Crypto Fund Inflows Hit $716 Million as Bitcoin, XRP, and Chainlink Lead Institutional Shift

Crypto funds recorded a second consecutive week of inflows, pulling in $716 million as investor sentiment across crypto markets continued to stabilize and improve. The fresh capital increased total assets under management (AuM) to $180 billion, marking a 7.9% rebound from the lows in November. However, this is still significantly below the sector’s all-time high

Crypto funds recorded a second consecutive week of inflows, pulling in $716 million as investor sentiment across crypto markets continued to stabilize and improve.

The fresh capital increased total assets under management (AuM) to $180 billion, marking a 7.9% rebound from the lows in November. However, this is still significantly below the sector’s all-time high of $264 billion.

Crypto Inflows Hit $716 Million as Crypto Sentiment Turns Higher

According to weekly flow data, crypto inflows were broad-based across major regions, signaling renewed global participation. The US led with $483 million, followed by Germany with $96.9 million and Canada with $80.7 million.

This highlights a coordinated return of institutional interest across North America and Europe.

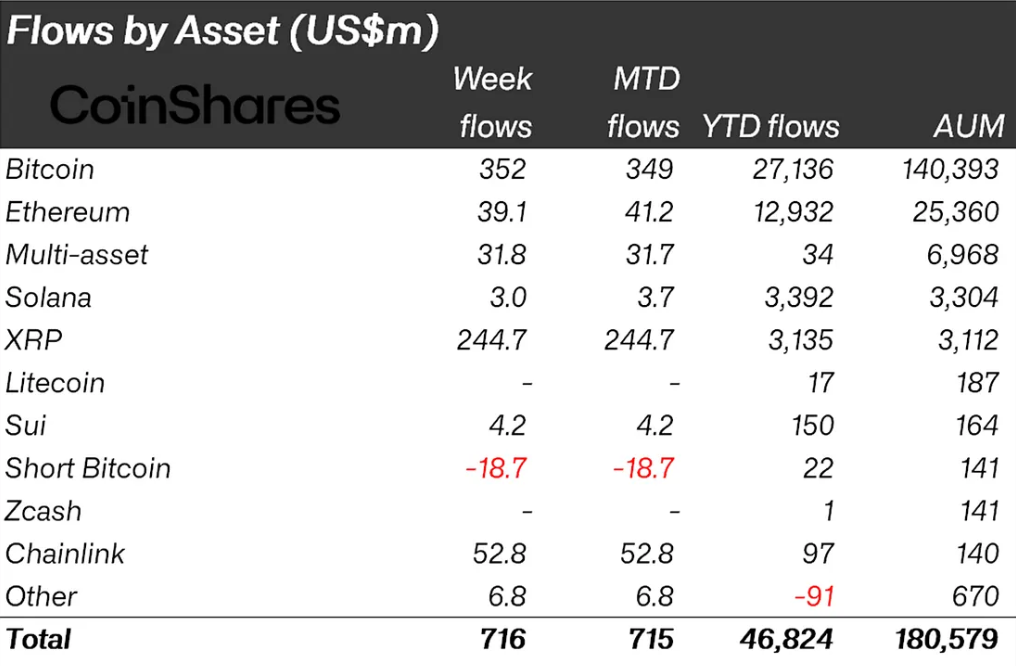

Bitcoin once again emerged as the primary beneficiary, attracting $352 million in weekly inflows. That brings Bitcoin’s year-to-date (YTD) inflows to $27.1 billion, still trailing the $41.6 billion recorded in 2024, but showing renewed momentum after months of hesitation.

At the same time, short-Bitcoin products saw outflows of $18.7 million, the largest withdrawal since March 2025.

Crypto Inflows Last Week. Source:

CoinShares

Crypto Inflows Last Week. Source:

CoinShares

Historically, similar outflows have coincided with price bottoms, suggesting that traders are increasingly abandoning bearish positioning as downside pressure weakens.

However, daily data showed minor outflows on Thursday and Friday, which analysts attribute to the release of fresh US macroeconomic data indicating persistent inflation pressures.

“Daily data highlighted minor outflows on Thursday and Friday in what we believe was a response to macroeconomic data in the US alluding to ongoing inflationary pressures,” wrote CoinShares’ James Butterfill.

That brief pause suggests that while sentiment is improving, it remains sensitive to interest rate expectations and signals from the Federal Reserve.

XRP and Chainlink Post Standout Demand

Beyond Bitcoin, XRP continued its strong multi-month run, recording $245 million in weekly inflows. This pushes XRP’s YTD inflows to $3.1 billion, dramatically outperforming its $608 million total for all of 2024.

The sustained demand reflects ongoing optimism surrounding XRP’s institutional use cases and regulatory positioning in key jurisdictions.

Chainlink posted one of the most striking performances of the week, with $52.8 million in inflows, its largest weekly intake on record.

Notably, this figure now represents over 54% of Chainlink’s total ETP AuM, highlighting how fast capital is rotating into oracle and infrastructure-focused crypto assets.

Sentiment Shifts After November’s Surge

The latest inflow streak follows an even stronger period at the end of November. For the week ending November 29, crypto funds recorded a powerful $1.07 billion in inflows, driven largely by rising expectations of potential 2026 interest rate cuts.

Together, the late-November surge and the current $716 million follow-up suggest a gradual yet consistent shift in institutional sentiment, even as concerns about inflation remain unresolved.

While total AuM remains well below peak levels, the steady return of capital into Bitcoin, XRP, and Chainlink suggests growing confidence that the worst of the recent risk-off cycle may be behind us.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decentralized Finance (DeFi) and the Emergence of DASH Aster DEX

- DASH Aster DEX combines AMM and CEX features, reducing slippage by 40% and attracting $1.399B TVL by Q3 2025. - Cross-chain interoperability and yield-bearing collateral address liquidity gaps, while dual-mode trading caters to both retail and institutional users. - Privacy tools like ZKPs and decentralized governance mitigate regulatory risks, though challenges persist under MiCA and CLARITY Act frameworks. - With 70% perpetual derivatives market share and Aster Chain's 2026 launch, it aims to redefine

Empowering Crypto Traders: How FlipsideAI Simplifies Technical Analysis with Natural Language

Exploring the Opportunities and Challenges of Decentralized Exchanges After Regulatory Changes

- Global DeFi regulation (GENIUS Act, MiCA, FATF) forces platforms to balance compliance with decentralization, reshaping innovation and investment viability. - Aster DEX (19.3% DEX market share) integrates AI surveillance, MiCA-compliant tools, and 1:1 stablecoin reserves to align with 2025 regulatory benchmarks. - The platform bridges TradFi and DeFi via Aster Chain (Q1 2026), offering institutional-grade privacy features and tokenized real-world assets to attract traditional investors. - Proactive compl

ZK Technology's 2025 Price Increase: An In-Depth Analysis of On-Chain Integration and Protocol Enhancements

- ZK technology surged 170% in Q3 2025 due to protocol upgrades and institutional adoption. - ZKsync's 15,000 TPS Atlas upgrade and StarkNet's $150M TVL validated scalability breakthroughs. - Goldman Sachs , Nike , and 35+ institutions adopted ZK for confidential transactions and NFT authentication. - ZKP market reached $1.5B in 2025, projected to hit $7.59B by 2033 at 22.1% CAGR. - 230% developer growth and $3.3B TVL across ZK Rollups signal maturing blockchain infrastructure.