Wood Says ARK Is ‘Taking Profits’ as It Sells $26 Million in COIN

The sale comes a day after ARK sold $50.5 million of the crypto exchange’s stock.

Cathie Wood’s ARK Invest is offloading more Coinbase shares after the stock closed Monday at $105.55, just shy of its one-year high of $107.

A trade disclosure sent out by the growth-focused fund shows that it offloaded 248,838 of COIN, worth just over $26 million, based on Monday’s closing price.

ARK has been selling off its holdings of COIN as the stock continues to perform well. On July 14, it disclosed it had sold 480,000 COIN shares across three funds, based on the day’s closing prices. The previous week as the stock rallied.

“We’re very positive about Coinbase, especially in light of the court ruling for Ripple against the SEC,” . “We’re simply taking profits and reallocating the capital to some laggards.”

Wood recently said that since Elon Musk took it private last year.

Edited by James Rubin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Fluidity: The CFTC-Endorsed Transformation

- CFTC approved CleanTrade as the first SEF for clean energy , addressing market fragmentation and liquidity gaps. - The platform enables institutional-scale trading of VPPAs and RECs with automated compliance and $16B in early trading volume. - Integrated analytics and regulatory compliance enhance transparency, reducing risks for investors in renewable energy assets. - Early adoption by Cargill and Mercuria highlights CleanTrade's potential to reshape $1.2T clean energy investment landscape.

How iRobot Strayed from Its Original Path

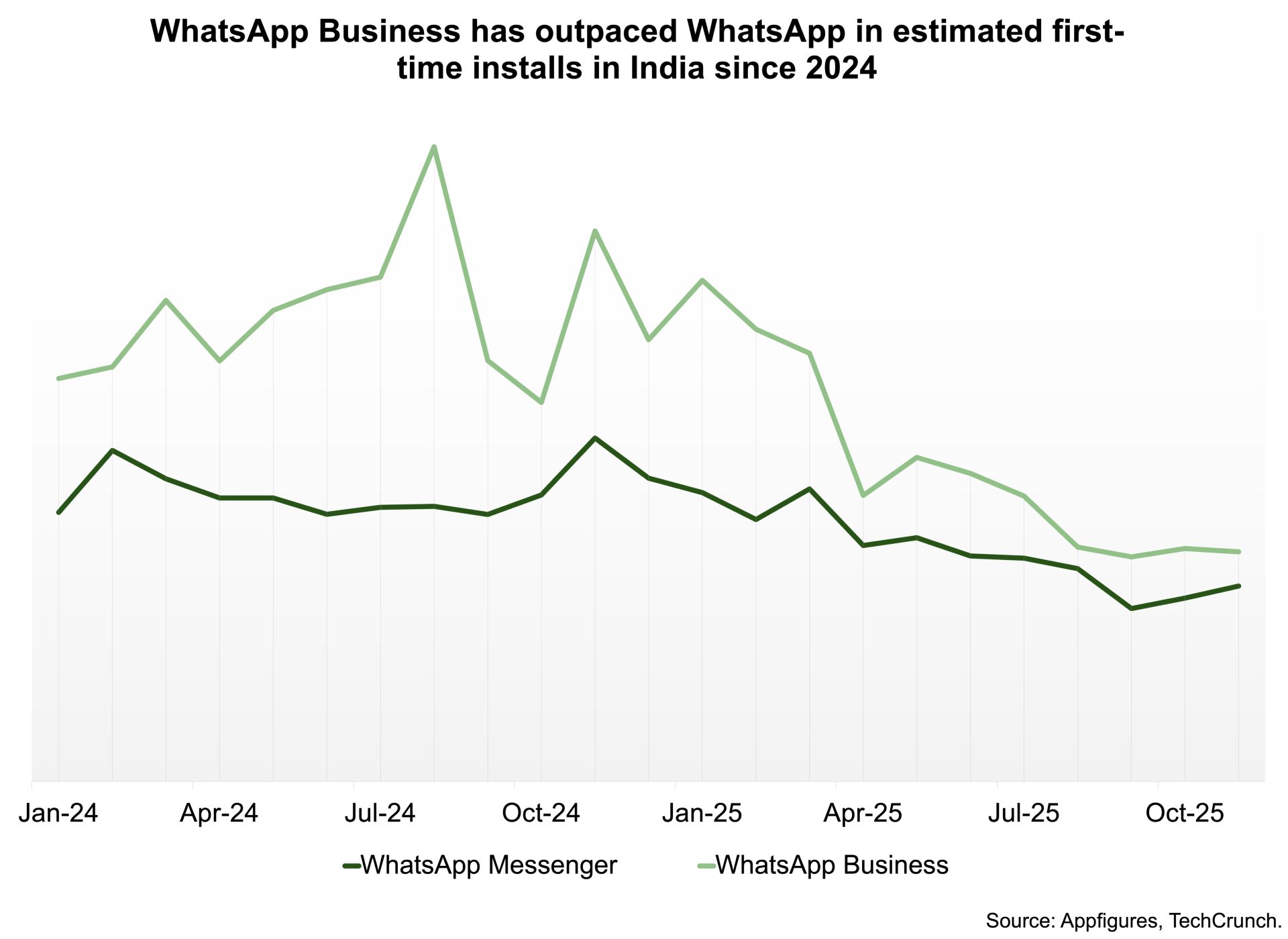

WhatsApp’s largest user base is now presenting its greatest challenge

Assessing Bitcoin’s Price Movement in Light of Macroeconomic Changes and Positive ETF Sentiment in November 2025

- Bitcoin faces macroeconomic headwinds in 2025, with Fed tightening causing a 15% crypto market cap drop, but ETF approvals drove 45% growth in institutional Bitcoin ETF AUM to $103B. - Institutional investors navigate $81k-$91k Bitcoin consolidation, balancing Fed policy risks against 68% adoption rates and regulatory clarity from EU MiCA and U.S. GENIUS Act. - Strategic entry strategies include core positions at $85k-$87k support, hedging with stablecoins/altcoins, and timing Fed rate cut expectations t