News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

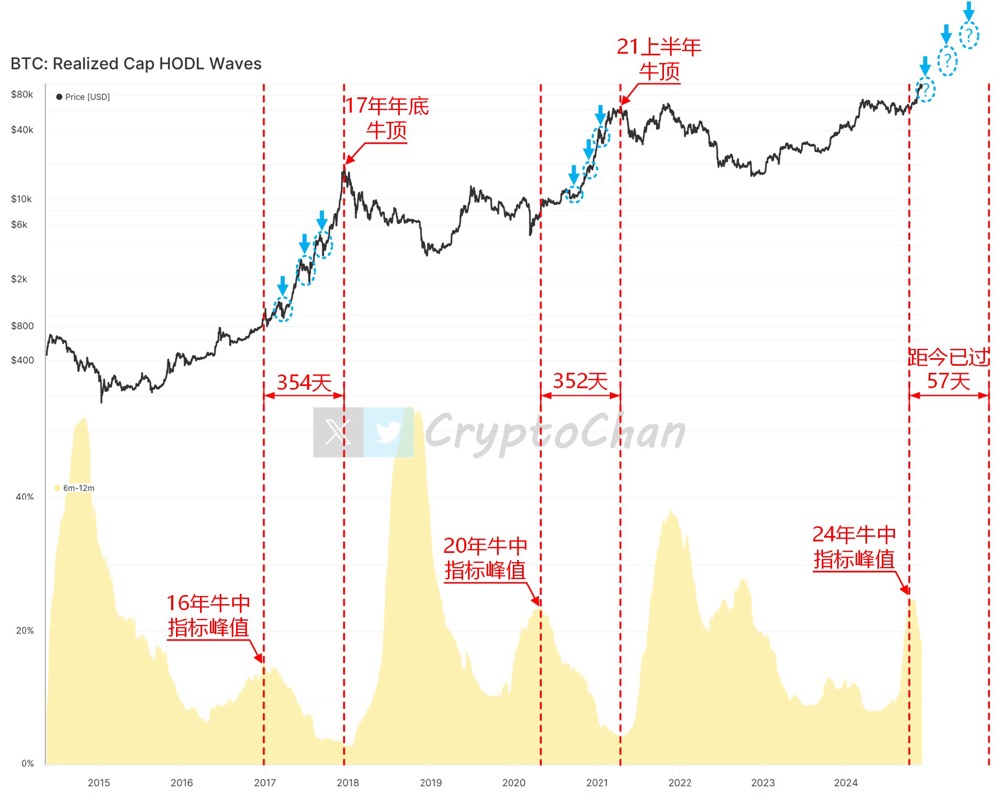

Bitcoin targets £140,000! Fibonacci pricing model reveals potential space

CryptoChan·2024/12/02 03:28

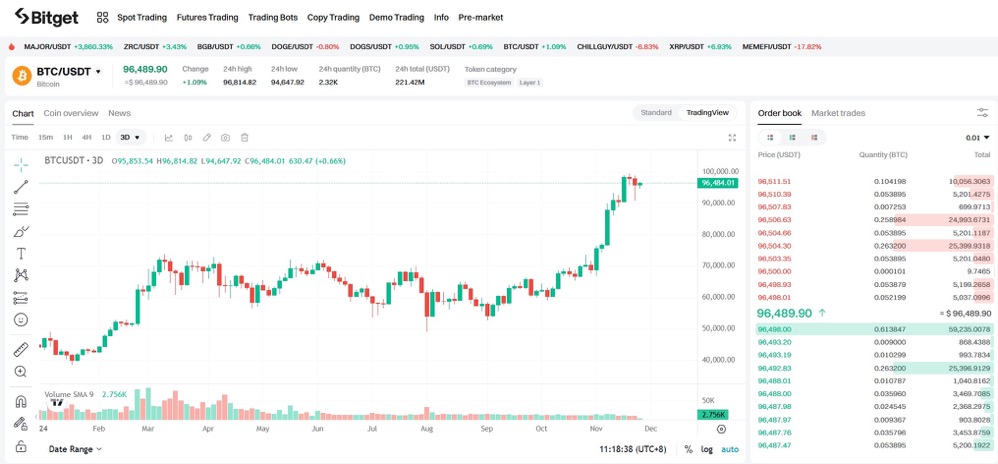

Why not try short selling easily from a market maker's perspective

Bugsbunny—e/acc·2024/11/29 04:18

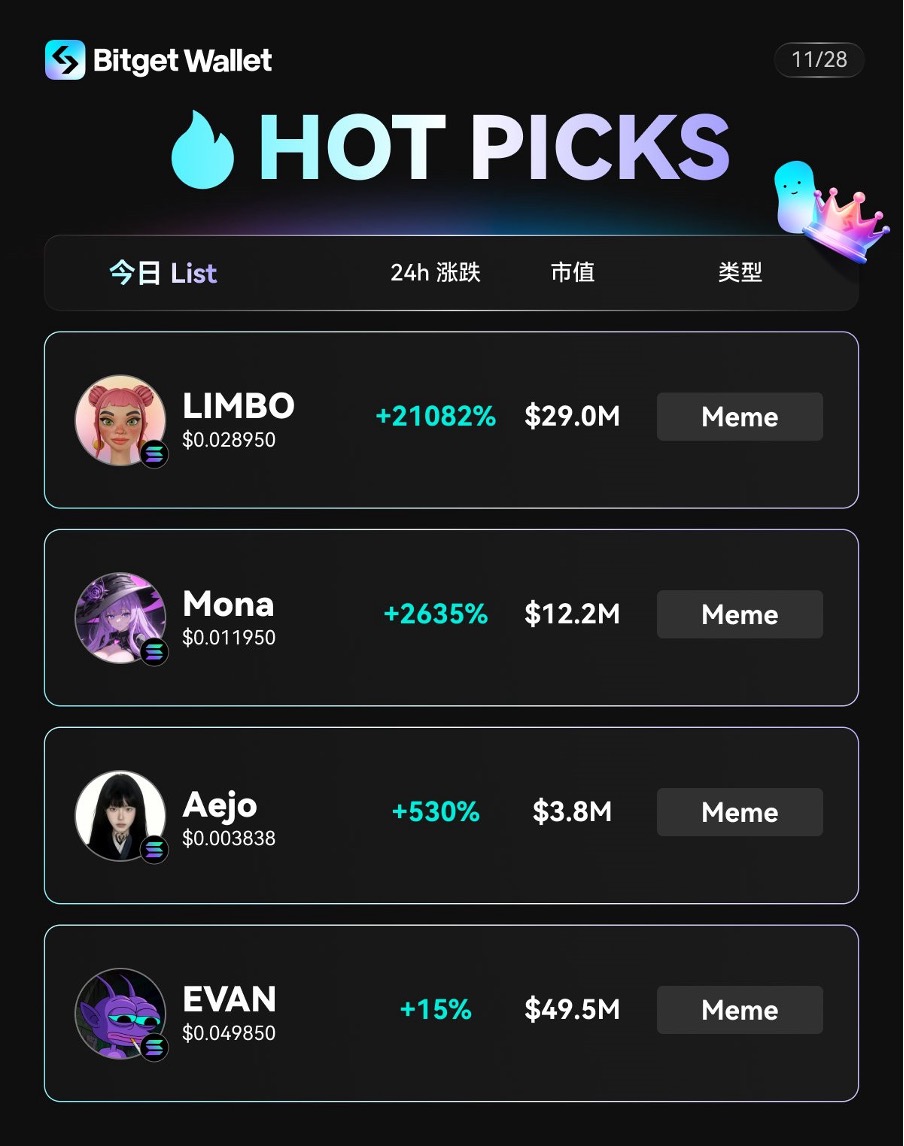

Today's Popular MEME Inventory

币币皆然 ·2024/11/28 10:02

TikTok traffic boost, can CHILLGUY become the next top-tier Meme?

远山洞见·2024/11/28 08:32

Flash

- 04:50Bitwise announces Dogecoin ETF details, initial DOGE holdings around 16.429 million, management fee rate at 0.34%ChainCatcher reported that crypto asset management company Bitwise Asset Management plans to list the Dogecoin exchange-traded fund Bitwise Dogecoin ETF (NYSE: BWOW) today. The official details of the ETF have been released: currently, BWOW holds 16,429,836.05 Dogecoin (custodied by a certain exchange), with a market value of $2,499,996.71 and a management fee rate of 0.34%. Bitwise stated that if BWOW's assets under management reach $500 million or within one month (whichever comes first), the management fee will be waived.

- 04:47Zhang Jun from China Galaxy Securities: The AI bubble does exist, but the overall risk is relatively controllable at presentJinse Finance reported that recently, investors' concerns about an AI bubble have been rising. In response, at the 2026 Annual Investment Strategy Report Conference of China Galaxy Securities held on November 26, Zhang Jun, Chief Economist and President of the Research Institute at China Galaxy Securities, stated that while an AI bubble does exist, it is still too early to say whether it will develop into a crisis. Zhang Jun mentioned that the IMF has compared the current situation to the internet bubble. Judging from indicators such as price-earnings ratios and investment enthusiasm, the overall situation remains relatively controllable. The Federal Reserve's interest rate hikes were a key factor in bursting the internet bubble, but currently, both the Federal Reserve and the world are in an interest rate cut cycle, so policy risks are manageable. However, he also emphasized that the resilience of the global economy is much lower than it was back then, so there is still uncertainty regarding the comparability of these indicators. (Securities Times)

- 04:47Chainlink co-founder: DeFi has completed 30% of its mass adoption process, expected to reach 100% by 2030Jinse Finance reported that Chainlink co-founder Sergey Nazarov, in an interview with MN Capital founder Michael van de Poppe, stated that decentralized finance (DeFi) has currently completed about 30% of its large-scale adoption process, and is expected to reach 100% global adoption by 2030. Nazarov pointed out that when regulatory frameworks become clearer and can explain the reliability of DeFi, the global adoption rate will reach 50%; when institutional users have a clear and efficient path to allocate funds into DeFi, the adoption rate will reach 70%; and when DeFi's capital base can be meaningfully compared with traditional financial capital allocation, 100% adoption will be achieved.