News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Block Sec Arena Partners with Fomo_in To Deliver Comprehensive Security and Growth Solutions for Blockchain Startups

BlockchainReporter·2025/12/19 17:03

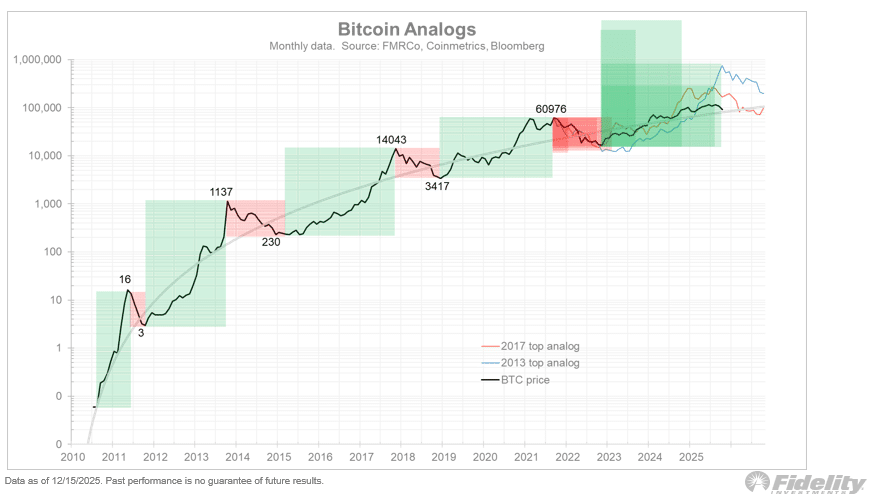

Bitcoin – Could 2026 be an ‘off year’ for BTC’s price?

AMBCrypto·2025/12/19 17:03

Netflix acquires gaming avatar maker Ready Player Me

TechCrunch·2025/12/19 17:03

Crypto Staking Tax: Republican Lawmakers Launch Urgent Push for Repeal

Bitcoinworld·2025/12/19 16:43

DraftKings launches standalone predictions app under CFTC oversight

The Block·2025/12/19 16:21

House Republicans Urge IRS to Overhaul Crypto Staking Tax Rules—Before 2025 Ends

Decrypt·2025/12/19 16:16

Is Bitcoin Primed for a 2026 Breakout? Analysts Weigh History vs. Fundamentals

Decrypt·2025/12/19 16:12

Explosive Jeffrey Epstein Files to Reveal Secret Bitcoin Summit with Tether Founder

Bitcoinworld·2025/12/19 16:12

Ripple CEO Declares ‘Nobody Can Manipulate XRP Prices’ amid December Volatility. Here’s Why.

Tipranks·2025/12/19 13:33

Expert to XRP Holders: This Will Be One of the Biggest Fakeouts in History If This Happens

TimesTabloid·2025/12/19 13:06

Flash

20:50

Ethereum Foundation sets strict 128-bit encryption rules for 2026Jinse Finance reported that the Ethereum Foundation stated that the only acceptable ultimate goal for L1 is "provable security," rather than "security assuming conjecture X holds." They have set 128-bit security as the target, aligning with mainstream cryptographic standards organizations and academic literature on long-term systems, as well as real-world recorded computational results, which indicate that 128-bit is practically out of reach for attackers. The EF pointed out some specific tools aimed at achieving the 128-bit, less than 300 KB target. They highlighted WHIR, a new Reed-Solomon proximity test, which is also a multilinear polynomial commitment scheme.

20:23

BlackRock Chief Investment Officer Rick Rieder will interview for the position of Federal Reserve Chairman at Mar-a-Lago.Jinse Finance reported that BlackRock Chief Investment Officer Rick Rieder will be interviewed for the position of Federal Reserve Chairman at Mar-a-Lago. Other candidates include Kevin Hassett, Kevin Warsh, and Federal Reserve Governor Christopher Waller.

19:12

VanEck updates Avalanche ETF application to include staking rewardsVanEck has updated its application for the Avalanche ETF (VAVX) to include staking rewards, planning to stake up to 70% of its AVAX holdings. The fund will use a certain exchange's Crypto Services as the initial staking service provider and pay a 4% service fee. The rewards will belong to the fund and be reflected in its net asset value. If approved, the fund will be traded on Nasdaq under the VAVX ticker, track the price of AVAX through a custom index, and be custodied by regulated providers such as Anchorage Digital and a certain exchange's Custody.

News