Altcoin Signal

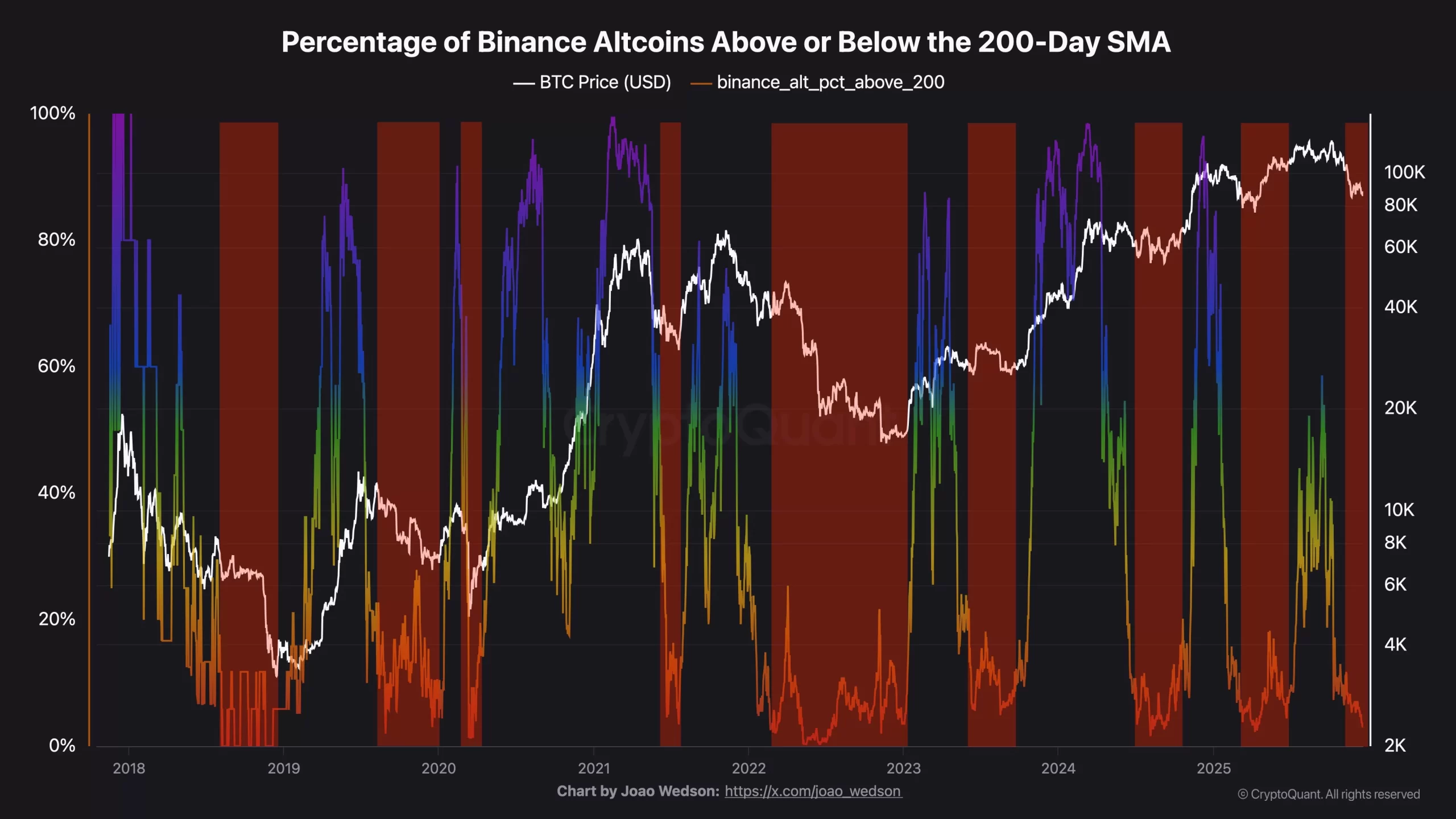

Most altcoins on Binance are trading below their 200-day moving averages, signaling historical overselling and potential further declines. Analyst Darkfost has emphasized critical details, discussing the current state of altcoins and what they face ahead.

The liquidity shortage has worsened, especially following the October 10 crash. Since the beginning of October, TOTAL2—representing the total market value of altcoins, excluding BTC and stablecoins—has dropped by 36%.

In the last three months, the top ten cryptocurrencies have decreased by 46%. Merely 3% of altcoins on Binance trade above their 200-day moving average, indicating that nearly all are oversold. Darkfost remarked on the situation, emphasizing that:

“Investors preferring to safeguard their capital over engaging in high-risk assets is evident in recent data. Although it seems counterintuitive, such periods often offer the best opportunities, but this phase could persist if the market enters a long-term downturn.”

Uncertainty prevails in current market conditions, but if a bullish trend emerges, it should not be overlooked.”

Those who believe in the “buy when everyone else is fearful” philosophy can see fears surrounding many altcoins. Although some fears may prove warranted with potential losses of 90%, others will savor purchasing near the bottom. Predicting the future is impossible; external factors could further impact cryptocurrency values overnight.

Predicting Declines and Now Forecasting Rises

The analyst known as Faibik predicted a swift plunge in BTC months ago, a view not widely shared at the time, yet it proved accurate. Now, with the confidence from accurately forecasting a 36% decline, Faibik asserts, “The downturn has ended.” Despite the unlikely odds of an analyst making two correct predictions consecutively, it is possible.

“The correction is complete. Bitcoin is primed for another rally, but many still await another downturn. It baffles me why this chance might be missed.”

In the coming days, Bitcoin will surge, causing a FOMO rush that’s counterproductive. The wiser move is to seize opportunities currently present. You can thank me later for this advice.”