News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

KimberLite Token and CheersLand Unite to Bridge RWA and Web3 Gaming

BlockchainReporter·2025/12/20 05:00

7 Major Crypto Trends and Lessons You Must Know in 2026

TechFlow深潮·2025/12/20 04:02

The dawn of regulatory reform is coming—can Bitcoin make a comeback?

AIcoin·2025/12/20 03:56

Crypto Market Frenzy: How Will Regulation Impact the Future?

AIcoin·2025/12/20 03:14

Ethereum supply plummets, how will the market react?

AIcoin·2025/12/20 03:13

Magic Eden undergoes an epic transformation into entertainment!

AIcoin·2025/12/20 03:13

U.S. stocks sprint toward "never closing": Why is Nasdaq launching the "5×23 hours" trading experiment?

Odaily星球日报·2025/12/20 03:03

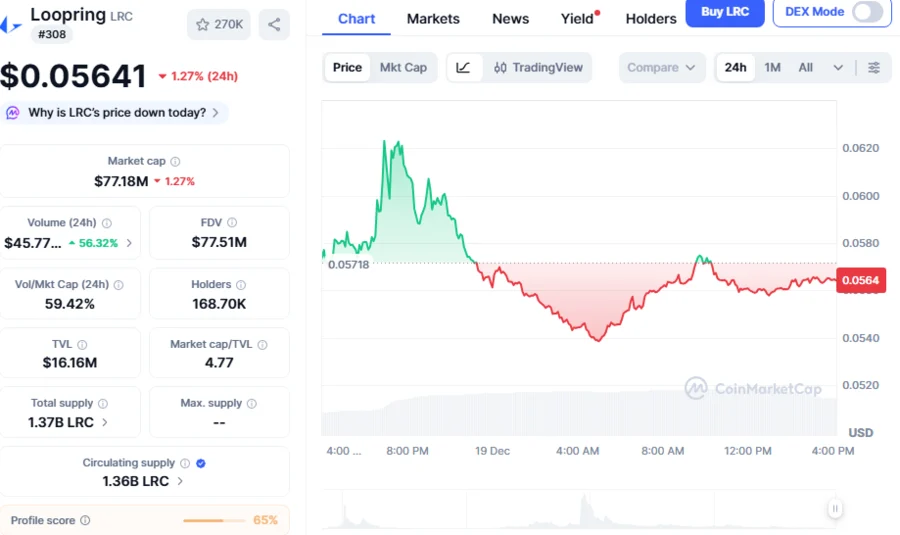

LRC Price Recovery? LRC Holds At $0.05607 As Loopring Grabs Liquidity Sweep, Printing Bullish Bet

BlockchainReporter·2025/12/20 03:01

The Invisible Boom: Arthur Hayes Reveals Why You Missed the Altcoin Season

Bitcoinworld·2025/12/20 02:57

Massive Bitcoin Whale Withdraws $221 Million from FalconX: Bullish Signal Emerges

Bitcoinworld·2025/12/20 02:42

Flash

08:05

Wang Chun: Once transferred 500 BTC to verify if the private key was compromised, hacker moved 490 BTC out.BlockBeats News, December 21, F2Pool co-founder Wang Chun commented on the recent "loss of 50 million USDT due to a phishing attack," saying, "It's really a pity. Last year, I suspected that my private key was leaked. To confirm whether the address was really stolen, I transferred 500 bitcoins to that address. What surprised me was that the hacker 'generously' only took 490 bitcoins and left me with 10 bitcoins, enough to make a living."

07:56

Analysis: DOGE is currently at the key support level of $0.128Jinse Finance reported that crypto analyst Ali stated DOGE is currently at a key support level of $0.128 after breaking below a multi-year support trendline. If selling pressure continues, the next target price will be $0.090.

07:52

Data: Leverage ratio in the U.S. investment market surges, margin debt to M2 ratio exceeds levels seen during the 2000 internet bubble.BlockBeats News, on December 21, KobeissiLetter released data showing that in November, U.S. trading margin debt surged by $30 billion, reaching a record high of $1.21 trillion, marking the seventh consecutive month of increase. Over the past seven months, U.S. margin debt has soared by $364 billion, an increase of 43%. After adjusting for inflation, margin debt rose 2% month-on-month and 32% year-on-year, reaching an all-time high. Meanwhile, the ratio of margin debt to the M2 money supply jumped to about 5.5%, the highest level since 2007. The margin debt-to-M2 ratio is now higher than during the internet bubble of 2000, indicating that leverage in the U.S. investment market has reached an extremely high level. Trading margin debt refers to the total amount of debt investors incur when borrowing money from brokers to purchase stocks or other securities in securities trading. This allows investors to amplify their investment scale with less of their own capital, thereby increasing potential returns, but also magnifying risks.

News