News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

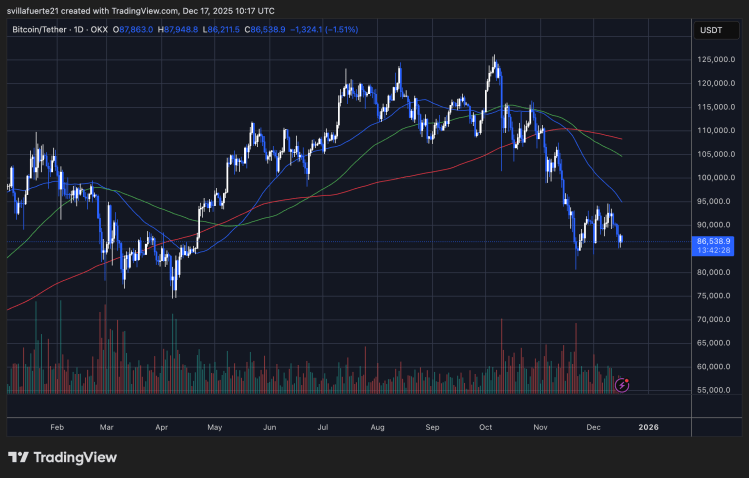

Bitcoin structure turns bearish, structural indicators turn negative

币界网·2025/12/17 19:15

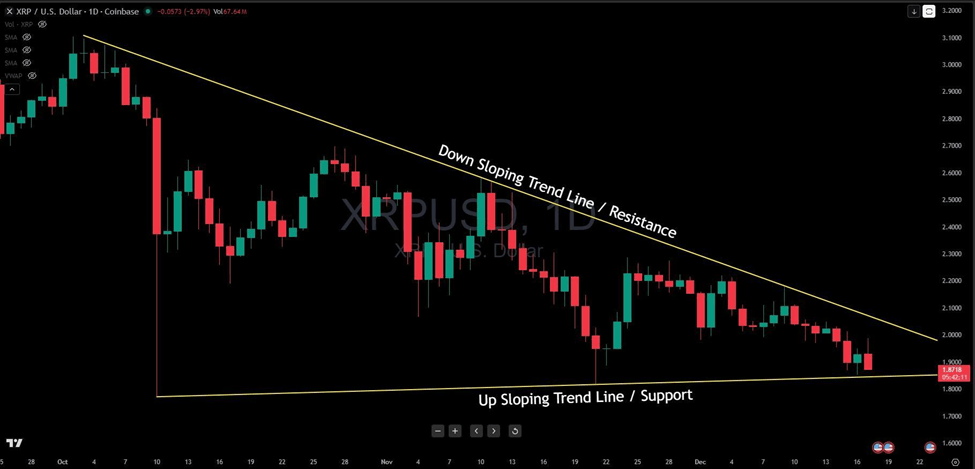

XRP/USD price consolidates: Triangle pattern signals imminent breakout

币界网·2025/12/17 19:13

Dark Defender: Expect the Unexpected for XRP

TimesTabloid·2025/12/17 19:06

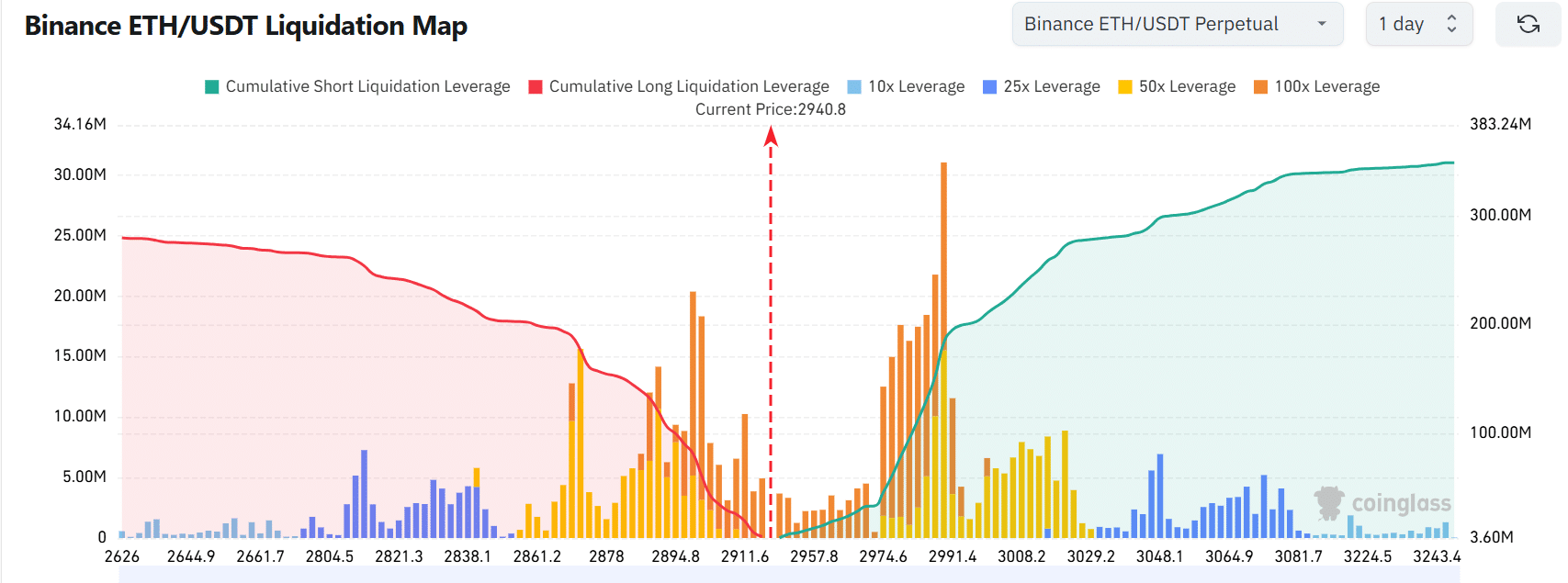

Ethereum – Can Bitmine’s $140.6M ETH buy offset a liquidity trap?

AMBCrypto·2025/12/17 19:03

Bitcoin’s $3,000 Up-and-Down Swing Liquidates 123,200 Traders in Volatile Pump and Dump

Coinspeaker·2025/12/17 18:45

Bitcoin Demand Cycle Warning: Why Analysts See a Steep Decline Ahead

Bitcoinworld·2025/12/17 18:42

Flash

08:33

Machi increases ETH long positions to $16.6 million, with an entry price of $2,944.04ChainCatcher News, according to monitoring by HyperInsight, Huang Licheng has increased his long positions in ETH and HYPE over the past 6 hours. The current positions are as follows: ETH long position of $16.6 million, opening price $2,944.04, liquidation price $2,813.72, unrealized profit of $220,000; BTC long position of $1.5 million, opening price $88,283.5, liquidation price $32,842; HYPE long position of $630,000, opening price $24.1139.

08:30

「Whale」 Increases ETH Long Position to $16.6 Million, Opening Price $2,944.04BlockBeats News, December 21st, according to HyperInsight monitoring, "Big Brother Whale" Huang Licheng increased his ETH and HYPE long positions for nearly 6 hours. His current positions are as follows:

ETH Long Position $16.6 million, entry price $2,944.04, liquidation price $2,813.72, unrealized gains $220,000;

BTC Long Position $1.5 million, entry price $88,283.5, liquidation price $32,842.0;

HYPE Long Position $630,000, entry price $24.1139.

08:21

Ethereum has become the global settlement layer for USD liquidity, processing approximately $9 billion to $10 billion in stablecoin transfers daily.According to Odaily, Leon Waidmann posted on X stating that Ethereum is not only a smart contract platform but has also become the settlement layer for global USD liquidity. The Ethereum mainnet processes approximately $9 billion to $10 billion in stablecoin transfers daily, mainly involving USDT and USDC used for payments, financial management, and settlements. These represent real value flows on-chain, rather than DeFi loops or incentive mining. Leon Waidmann pointed out that although other blockchains are growing, large funds still choose to settle on the Ethereum mainnet. Users are willing to pay transaction fees because they value its settlement finality and credibility. Stablecoins bring utility to blockchains, while Ethereum provides reliability for stablecoins.

News