News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

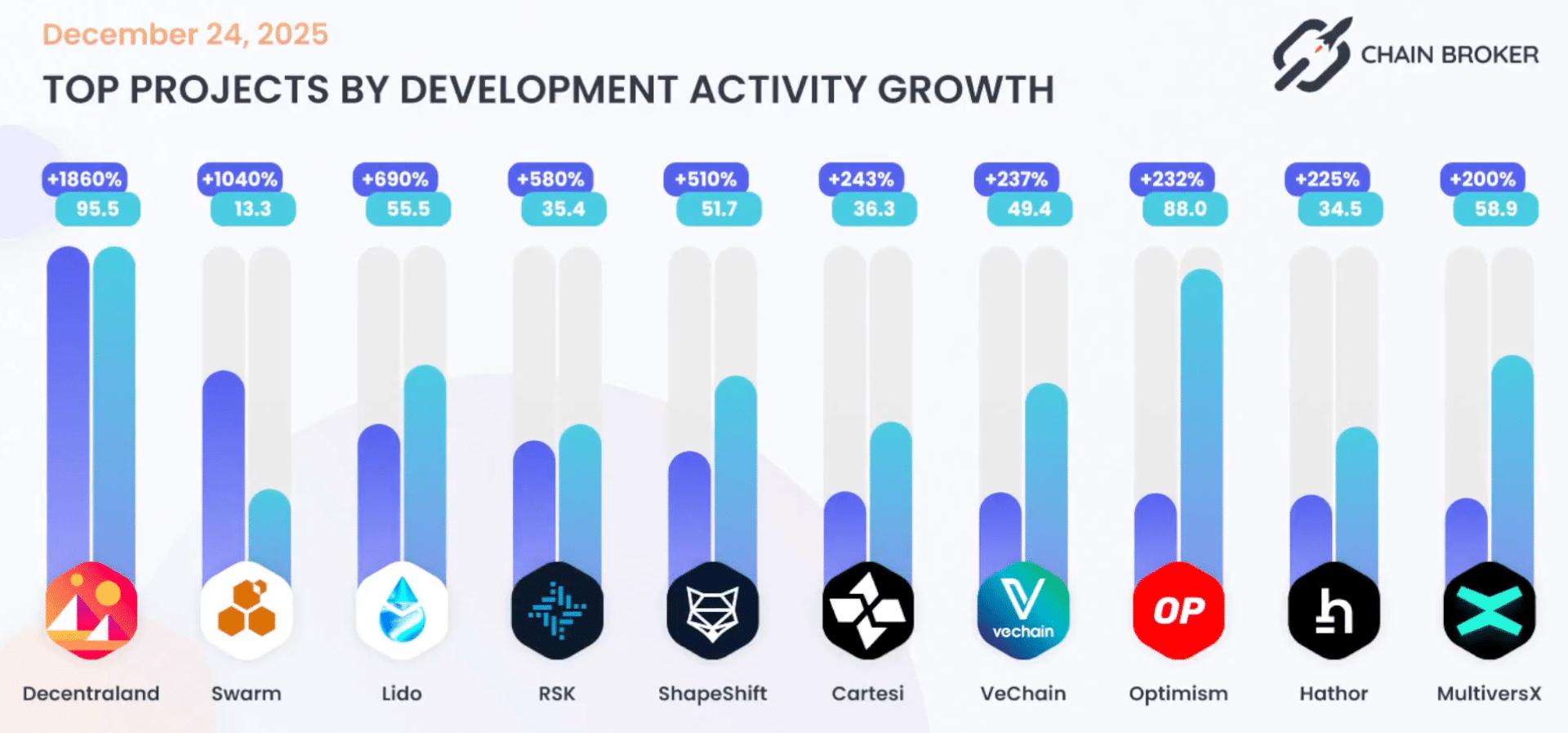

How Lido’s 690% dev growth is reshaping LDO price action

AMBCrypto·2025/12/26 07:03

Vitalik Buterin Praises Grok’s Role in Challenging Misinformation on X

BlockchainReporter·2025/12/26 07:00

Diverging from Wall Street: Bitcoin "Decouples" in the Bull Market

AIcoin·2025/12/26 06:37

Trust Wallet Browser Extension Compromised, $7 Million Lost

Cryptotale·2025/12/26 06:36

Pudgy Penguins Conquers the Las Vegas Sphere in a Dazzling Mainstream Breakthrough

Bitcoinworld·2025/12/26 06:36

Revealing: The Crucial BTC Perpetual Futures Long/Short Ratio You Can’t Ignore

Bitcoinworld·2025/12/26 06:36

TGE in 3 days: What details were revealed in the call between Lighter and the whales?

BlockBeats·2025/12/26 06:35

Five New XRPL Amendments on Way to Transform 2026, What to Watch?

UToday·2025/12/26 06:30

Flash

07:02

The total market capitalization of stablecoins has increased by 70% this year, with global payment applications and institutional demand being the main driving factors.ChainCatcher News, according to Cointelegraph, the stablecoin market capitalization has surpassed the $310 billion mark, reaching a key milestone. This represents a 70% growth in just one year. This growth is not merely another indicator of a cryptocurrency bubble; it signifies a fundamental shift in the way digital assets are used globally.

07:00

The total market capitalization of stablecoins has grown by 70% this year, with global payment applications and institutional demand being the main driving factors.BlockBeats News, December 26th, according to Cointelegraph, the stablecoin market capitalization has surpassed the $310 billion mark, reaching a key milestone. This signifies a 70% growth in just one year. This growth is not merely another indicator of a cryptocurrency bubble; it marks a fundamental shift in the global digital asset landscape.

The report points out that the main drivers behind the rapid growth of stablecoins include: global adoption in payment applications, institutional demand, and DeFi development. Furthermore, multiple industry analysis models predict that by 2028, with the broader integration of stablecoins by large financial institutions, the supply of stablecoins will reach $20 trillion. These predictions are based on stablecoins evolving from a transactional tool to a more universal digital cash layer, applied in e-commerce, inter-enterprise payments, embedded finance, and other fields.

06:58

Opinion: Grayscale's ETH holdings are more stable than BTC, with significantly lower selling pressureAccording to Odaily, crypto data analyst CyrilXBT posted on X that Grayscale's BTC holdings have continued to decrease after the ETF approval due to GBTC outflows, as investors are taking profits or reallocating, causing BTC prices to fluctuate under supply pressure. In contrast, Grayscale's ETH holdings have been more stable in recent weeks, with significantly less selling pressure compared to BTC. This indicates that the market has stronger holding confidence in ETH, possibly driven by expectations for an ETH ETF, staking yields, and lower urgency to sell. Currently, BTC is in a distribution and rotation phase, while ETH is in a patient waiting and positioning phase. During BTC's absorption of selling pressure, Grayscale is viewing ETH as the next asymmetric opportunity.

News