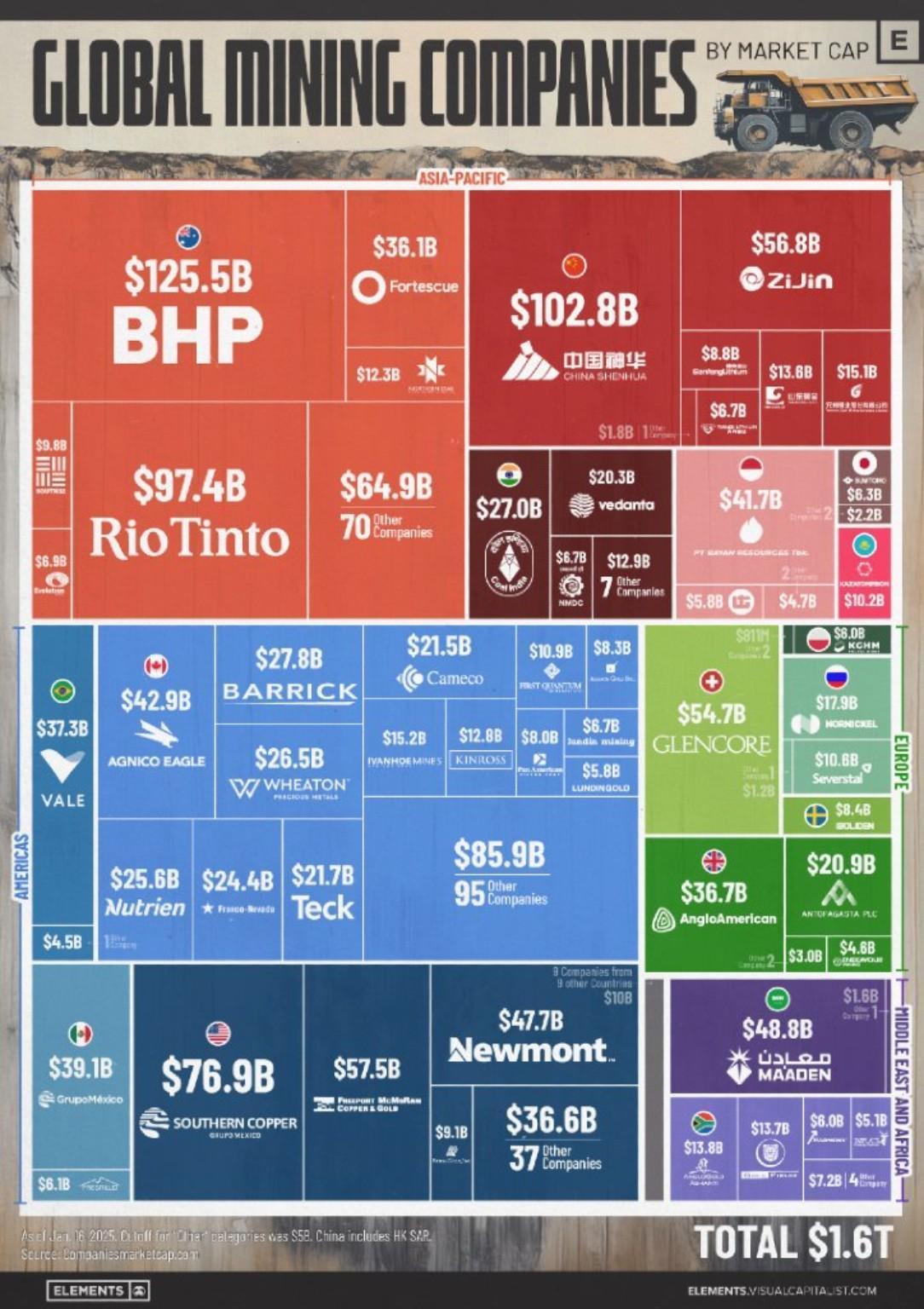

- New spot XRP ETFs from Grayscale and Franklin Templeton draw over $120 million on the first day.

- Broader flows show investors rotating from Bitcoin into Ethereum and Solana ETFs amid the DOGE launch.

On Monday, spot XRP exchange-traded funds from Grayscale and Franklin Templeton started trading on NYSE Arca. They immediately drew large interest, each attracting more than $60 million in net inflows, totaling over $120 million. At the same time, other digital asset funds in the United States posted lower figures on the same day.

Grayscale’s GXRP fund, converted from a closed-end trust, recorded first-day net subscriptions of $67.4 million. Franklin Templeton’s XRPZ product, managed by an asset manager with around $1.5 trillion under management, picked up $62.6 million, according to data compiled by SoSoValue.

Canary Capital’s XRPC vehicle and Bitwise’s XRP fund added a further $16.4 million and $17.7 million. Overall spot XRP ETF inflows on Monday reached $164.1 million. Since launch on Nov. 13, pure spot XRP funds have drawn $586.8 million in cumulative net inflows, with no single day of net outflows recorded so far.

Source: SoSoValue

Source: SoSoValue

Crypto ETF Flows Show Shifting Focus

On the same trading day, spot Bitcoin funds in the United States moved back into negative territory, with $151.1 million in net outflows. Spot Ethereum products, in contrast, attracted $96.6 million in fresh funding, while spot Solana funds took in $58 million.

Spot Solana ETFs have now logged twenty consecutive trading days of positive flows since debut, taking total net inflows for the group to $568.3 million. Interest in Solana fund exposure has stayed firm even while some Bitcoin products have faced renewed withdrawals.

Grayscale also launched the first pure spot DOGE ETF in the United States on Monday. SoSoValue reported no net flows on the opening day. NovaDius President Nate Geraci wrote on X:

Some (many) might laugh, but I actually view this as a highly symbolic launch. IMO, best example of monumental crypto regulatory shift over the past year. Btw, GDOG might already be a top 10 ticker symbol for me.

ETF launches have helped lift sentiment toward longer-term XRP prospects. At the time of writing, XRP is trading at $2.16 after a 5% rally in the past 24 hours. Analyst Egrag Crypto pointed to key monthly support still holding despite pressure on prices.