News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

KimberLite Token and CheersLand Unite to Bridge RWA and Web3 Gaming

BlockchainReporter·2025/12/20 05:00

7 Major Crypto Trends and Lessons You Must Know in 2026

TechFlow深潮·2025/12/20 04:02

The dawn of regulatory reform is coming—can Bitcoin make a comeback?

AIcoin·2025/12/20 03:56

Crypto Market Frenzy: How Will Regulation Impact the Future?

AIcoin·2025/12/20 03:14

Ethereum supply plummets, how will the market react?

AIcoin·2025/12/20 03:13

Magic Eden undergoes an epic transformation into entertainment!

AIcoin·2025/12/20 03:13

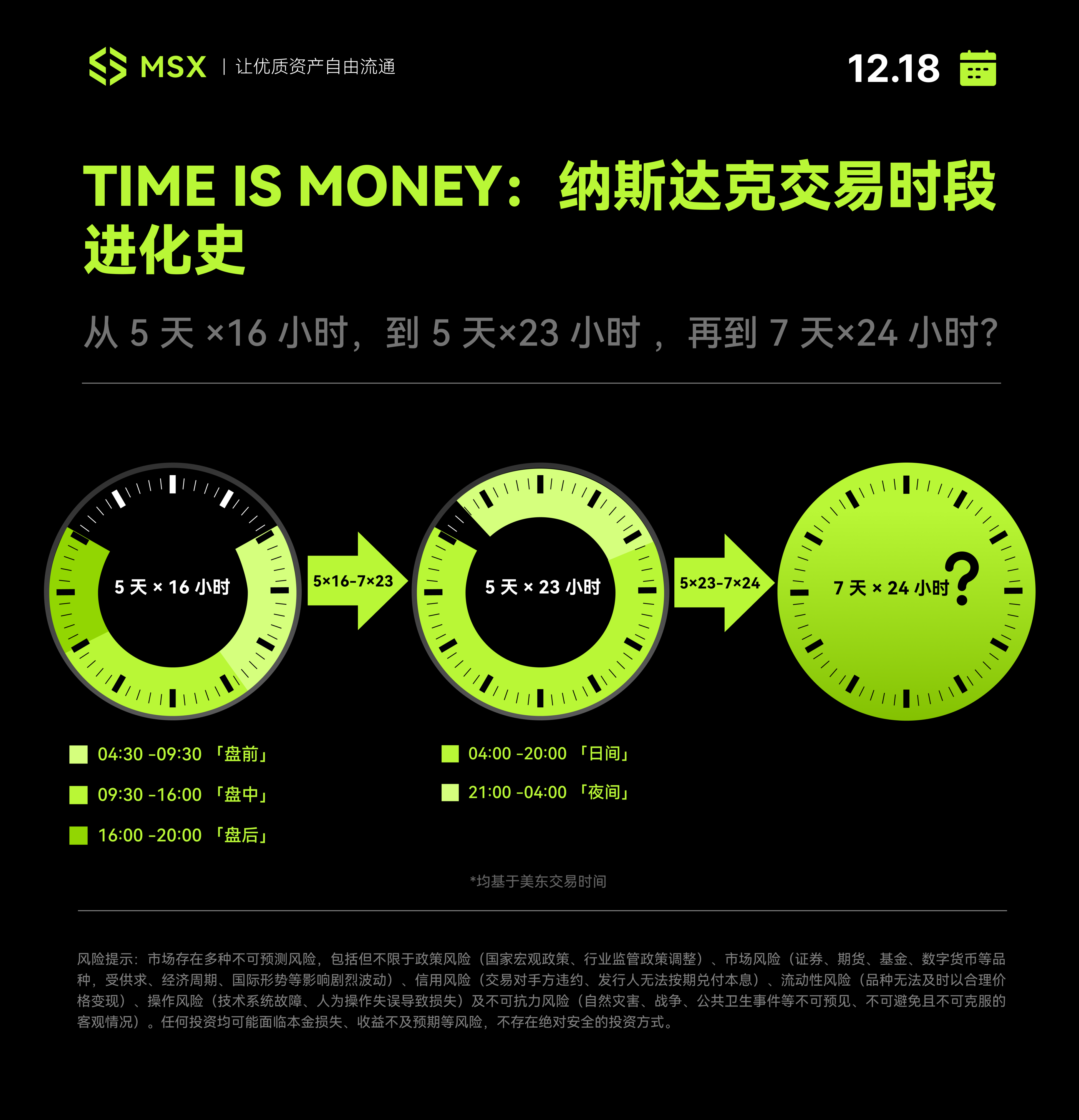

U.S. stocks sprint toward "never closing": Why is Nasdaq launching the "5×23 hours" trading experiment?

Odaily星球日报·2025/12/20 03:03

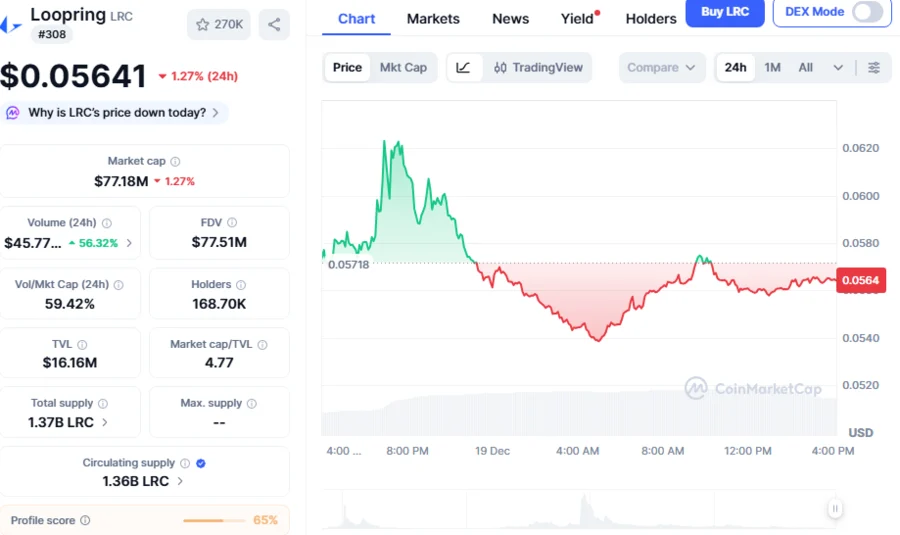

LRC Price Recovery? LRC Holds At $0.05607 As Loopring Grabs Liquidity Sweep, Printing Bullish Bet

BlockchainReporter·2025/12/20 03:01

The Invisible Boom: Arthur Hayes Reveals Why You Missed the Altcoin Season

Bitcoinworld·2025/12/20 02:57

Massive Bitcoin Whale Withdraws $221 Million from FalconX: Bullish Signal Emerges

Bitcoinworld·2025/12/20 02:42

Flash

19:12

VanEck updates Avalanche ETF application to include staking rewardsVanEck has updated its application for the Avalanche ETF (VAVX) to include staking rewards, planning to stake up to 70% of its AVAX holdings. The fund will use a certain exchange's Crypto Services as the initial staking service provider and pay a 4% service fee. The rewards will belong to the fund and be reflected in its net asset value. If approved, the fund will be traded on Nasdaq under the VAVX ticker, track the price of AVAX through a custom index, and be custodied by regulated providers such as Anchorage Digital and a certain exchange's Custody.

19:05

Ethereum Glamsterdam upgrade planned for 2026 aims to address MEV fairnessAfter completing last month's Fusaka upgrade, which reduced node costs, Ethereum developers are now advancing the planning of the next major change, Glamsterdam. Glamsterdam is an upgrade that will take place simultaneously on both of Ethereum's core layers, with key features including ePBS and Block-level Access Lists. Developers have not yet finalized the full scope of Glamsterdam, but the goal is to launch it in 2026.

18:48

Bitwise: Market maturity, institutional accumulation, and ETF inflows have made bitcoin less volatile than Nvidia stockJinse Finance reported that Bitwise pointed out that in 2025, bitcoin's volatility has fallen below that of Nvidia stock. The main driving factors are the maturation of the bitcoin market, the rising proportion of institutional holdings, and ETF capital inflows.

News