Coinbase, Microstrategy Shares Rally After Cboe Refiles Bitcoin ETF Applications

Shares in Coinbase, chosen as the market for the surveillance-sharing agreements in ETF applications, rose above $80 at around 11:30 ET on Monday.

Bitcoin-adjacent stocks rallied on Monday in response to Friday's news that Cboe's BZX Exchange had refiled its applications for several spot bitcoin exchange-traded funds (ETFs).

Shares in crypto exchange (COIN), which was chosen to be the market for surveillance-sharing agreements in the ETF applications, rose more than 10% to over $80 at around 11:30 ET on Monday.

Cboe has been working with a number of providers to finally get an application for a spot bitcoin ETF approved by the U.S. Securities and Exchange Commission (SEC), including Fidelity, WisdomTree and ARK Invest. Meanwhile, BlackRock (BLK) is doing the same with Nasdaq.

After having their applications rejected by the SEC for not naming the exchange they were working with on surveillance-sharing agreements, as the firm in question.

COIN's upward trend mirrored that of BTC itself, which was up around 2% on the day above $31,000 around the same time.

(MSTR), the business intelligence firm which holds over $4.6 billion worth of bitcoin (BTC), also saw its shares rally, rising around 10% to $375, their highest level in over a year.

The increasing chances of a spot bitcoin ETF finally getting approved by the SEC is seen by crypto analysts as bullish for BTC, since it could simplify adoption by traditional investors with stock accounts.

Read More:

Edited by Bradley Keoun.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How iRobot Strayed from Its Original Path

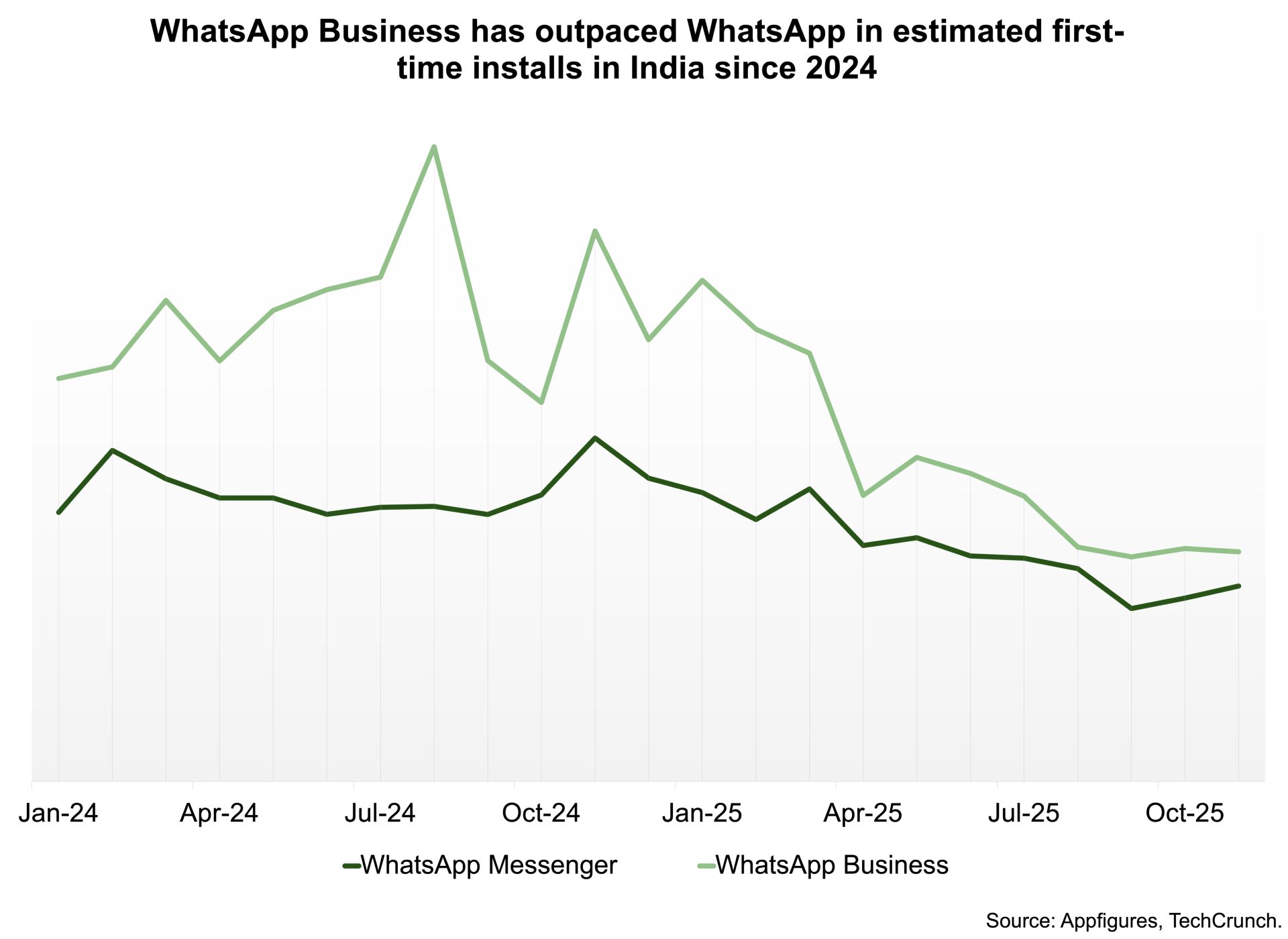

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t

Moonbirds to launch BIRB token in early Q1 2026