BitMine buys $199M in Ether as smart money traders bet on ETH decline

BitMine Immersion Technologies, the world’s largest corporate Ether holder, continues buying the dip, despite the industry’s most successful traders betting on Ethereum's price fall.

BitMine acquired $199 million worth of Ether (ETH) during the past two days, through a $68 million ETH acquisition on Saturday and another $130.7 million buy on Friday, according to blockchain data platform Lookonchain.

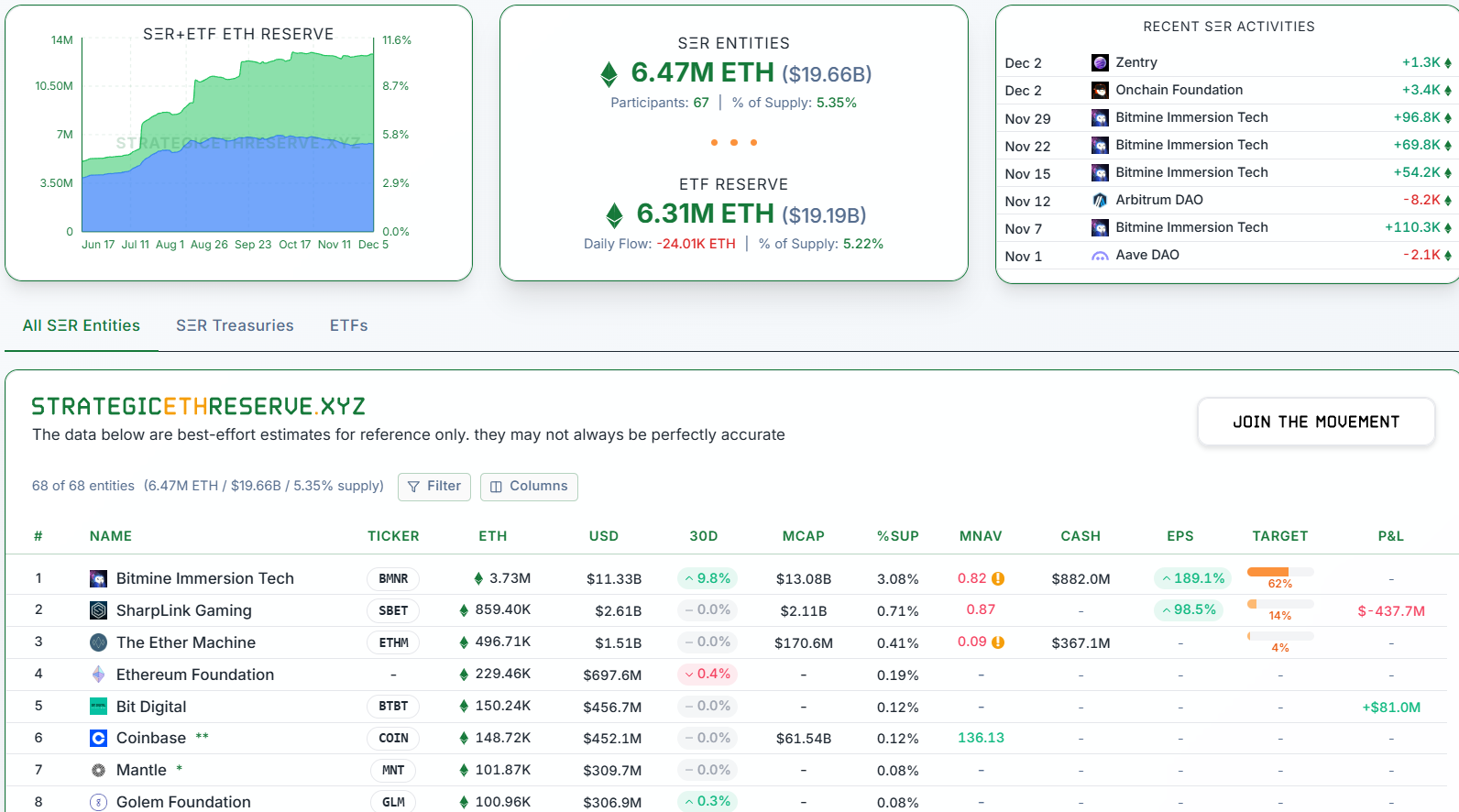

With the latest investments, BitMine now holds $11.3 billion, or 3.08%, of the total Ether supply, closing in on its 5% accumulation target, according to data from the StrategicEthReserve.

BitMine’s continued accumulations are a strong sign of conviction in Ether's long-term growth potential. The company holds an additional $882 million in cash reserves, which may be used for more Ether accumulation.

BitMine’s investment comes amid a significant slowdown in digital asset treasury (DAT) activity, which saw corporate Ether acquisitions fall 81% in three months, from 1.97 million Ether in August to 370,000 in net ETH acquired in November.

Despite the slowdown, BitMine accumulated the lion’s share, or 679,000 Ether worth $2.13 billion during the past month.

Smart money traders are betting on Ether’s price decline

The crypto industry’s best-performing traders by returns, who are tracked as “smart money” traders on Nansen’s blockchain intelligence platform, are betting on the short-term depreciation of Ether’s price.

Smart money traders added $2.8 million in short positions over the past 24 hours, as the cohort was net short on Ether, with a cumulative short position of $21 million, according to Nansen.

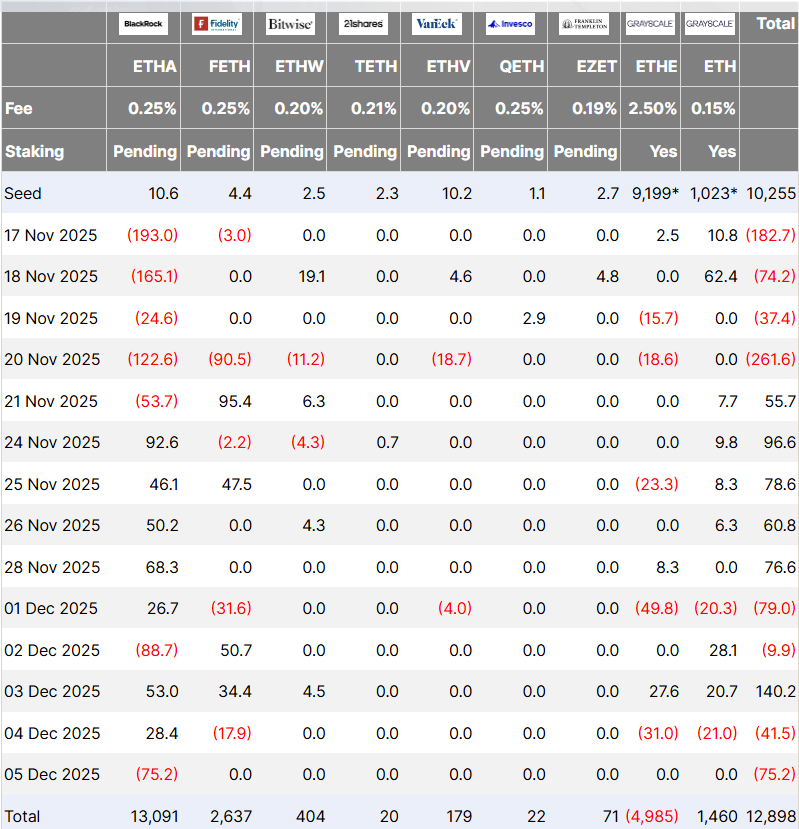

Ethereum exchange-traded funds (ETFs), a significant driver of liquidity for Ether, also continue to lack demand.

The spot Ether ETFs recorded $75.2 million in net positive outflows for the second consecutive day on Friday, following the $1.4 billion in monthly outflows in November, according to Farside Investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The USE.com Presale Heats Up as Early Contributors Position for a High-Impact Exchange Launch

The Rapid Downturn of COAI: An In-Depth Analysis of Market Drivers and Effects on Investors

- COAI index plummeted 88% in 2025 due to governance failures, regulatory ambiguity, and systemic AI-driven risks. - C3.ai's leadership crisis and $116.8M loss triggered investor panic, while CLARITY Act's unclear regulations deepened uncertainty. - AI's role in synchronized market swings and fragmented oversight amplified COAI's collapse, exposing systemic vulnerabilities. - Behavioral biases like herd behavior accelerated sell-offs, underscoring the need for diversified portfolios and robust regulatory f

Crypto: 23,561 Billion SHIB Moved in 24H — Manipulation or Glitch?

Jupiter Lend Clarifies Earlier 'Zero Contagion' Statement Was Not Accurate