News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.24)|Bitmine Buys Over $200M Worth of ETH Again; U.S. Q3 Real GDP (Annualized) at 4.3%; $200M in Long Liquidations Across the Crypto Market2Bitget US Stock Daily Report | S&P Hits Closing Record High; Gold Breaks $4500 for the First Time; US Q3 GDP Grows 4.3% (December 24, 2025)3Solana: Short-term pain, long-term hope? SOL faces liquidation test

Bitcoin Enters a Critical Decision Phase as Consolidation Persists

The Bitcoin News·2025/12/23 09:09

Why Ethereum’s 2026 outlook weakens after $555M ETH outflow

AMBCrypto·2025/12/23 09:03

Experts Predict Challenges for the Long-Awaited Altcoin Bull Market

Cointurk·2025/12/23 09:03

Honeypot Finance: A rising full-stack Perp DEX, can it challenge Hyperliquid?

Chaincatcher·2025/12/23 09:01

Ethereum Treasury Company BitMine Buys Millions of Dollars Worth of Ethereum Again! Here Are the Details

BitcoinSistemi·2025/12/23 09:00

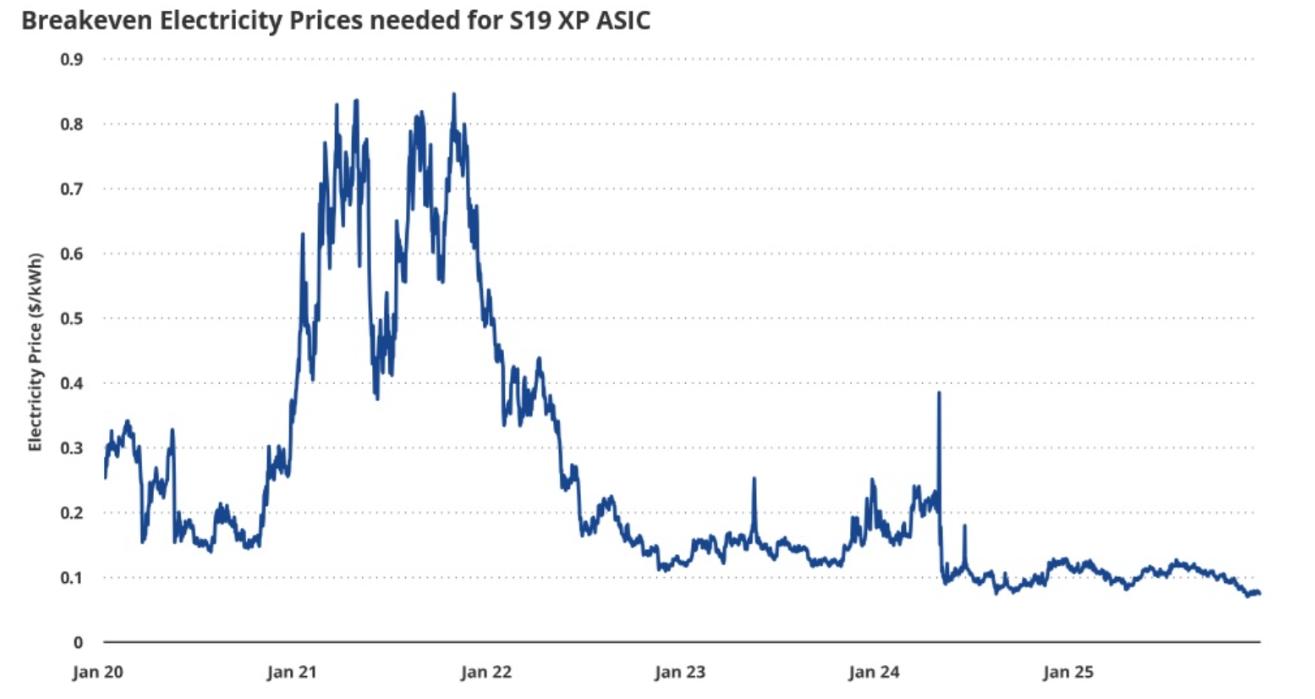

Bitcoin Price Bottom Is Here, Says VanEck Citing Miner Capitulation

Coinspeaker·2025/12/23 08:54

The 2025 Whale Tragedy: Mansion Kidnappings, Supply Chain Poisoning, and Hundreds of Millions Liquidated

BlockBeats·2025/12/23 08:46

Tether Data Expands QVAC Genesis II To 148 Billion AI Tokens

Cryptotale·2025/12/23 08:42

One year into the Trump administration: Transformations in the U.S. crypto industry

TechFlow深潮·2025/12/23 08:35

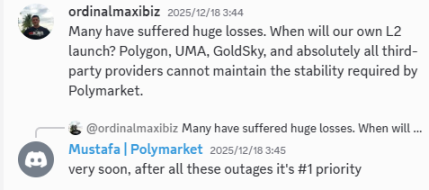

Polymarket coming of age: Farewell, Polygon

ForesightNews·2025/12/23 08:27

Flash

14:08

MegaETH integrates Mayan protocol to enable cross-chain swapsForesight News reported that MegaETH has now been integrated via the Mayan protocol. Applications can now access instant cross-chain swaps to MegaETH through Mayan's bridging service, which is powered by Wormhole.

14:08

Aave founder accused of increasing governance voting power by purchasing $10 million worth of AAVE tokensPANews, December 24 — According to Cointelegraph, Aave founder Stani Kulechov recently spent $10 million to purchase AAVE tokens. Some members of the crypto community claim that this move is aimed at increasing his voting power in key governance proposals. Critics argue that large token purchases could have a substantial impact on the voting outcomes of high-risk proposals. This controversy has once again raised concerns about whether token-based governance can adequately protect the interests of minority holders, especially when founders or early insiders possess significant economic influence. DeFi strategist Robert Mullins posted on X, stating that Kulechov’s purchase of AAVE tokens was intended to increase his “voting power so that he can vote in favor of a proposal that directly harms the interests of token holders.” He added, “This clearly demonstrates that the token mechanism is insufficient to effectively prevent governance attacks on AAVE tokens.” Previous reports indicate that a new AAVE community proposal aims to reclaim brand and channel ownership.

14:08

OpenAI is considering placing ads in ChatGPTBlockBeats News, December 24, according to The Information, OpenAI is considering placing advertisements in ChatGPT.

News