Preço de HyperlaneHYPER

EUR

Listada

€0.2614EUR

+3.02%1D

O preço de Hyperlane (HYPER) em Euro é €0.2614 EUR a partir de 01:52 (UTC) de hoje.

Gráfico de preços de Hyperlane (EUR/HYPER)

Última atualização em 2025-09-17 01:52:40(UTC+0)

Conversão de HYPER para EUR

HYPER

EUR

1 HYPER = 0.2614 EUR. O preço atual de conversão de 1 Hyperlane (HYPER) para EUR é 0.2614. A taxa serve apenas como referência. Atualizado agora.

A Bitget oferece as menores taxas de transação do mercado. Quanto mais alto for seu nível VIP, melhores serão as taxas.

Preço atual de Hyperlane em EUR

O preço em tempo real de Hyperlane hoje é €0.2614 EUR, com uma capitalização de mercado atual de €45.80M. O preço de Hyperlane aumentou 3.02% nas últimas 24 horas e o volume de trading em 24 horas é de €16.36M. A taxa de conversão de HYPER/EUR (de Hyperlane para EUR) é atualizada em tempo real.

Quanto custa 1 Hyperlane em Euro?

A partir de agora, o preço de Hyperlane (HYPER) em Euro é €0.2614 EUR. Você pode comprar 1 HYPER por €0.2614, ou 38.25 HYPER por €10 agora. Nas últimas 24 horas, o maior preço de HYPER para EUR foi €0.2659 EUR, e o menor preço de HYPER para EUR foi €0.2521 EUR.

Você acha que o preço de Hyperlane vai subir ou cair hoje?

Total de votos:

Subida

0

Queda

0

Os dados de votação são atualizados a cada 24 horas. Eles refletem as previsões da comunidade sobre a tendência de preço de Hyperlane e não devem ser considerados como uma recomendação de investimento.

Informações de mercado sobre Hyperlane

Desempenho do preço (24h)

24h

Baixa em 24h de €0.25Alta em 24h de €0.27

Máxima histórica:

€0.5817

Variação de preço (24h):

+3.02%

Variação de preço (7 dias):

-1.40%

Variação de preço (1 ano):

+15.99%

Classificação de mercado:

#565

Capitalização de mercado:

€45,803,941.16

Capitalização de mercado totalmente diluída:

€45,803,941.16

Volume em 24h:

€16,364,410.74

Oferta circulante:

175.20M HYPER

Oferta máxima:

1.00B HYPER

Relatório de análise de IA sobre Hyperlane

Destaques de hoje do mercado de criptomoedasVer relatório

Histórico de preços de Hyperlane (EUR)

O preço de Hyperlane variou +15.99% no último ano. O preço mais alto de HYPER em EUR no último ano foi €0.5817 e o preço mais baixo de HYPER em EUR no último ano foi €0.07337.

PeríodoVariação de preço (%) Preço mais baixo

Preço mais baixo Preço mais alto

Preço mais alto

Preço mais baixo

Preço mais baixo Preço mais alto

Preço mais alto

24h+3.02%€0.2521€0.2659

7d-1.40%€0.2508€0.2930

30d-13.48%€0.2362€0.3147

90d+190.42%€0.07337€0.5817

1y+15.99%€0.07337€0.5817

Todo o período-68.84%€0.07337(2025-06-22, 87 dia(s) atrás)€0.5817(2025-07-25, 54 dia(s) atrás)

Qual é o preço mais alto do token Hyperlane?

A máxima histórica do token HYPER em EUR foi €0.5817, registrada em 2025-07-25. Em comparação com a máxima (Hyperlane), seu preço atual (Hyperlane) caiu 55.06%.

Qual é o preço mais baixo do token Hyperlane?

O mínima histórica do token HYPER em EUR foi €0.07337, registrada em 2025-06-22. Em comparação com a mínima (Hyperlane), seu preço atual (Hyperlane) subiu 256.35%.

Previsão de preço do token Hyperlane

Qual é o melhor momento para comprar HYPER? Devo comprar ou vender HYPER agora?

Antes de comprar ou vender HYPER, avalie suas estratégias de trading. As atividades dos traders de longo e curto prazo também podem apresentar diferenças. A análise técnica de Análise técnica de HYPER na Bitget na Bitget pode fornecer referências de trading.

De acordo com a análise técnica de HYPER em 4 horas, o sinal de trading é Venda.

De acordo com Análise técnica de HYPER em 1 dia, o sinal de trading é Neutro.

De acordo com Análise técnica de HYPER em 1 semana, o sinal de trading é Compra.

Promoções em destaque

Preços globais de Hyperlane

Qual é o valor de Hyperlane em outras moedas atualmente? Última atualização: 2025-09-17 01:52:40(UTC+0)

HYPER para ARS

Argentine Peso

ARS$455.57HYPER para CNYChinese Yuan

¥2.2HYPER para RUBRussian Ruble

₽25.79HYPER para USDUnited States Dollar

$0.31HYPER para EUREuro

€0.26HYPER para CADCanadian Dollar

C$0.43HYPER para PKRPakistani Rupee

₨87.59HYPER para SARSaudi Riyal

ر.س1.16HYPER para INRIndian Rupee

₹27.24HYPER para JPYJapanese Yen

¥45.41HYPER para GBPBritish Pound Sterling

£0.23HYPER para BRLBrazilian Real

R$1.64Como comprar Hyperlane(HYPER)

Crie sua conta na Bitget gratuitamente

Crie sua conta na Bitget com seu e-mail ou número de celular e escolha uma senha forte para proteger sua conta.

Verifique sua conta

Verifique sua identidade inserindo suas informações pessoais e enviando um documento de identidade válido com foto.

Converter HYPER em EUR

Escolha quais criptomoedas operar na Bitget.

Perguntas frequentes

Qual é o preço atual de Hyperlane?

O preço em tempo real de Hyperlane é €0.26 por (HYPER/EUR), com uma capitalização de mercado atual de €45,803,941.16 EUR. O valor de Hyperlane sofre oscilações frequentes devido às atividades 24h do mercado de criptomoedas. O preço atual e os dados históricos de Hyperlane estão disponíveis na Bitget.

Qual é o volume de trading em 24 horas de Hyperlane?

Nas últimas 24 horas, o volume de trading de Hyperlane foi €16.36M.

Qual é o recorde histórico de Hyperlane?

A máxima histórica de Hyperlane é €0.5817. Essa máxima histórica é o preço mais alto para Hyperlane desde que foi lançado.

Posso comprar Hyperlane na Bitget?

Sim, atualmente, Hyperlane está disponível na Bitget. Para informações detalhadas, confira nosso guia Como comprar hyperlane .

É possível obter lucros constantes ao investir em Hyperlane?

Claro, a Bitget fornece uma plataforma de trading estratégico com robôs de trading para automatizar suas operações e aumentar seus lucros.

Onde posso comprar Hyperlane com a menor taxa?

Temos o prazer de anunciar que a plataforma de trading estratégico já está disponível na corretora da Bitget. A Bitget é líder de mercado no que diz respeito a taxas de trading e profundidade, o que garante investimentos lucrativos para os traders.

Preços de criptomoedas relacionadas

Preço de dogwifhat EURPreço de Kaspa EURPreço de Smooth Love Potion EURPreço de Terra EURPreço de Shiba Inu EURPreço de Dogecoin EURPreço de Pepe EURPreço de Cardano EURPreço de Bonk EURPreço de Toncoin EURPreço de Pi EURPreço de Fartcoin EURPreço de Bitcoin EURPreço de Litecoin EURPreço de WINkLink EURPreço de Solana EURPreço de Stellar EURPreço de XRP EURPreço de OFFICIAL TRUMP EURPreço de Ethereum EUR

Onde posso comprar Hyperlane (HYPER)?

Seção de vídeos: verificação e operações rápidas

Como concluir a verificação de identidade na Bitget e se proteger contra golpes

1. Faça login na sua conta Bitget.

2. Se você for novo na Bitget, assista ao nosso tutorial sobre como criar uma conta.

3. Passe o mouse sobre o ícone do seu perfil, clique em "Não verificado" e clique em "Verificar".

4. Escolha seu país ou região emissora, o tipo de documento de identidade e siga as instruções.

5. Selecione como prefere concluir sua verificação: pelo app ou computador.

6. Insira seus dados, envie uma cópia do seu documento de identidade e tire uma selfie.

7. Envie sua solicitação e pronto. Verificação de identidade concluída!

Compre Hyperlane por 1 EUR

Pacote de boas-vindas de 6.200 USDT para novos usuários Bitget!

Comprar Hyperlane agora

Os investimentos em criptomoedas, incluindo a compra de Hyperlane na Bitget, estão sujeitos a risco de mercado. A Bitget fornece maneiras fáceis e convenientes para você comprar Hyperlane. Fazemos o possível para informar totalmente nossos usuários sobre cada criptomoeda que oferecemos na corretora. No entanto, não somos responsáveis pelos resultados que possam advir da sua compra Hyperlane. Esta página e qualquer informação incluída não são um endosso de investimento ou a nenhuma criptomoeda em particular.

Conversão de HYPER para EUR

HYPER

EUR

1 HYPER = 0.2614 EUR. O preço atual de conversão de 1 Hyperlane (HYPER) para EUR é 0.2614. A taxa serve apenas como referência. Atualizado agora.

A Bitget oferece as menores taxas de transação do mercado. Quanto mais alto for seu nível VIP, melhores serão as taxas.

Recursos de HYPER

Avaliações de Hyperlane

4.4

Contratos:

0xC9d2...E1ca5c4(Arbitrum)

Mais

Bitget Insights

GareeboHere

8h

⛽ Today I Shared 3 Trades Results 🤑 👇

👉 $RARE All Tps Hits 🎯

👉 $NAORIS 1st and 2nd Tps Achieved

👉 $BOOM 1st Tp Achieved ✅

🚨if You Want to Join our Community 🤑🚀

$BTC

$VOXEL $MORE $H $BAI $HYPER $SPK $ANI $CSTAR $M $C $SPK $PHY $ANI $CSTAR $WLFI $PTB $MYX $TOWN $BOOM $AVNT

BTC-0.11%

WLFI-1.29%

GareeboHere

9h

👉$RARE 751$ Profit Booked ✅ In Just 1 Day🚀 Allhamdulilah 🔥

🚨if You Want to Join our Community 🤑🚀

$BTC

$VOXEL $MORE $H $BAI $HYPER $SPK $ANI $CSTAR $M $C $SPK $PHY $ANI $CSTAR $WLFI $PTB $MYX $TOWN $BOOM $AVNT

BTC-0.11%

WLFI-1.29%

GareeboHere

13h

Sell $PI $WLFI 👉 Buy $BOOM 2x Pump Ready 🤑🚀

⛽ $BOOM Break 0.01000$ Then Tp 🎯 0.01100$+

$BTC

$VOXEL $MORE $H $BAI $HYPER $SPK $ANI $CSTAR $M $C $SPK $PHY $ANI $CSTAR $WLFI $PTB $MYX $TOWN $BOOM $AVNT

BTC-0.11%

WLFI-1.29%

GareeboHere

13h

🚀 Don't Miss $BOOM 2x Pump Ready 🤑🚀

⛽ $BOOM Break 0.01000$ Then Tp 🎯 0.01100$+

$BTC

$VOXEL $MORE $H $BAI $HYPER $SPK $ANI $CSTAR $M $C $SPK $PHY $ANI $CSTAR $WLFI $PTB $MYX $TOWN $BOOM $AVNT

BTC-0.11%

WLFI-1.29%

GareeboHere

13h

Sell $ZORA $MYX 👉 Buy $BOOM 2x Pump Ready 🤑🚀

⛽ $BOOM Break 0.01000$ Then Tp 🎯 0.01100$+

$BTC

$VOXEL $MORE $H $BAI $HYPER $SPK $ANI $CSTAR $M $C $SPK $PHY $ANI $CSTAR $WLFI $PTB $MYX $TOWN $BOOM $AVNT

BTC-0.11%

WLFI-1.29%

Operar

Earn

HYPER está disponível para operação na Bitget e pode ser mantido sob custódia na Bitget Wallet. A Bitget também é uma das primeiras corretoras centralizadas (CEX) a disponibilizar operações com HYPER.

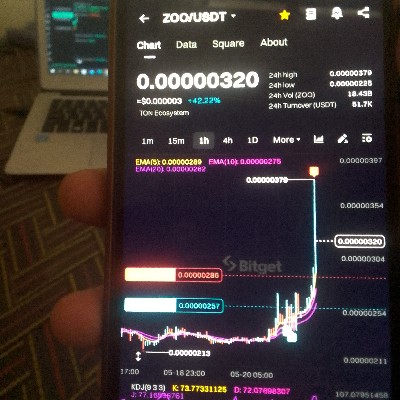

Você pode operar HYPER na Bitget.HYPER/USDT

SpotHYPER/USDT

MargemHYPER/USDT

Futuros USDTPreços de moedas recém-listadas na Bitget