-Depth Analysis of Market Drivers and Effects on Investors

- COAI index plummeted 88% in 2025 due to governance failures, regulatory ambiguity, and systemic AI-driven risks. - C3.ai's leadership crisis and $116.8M loss triggered investor panic, while CLARITY Act's unclear regulations deepened uncertainty. - AI's role in synchronized market swings and fragmented oversight amplified COAI's collapse, exposing systemic vulnerabilities. - Behavioral biases like herd behavior accelerated sell-offs, underscoring the need for diversified portfolios and robust regulatory f

Crypto: 23,561 Billion SHIB Moved in 24H — Manipulation or Glitch?

Jupiter Lend Clarifies Earlier 'Zero Contagion' Statement Was Not Accurate