News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Block Sec Arena Partners with Fomo_in To Deliver Comprehensive Security and Growth Solutions for Blockchain Startups

BlockchainReporter·2025/12/19 17:03

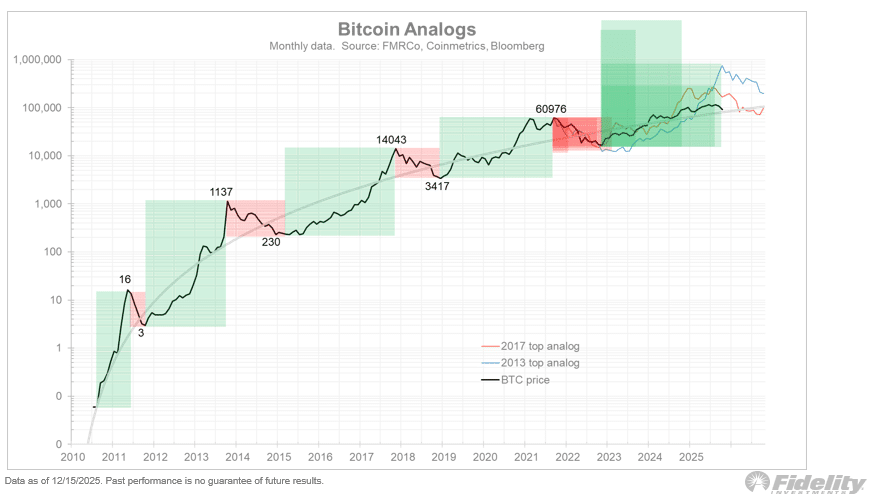

Bitcoin – Could 2026 be an ‘off year’ for BTC’s price?

AMBCrypto·2025/12/19 17:03

Netflix acquires gaming avatar maker Ready Player Me

TechCrunch·2025/12/19 17:03

Crypto Staking Tax: Republican Lawmakers Launch Urgent Push for Repeal

Bitcoinworld·2025/12/19 16:43

DraftKings launches standalone predictions app under CFTC oversight

The Block·2025/12/19 16:21

House Republicans Urge IRS to Overhaul Crypto Staking Tax Rules—Before 2025 Ends

Decrypt·2025/12/19 16:16

Is Bitcoin Primed for a 2026 Breakout? Analysts Weigh History vs. Fundamentals

Decrypt·2025/12/19 16:12

Explosive Jeffrey Epstein Files to Reveal Secret Bitcoin Summit with Tether Founder

Bitcoinworld·2025/12/19 16:12

Ripple CEO Declares ‘Nobody Can Manipulate XRP Prices’ amid December Volatility. Here’s Why.

Tipranks·2025/12/19 13:33

Expert to XRP Holders: This Will Be One of the Biggest Fakeouts in History If This Happens

TimesTabloid·2025/12/19 13:06

Flash

03:57

Artemis Research Report: Ethereum Stablecoins Dominated by Institutions, Payment and DeFi Usage Ratio Close to 1:1According to TechFlow, on December 21, Artemis Analytics released its latest research report, which provides an empirical analysis of the actual payment use cases of stablecoins on the Ethereum network, focusing on peer-to-peer (P2P), business-to-business (B2B), and person-to-business/business-to-person (P2B/B2P) payment activities. The research focuses on Ethereum because this chain hosts about 52% of the global stablecoin supply, with USDT and USDC accounting for approximately 88% of the market share. The study points out: Stablecoin payments (transfers between EOA accounts) account for about 47% of the total stablecoin transfer volume (about 35% if internal transfers between accounts of the same institution are excluded), indicating that not all on-chain stablecoins are used for trading or DeFi, but a large portion is used in payment scenarios. In terms of transaction count, about 50% of stablecoin transactions are user-to-user payments (EOA-to-EOA), while the other half involves smart contracts (mainly DeFi). In terms of transaction value, payments by institutions or large accounts make up the vast majority, showing that the value density of stablecoin payments is concentrated among large accounts. Stablecoin transfers on Ethereum are mainly driven by a small number of wallets, with the top 1,000 wallets contributing about 84% of the total transaction volume, reflecting that payment activity in terms of actual value is highly concentrated among large holders or institutions.

03:53

Malicious code implanted in polymarket copy trading project polymarket-copy-trading-bot to steal private keysAccording to Odaily, the GitHub project polymarket-copy-trading-bot has been found to contain malicious code. When the program is launched, it automatically reads the user's wallet private key from the .env file and transmits it to a hacker's server via a hidden malicious dependency package, excluder-mcp-package@1.0.4, resulting in asset theft.

03:48

Security Alert: GitHub is experiencing an incident where a bot posing as a "follower" has been stealing private keys from malicious projects. GitHub project polymarket-copy-trading-bot has been injected with malicious code. The program automatically reads the wallet private key from the user's .env file upon startup and exfiltrates it to a hacker server through a hidden malicious dependency package [email protected], resulting in asset theft.

News