News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | US Stocks Close Lower for Third Straight Day; Fed Rate Cut Divisions Significant; Gold and Silver Prices Rebound (December 31, 2025)2Bitget Daily Digest (Dec.31)|Bitwise Files ETF Applications for AAVE and 11 Other Cryptos; Strategy Seeks Untapped Capital to Increase BTC Holdings3Crypto sentiment turns fearful as Bitcoin consolidates – Panic or patience?

Watch Out: Hackers Have Developed a New Method, So Be Careful to Keep Your Cryptocurrencies Safe

BitcoinSistemi·2025/12/31 21:33

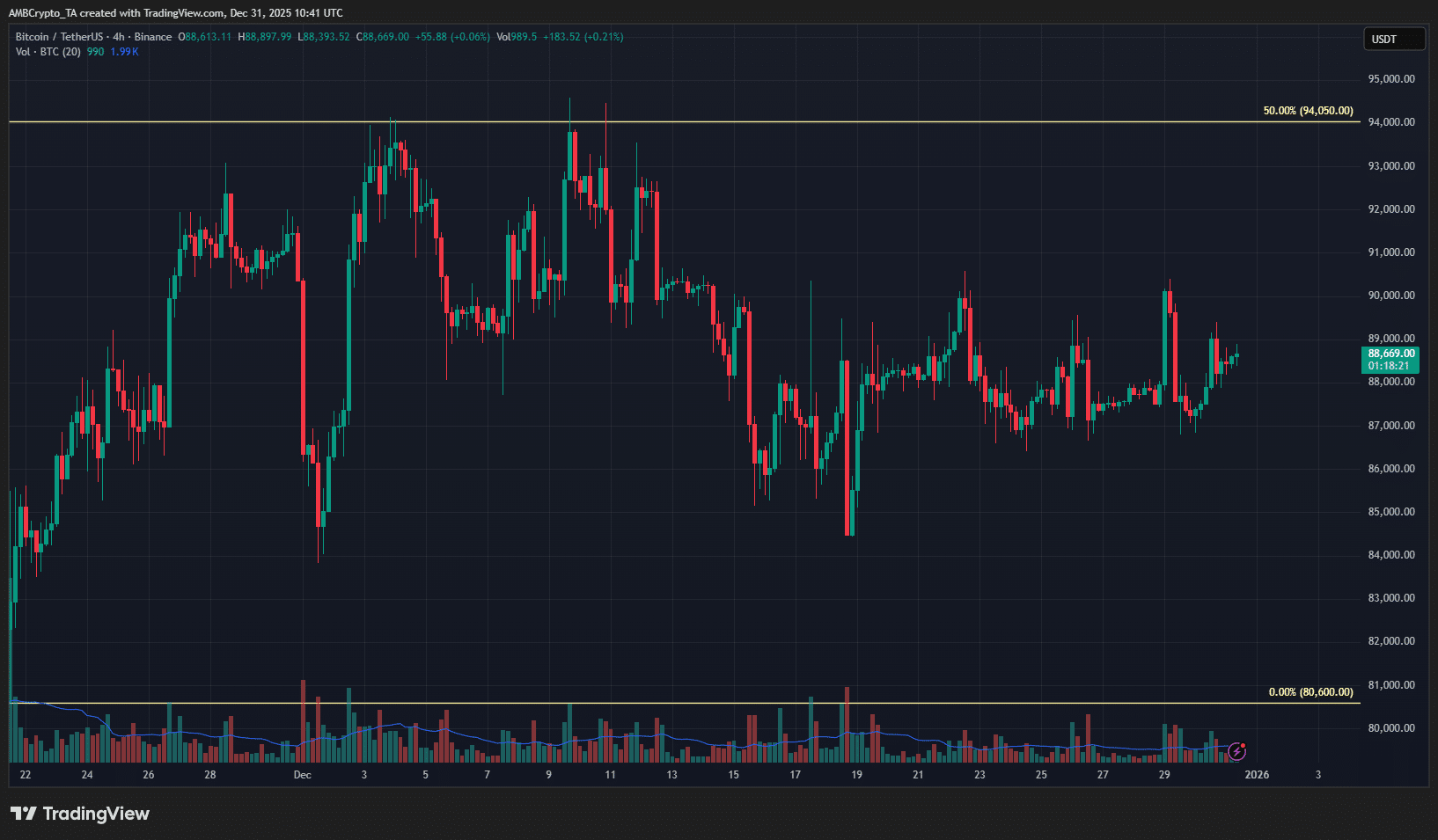

Bitcoin holds on to $88K as regional markets choose caution: What’s next?

AMBCrypto·2025/12/31 21:03

Bitcoin Tests Major Support Levels as Year-End Trading is Indecisive

BlockchainReporter·2025/12/31 21:00

Cryptocurrency Shocker Stirs Market with Unexpected Price Surge

Cointurk·2025/12/31 20:51

Crypto Crystal Ball 2026: Is Wall Street the Industry's Next Villain?

Decrypt·2025/12/31 20:01

Altcoins Break Crucial Boundaries in 2025

Cointurk·2025/12/31 19:03

From AAVE to HYPE: Bitwise bets on altcoins with 11 crypto ETF filings

AMBCrypto·2025/12/31 19:03

Alchemy Pay Secures Kansas Money Transmitter License, Expands U.S. Footprint to 11 States

BlockchainReporter·2025/12/31 19:00

Crypto Market Structure Bill Faces Pivotal US Senate Review on January 15, Offering Crucial Regulatory Clarity

Bitcoinworld·2025/12/31 18:36

US Jobless Claims Defy Expectations with Stunning 199,000 December Total

Bitcoinworld·2025/12/31 18:36

Flash

09:17

Investment Bank 2026 Keywords Series: The Year of Divergence—JPMorgan Teaches You How to Allocate Assets | Hi, What’s Your View Today?JPMorgan believes that the market in 2026 will exhibit multidimensional polarization. "Polarization," "AI super cycle," and "diversified allocation" are the investment keywords throughout the year. How should investors seek opportunities from this?

09:10

Southern Transitional Council of Yemen: Will "strongly retaliate" against military actions launched by the Yemeni governmentGolden Ten Data reported on January 2 that, on January 2 local time, a spokesperson for the Southern Transitional Council of Yemen stated that the council is fully prepared to launch a strong counterattack against the military operations initiated by the Yemeni government. Earlier that day, Salim Hambashi, governor of Yemen's Hadhramaut province, announced that the Yemeni government had launched a military operation against the Southern Transitional Council in the Hadhramaut region. Sources from the Yemeni government said that the military operation has already begun. (CCTV News)

09:10

U.S. Treasury bonds fall on the first trading day of 2026 as resilience in the job market draws attentionGolden Ten Data reported on January 2 that on the first trading day of 2026, U.S. Treasury bonds declined, with the 30-year Treasury yield rising to its highest level since early September, as optimism about the U.S. economic outlook weakened demand for safe-haven assets. The yield on the 30-year U.S. Treasury once climbed 4 basis points to 4.88%, while the 10-year Treasury yield rose 2 basis points to 4.19%. Previous data showed that U.S. initial jobless claims last week fell to one of the lowest levels this year. Eugene Leow, fixed income strategist at DBS Bank, said that the gradual rise in long-term yields may reflect growing optimism about the U.S. economy, and the stock market may also be echoing this sentiment.

News