News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | US Stocks Close Lower for Third Straight Day; Fed Rate Cut Divisions Significant; Gold and Silver Prices Rebound (December 31, 2025)2Bitget Daily Digest (Dec.31)|Bitwise Files ETF Applications for AAVE and 11 Other Cryptos; Strategy Seeks Untapped Capital to Increase BTC Holdings3Crypto sentiment turns fearful as Bitcoin consolidates – Panic or patience?

Sonic Labs and SonicStrategy Extend DAT Roadmap Amid Shifting Market Conditions

BlockchainReporter·2026/01/01 09:00

Ethereum Innovates with Pectra and Fusaka Upgrades

Cointurk·2026/01/01 08:12

Solana price prediction – Swing traders should wait for THIS opportunity!

AMBCrypto·2026/01/01 08:03

Bitcoin Price Drops 1% in New Year’s Eve: Here is a Critical Level to Watch in 2026

Coinpedia·2026/01/01 07:30

Lighter Faces Major Asset Withdrawals After LIT Token Airdrop

Cointurk·2026/01/01 07:24

XRP adoption rises as ETF inflows absorb supply – Signals to watch into 2026

AMBCrypto·2026/01/01 07:03

Is Crypto Truly Decentralized? Vitalik Buterin Raises Hard Questions

Cryptotale·2026/01/01 06:00

‘Leaving college early’ is now seen as the most desirable qualification for startup founders

101 finance·2026/01/01 03:03

OG Esports Enters New Chapter as Chiliz Group Secures Majority Ownership

BlockchainReporter·2026/01/01 03:00

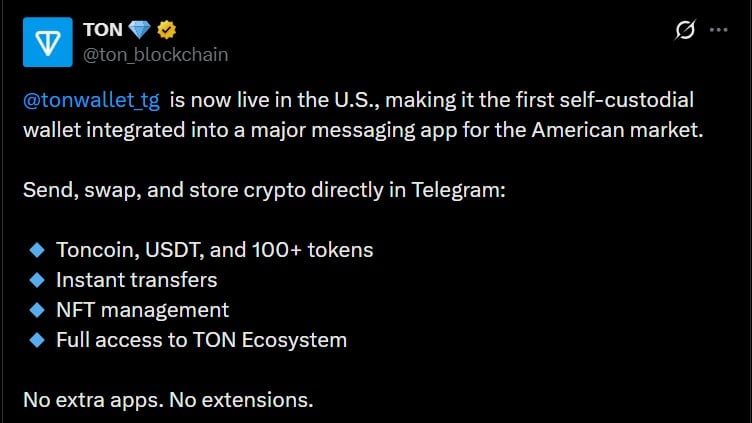

Decoding Toncoin’s 10% rally and what Telegram’s U.S. wallet means next

AMBCrypto·2026/01/01 02:03

Flash

21:03

The minutes of the Federal Reserve's December FOMC meeting show concerns over short-term funding pressures.Federal Reserve officials stated in the minutes of the December FOMC meeting that they are focusing on whether the financial system has enough cash to avoid sudden disruptions, rather than solely concentrating on interest rate adjustments. The minutes show that the Federal Reserve is concerned that short-term funding pressures may quietly emerge and trigger volatility, and has proposed measures to guard against cash shortages in order to cope with intensified seasonal pressures in early 2026.

20:10

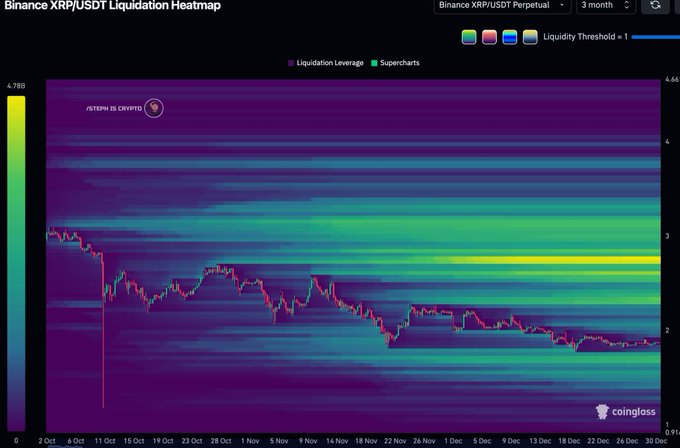

XRP ETF attracts over $1 billion in 50 days, locking up 746 million XRPThe XRP ETF has attracted over $1 billion in funds within 50 days, locking up 746 million XRP, which accounts for 1.14% of the circulating supply, with only one day during this period without any capital inflow. At the current daily inflow rate of $27.7 million, it is expected that by mid-May 2026, the ETF's assets will reach $5 billion, potentially locking up 2.6 billion XRP, accounting for 4% of the supply, while exchange balances will have decreased by 58% by 2025.

20:02

Data: 1.0157 million LINK transferred from an anonymous address, routed through intermediaries, and deposited into the exchange Prime Custody.ChainCatcher reported, according to Arkham data, at 03:52, 1.0157 million LINK (worth approximately $12.6757 million) was transferred from an anonymous address (starting with 0x7C87...) to another anonymous address (starting with 0x3db9...). Subsequently, all LINK was transferred from this address to an exchange.

News