News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 16)|Crypto market sees $508 million in long liquidations over 24 hours; Hassett faces opposition from Trump-aligned senior figures in Fed chair contest2Bitget US Stock Morning Report | US Stocks Fluctuate and Retreat, Tesla Hits New High for the Year, Fed Shows Strong Economic Confidence, Non-farm Payrolls to be Released Tonight, Commodity Prices Fluctuate Violently3Bitcoin sees ‘pure manipulation’ as US sell-off liquidates $200M in an hour

CMTA Adopts Chainlink Interoperability Standard for Cross-Chain Tokenized Assets

BlockchainReporter·2025/12/16 10:01

Unshakable Conviction: Why LD Capital’s Founder Sees Strong ETH Fundamentals Amid Market Volatility

Bitcoinworld·2025/12/16 09:57

Bank of America predicts that banks’ transition to blockchain will take years

币界网·2025/12/16 09:52

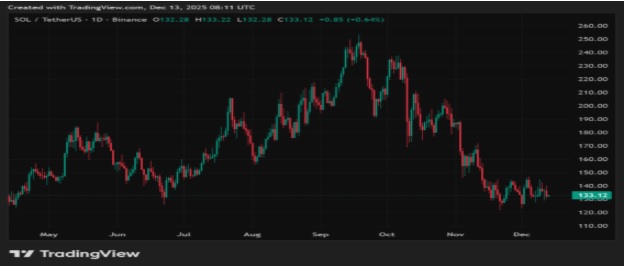

Solana December 16 Price Prediction: Key Level for SOL Price Recovery

币界网·2025/12/16 09:51

MetaMask adds native Bitcoin support, accelerating its multi-chain strategy

币界网·2025/12/16 09:51

APRO: A Rising Star in AI-Enhanced Decentralized Oracles

币界网·2025/12/16 09:49

PancakeSwap-backed prediction markets platform Probable to launch on BNB Chain

The Block·2025/12/16 09:48

Flash

- 10:14Bitget is launching the 6th Stock Token Zero Fee Trading Competition with a total prize pool of 30,000 BGB.BlockBeats News, December 16th, Bitget launched the 6th Stock Token Zero Fee Trading Competition. During the event, users will be ranked based on the cumulative trading volume of CRCLon/TSLAon/MUon and other coins. Users ranked Top 1-428 will each receive airdrops of 50-800 BGB. The detailed rules have been published on the Bitget official platform. Users can click the "Join Now" button to complete registration and participate in the event. The event will take place from 19:00 on December 16th to 23:59 on December 18th (UTC+8).

- 09:50A whale who used a looping loan to go long on ETH sold 10,000 ETH for approximately $29.15 million.According to Jinse Finance, as reported by Yujin, address 0xa339 was forced to sell 30,894 ETH in April due to a drop in ETH price to avoid liquidation, resulting in a loss of approximately $40 million. Later, when ETH stabilized, the whale bought back 19,973 ETH at $1,740, bringing its total holdings to about 50,000 ETH at an average price of $2,545. After holding for about eight months, this whale sold 10,000 ETH four hours ago at a price of $2,915, cashing out approximately $29.15 million and realizing a profit of about $3.7 million. Currently, the whale still holds around 40,600 ETH, with an unrealized profit of about $15 million, but this is still not enough to offset the losses from the forced sale at the beginning of the year.

- 09:49Whale 0xa339 sells 10,000 ETH for a profit of $3.7 millionAccording to Ember monitoring, whale 0xa339 sold 10,000 ETH (29.15 million USD) at a price of 2,915 USD four hours ago after holding for 8 months, realizing a profit of 3.7 million USD. This whale had previously suffered a loss of 40 million USD in April due to risk aversion and stop-loss selling, but later repurchased at 1,740 USD and held 50,000 ETH at an average price of 2,545 USD. Currently, this address still holds 40,600 ETH (119 million USD), with an unrealized profit of 15 million USD, but has not yet made up for the stop-loss loss from April. (Ember)

News