TUFT Token Price: What Is TUFT Token, Legitimacy and Withdrawals

New to TUFT Token and trying to get up to speed fast? Most readers want clear answers to the same questions: what TUFT Token is used for, where to check the live tuft token price, how the market has been moving, whether the project is legitimate, and when funds can be withdrawn. This guide addresses all of those points in one place.

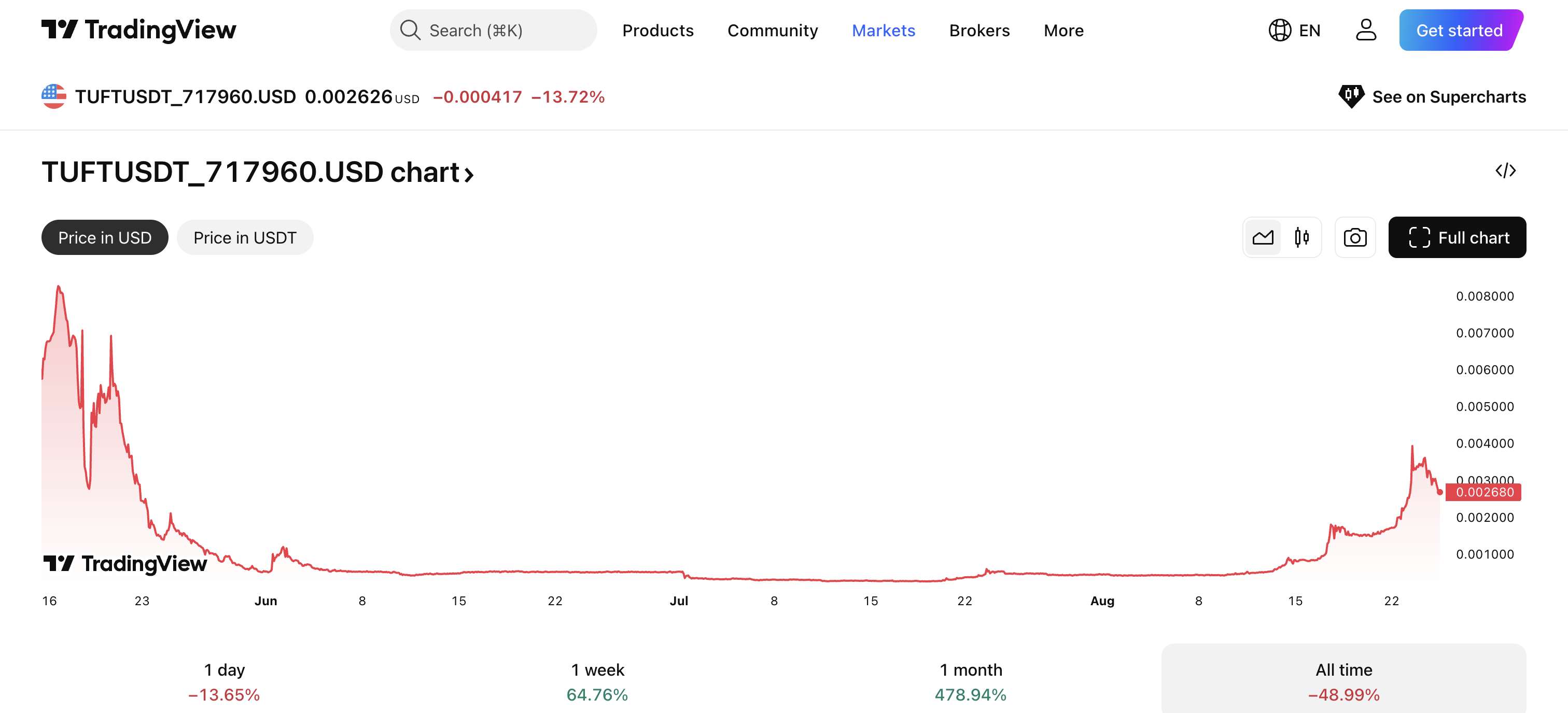

Source: TradingView

What is TUFT Token

TreasureNFT describes itself as an NFT marketplace built around algorithmic pricing, pooling-based trade execution, and fractionalized ownership. The platform’s stated aim is to improve liquidity and price discovery for NFTs through:

-

Pool-based trading: Instead of waiting for one-to-one matches, buyers and sellers interact with aggregated NFT pools to accelerate settlement and deepen liquidity.

-

Automatic pricing and fractionalization: NFTs can be split into smaller fungible units so multiple participants can share ownership, lowering entry barriers and potentially increasing turnover.

-

Community incentives and DAO-style governance: The project references rewards, points, and community participation mechanisms to drive engagement.

Within this system, TUFT Token functions as the native token. Common roles for such a token in similar ecosystems can include utility (fees, access, discounts), incentives (trading or liquidity rewards), and governance (if DAO voting is implemented). Because comprehensive, independently verified tokenomics and audits are limited in open sources, anyone considering TUFT Token should review the official contract(s), whitepaper, audits, and signed announcements from verifiable channels.

TUFT Token Price

TUFT Token price is currently trading around 0.00263 USD, down roughly 13.7% on the day.

Performance on that snapshot:

-

1 day: −13.65%

-

1 week: +64.76%

-

1 month: +478.94%

-

All time: −48.99%

How the tuft token price has been moving

-

Structure: After an initial spike and a long period of flat trading through June to mid‑August, tuft token price broke out sharply in late August, pushing into the 0.003–0.004 USD region before pulling back to the 0.0026–0.0027 area.

-

Volatility: The combination of thin liquidity and sudden bursts of volume has produced wide intraday ranges and noticeable wicks. The latest daily move (about −13% in the snapshot) illustrates this heightened volatility.

-

Momentum vs. history: Despite strong 1‑week and 1‑month gains, the all‑time figure remains negative, indicating earlier peaks have not been fully reclaimed.

Is TUFT Token legit? A third‑party perspective on concerns

Independent researchers, community forums, and crypto risk-watch outlets have flagged several issues for prospective users to review carefully. The points below summarize common third‑party observations; they are not determinations of fact and may change as more information becomes available:

-

High-yield marketing claims: Screenshots and posts circulating online have referenced unusually high fixed daily or monthly returns in connection with related platforms. Analysts often view guaranteed-yield messaging as a red flag because such returns are difficult to sustain without continuous external inflows.

-

Transparency gaps: Commentators note limited independently verified information on founders, custodial arrangements, audited code, and verifiable on-chain revenue sources. Absent audits and detailed disclosures, operational and counterparty risks are harder to assess.

-

Referral-heavy user acquisition: Reviews point to an emphasis on referral incentives in some materials. While referrals are common in web3, third-party observers scrutinize models that appear to prioritize recruitment over clear product-market utility.

-

Withdrawal frictions: User posts on social media and review sites describe delayed or blocked withdrawals in related environments. These reports are anecdotal and may not represent every user’s experience, but repeated complaints warrant caution and small test withdrawals first.

-

Regulatory posture: Mentions of registrations or generic compliance filings (e.g., MSB) do not validate a business model or protect against investment risk. Independent verification of the legal entity, jurisdiction, and the scope of any claimed approvals is recommended, along with monitoring for public regulatory notices.

Conclusion

TUFT Token underpins a marketplace that proposes algorithmic pricing, pooled trade execution, and fractionalized NFT ownership to address common liquidity and pricing frictions. For active traders and researchers, monitoring the tuft token price and analyzing intraday ranges, spreads, and volume can help contextualize risk and execution quality. Independent observers have raised questions around transparency, yield marketing, referral emphasis, and withdrawal reliability; thorough due diligence and small, test-based interactions are prudent.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.